Welcome to the world of medical practice accounting, where financial health and patient care intersect. Effective accounting is essential for the smooth operation and success of any medical practice, regardless of its size. From solo practitioners to large healthcare facilities, managing finances efficiently ensures accurate billing, proper reimbursement, and compliance with complex regulations.

Here are some tips for handling medical billing yourself

Accounting for medical practices is a little different than other businesses.

If you’re a medical practice owner, knowing how to use accounting software is probably already on your list of must-haves. But if you want to maximize the benefits of your accounting software truly, there are some other things you should keep in mind.

- Medical practices have a lot of different types of revenue and expenses. Income can come from payments for services rendered or products sold, which would be considered either patient care revenue (e.g., reimbursements for services) or product sales revenue (e.g., dispensing prescription medications). Expenses can include all sorts of things—buying new equipment and hiring employees to pay rent and utilities—but all are part of running a business.

- The IRS has strict rules about what qualifies as deductible business expenses and what doesn’t.For example, a purchase may not be deductible if it is purely personal in nature (i.e., something you’d buy at the store even if no one ever paid you for it), but it may qualify as an expense if it was purchased with business money; this is known as an “expense allocable” because only a portion of its cost could be written off on tax returns each year until all were used up over time through subsequent deductions.

Are you handling your medical practice’s accounting yourself? Then, get help from a service.

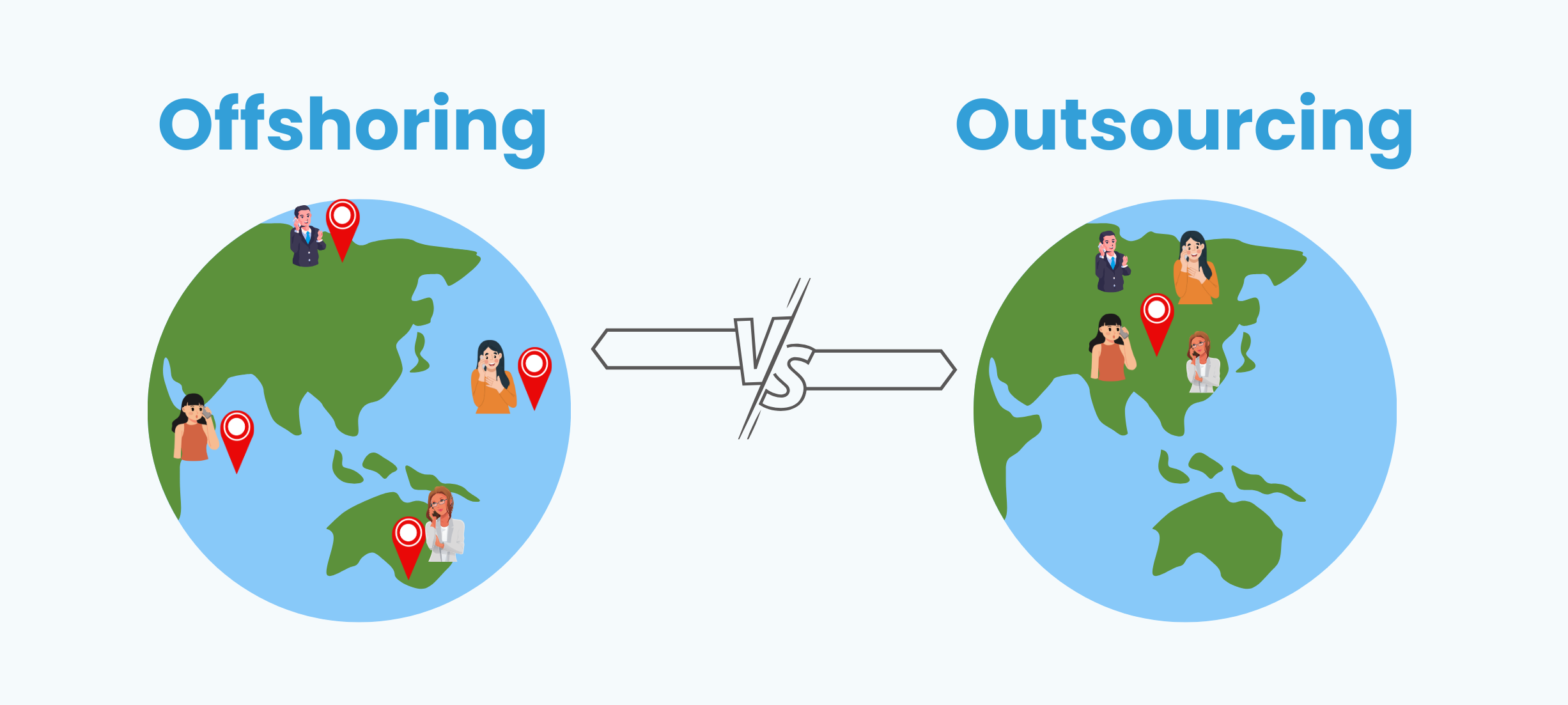

If you need help keeping up with the accounting for your medical practice, or if it’s taking too much time and effort, consider hiring an outsourced service. Several providers offer bookkeeping services for small businesses, including those with a medical focus.

These companies can process all of your financial transactions and produce reports and statements efficiently and promptly. This will save you from spending hours on paperwork each week and let you focus on what matters most: providing the best care possible to your patients!

It’s OK to get some help with your medical practice’s accounting.

If you’re not a professional accountant, getting some help with your medical practice’s accounting is okay. There are many ways to do this:

- You can hire an accountant on a per-hour basis. This will only be useful if the issues that need to be addressed are straightforward, such as completing tax forms or preparing basic financial statements.

- You can purchase, online solution for your medical billing company. These systems provide all the tools you need to manage your accounts receivable and ensure that collections are handled correctly and efficiently.

- You can use the services of an accounting firm or consulting group with experience handling small-business accounts receivable. The advantage here is that these services can take over almost all aspects of your financial management rather than just those related directly to billing and collection activities.

Be on the lookout for these common medical billing mistakes.

Most of these mistakes can be avoided by using an outsourced medical billing service to help you navigate the complex healthcare payment processing and reimbursement world.

Some common medical billing mistakes include:

- Not using the correct code when submitting claims.

- Claiming reimbursed amounts that are too high – or too low.

- Waiting too long to resubmit missing information on denied claims.

- Make sure you are keeping your medical billing practices by the book.

Maintaining good records is the first step to keeping your medical billing practices by the book. This means looking at each patient and ensuring they are being billed for the correct services and tests. In addition, it is essential to remember that some insurance companies might not cover specific treatments or services, which may leave you out-of-pocket with a higher bill than expected. Make sure you are billing for all of these things so that when the time comes, you can see where there was any discrepancy or error in your medical billing practices.

Conclusion

As you can see, accounting for a medical practice is a little different than other businesses. Therefore, the best way to get started is to find an experienced bookkeeper who knows how to handle the intricacies of this type of business. Consider looking into hiring an accountant if your business grows large enough!