If you own a small business and need to provide tax documentation for individuals associated with your enterprise, you have two distinct forms at your disposal. For individuals classified as employees within your business structure, the appropriate form is the W-2. Alternatively, if the individual is a contractor, you are required to complete the 1099 form. Within the 1099 form, it is imperative to declare the total compensation disbursed for their services throughout the entire tax year.

Intuit QuickBooks serves as a valuable tool for efficiently monitoring payments to contractors and automating the completion of a printable 1099 form, encompassing all essential data.

This article provides a comprehensive guide on how to generate a 1099 form in QuickBooks. Before we delve into the steps, let’s take a closer look at the intricacies of 1099 forms.

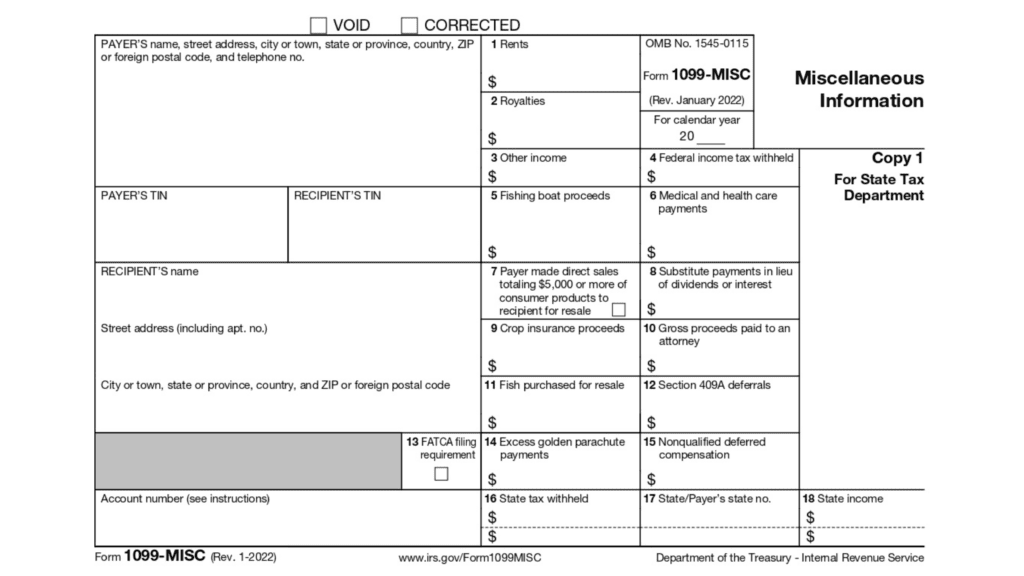

The 1099 form, recognized as an information return by the IRS, serves as a foundational document outlining your business’s financial activities. Various types of 1099 forms exist, with the 1099-MISC being the most frequently employed for reporting miscellaneous income.

Sample 1099 form

Significance of the 1099 form

The 1099 form is like a star player in the game of taxes for businesses. In the game of managing taxes for businesses, QuickBooks for small businesses is like a strategic teammate, enhancing efficiency and accuracy in financial record-keeping. Think of it as a special report card you give to the IRS (the tax people). This form is super handy because it helps you tell the IRS about different kinds of money your business has made. These can be things like payments to freelancers, money from renting, or even interest you’ve earned.

Now, here’s the cool part: if you keep this special report card (the 1099 form) in tip-top shape and send it to the IRS, you’re not only doing a great job at keeping track of your money, but you’re also following the rules. This helps make sure your tax reports are spot-on and that your business is playing by the tax book. So, it’s not just a form; it’s your business’s way of saying, “Hey, IRS, here’s what we’ve been up to money-wise!

Individuals eligible for a 1099 form

Not everyone you do business with will receive a 1099 form. Generally, the form is issued to individuals or entities that are considered non-employees and have received $600 or more in payments during the tax year. This includes freelancers, independent contractors, and vendors who provide services to your business.

How to make a 1099 in QuickBooks

Usually, there are two main ways to make and send 1099 forms to people you hire for specific jobs.

You have a couple of options for managing 1099 forms. One approach is to acquire a 1099 kit, print the forms directly from your QuickBooks file, and handle the task independently. Another option is to leverage QuickBooks services, allowing you to either pay for them to print and mail your documents on your behalf or streamline the process further by filing your 1099 forms online.

The second way is simpler because the first way can be a bit tricky. It’s not always easy to make sure all the 1099 forms line up perfectly in a printer. Also, if you get the forms early, it makes things easier for you.

First method

Enabling the 1099 feature

- Open QuickBooks and click on “edit” in the menu bar.

- From the drop-down menu, select “Preferences” and then go to “Tax 1099,” located on the left-hand side of the window.

- Click on “Company preferences” and choose “yes” in the “Do you file 1099 MISC forms” section. Select “Ok.”

Setting up vendors

- Navigate to the menu bar and select “Vendors.”

- Choose “Vendor center” from the drop-down menu, then right-click on the “independent contractor” – the person for whom you’re creating the 1099 form. Select “Edit.”

- Opt for the “address info” option, review the contractor’s details for accuracy, and click on “Additional info.”

- Select “Vendor eligible for 1099” and provide the contractor’s tax ID number in the “Tax ID” section.

- Click “OK.

Second method

Printing 1099 forms

- Put the empty 1099 form into your printer.

- Click on ‘File’ in the top menu bar of QuickBooks.

- From the drop-down menu, pick ‘Print Forms’ and then choose ‘1′ 1099s/1096’ from the list.

- Choose the person you’re making the 1099 form for and click ‘Print 1099.’

- A preview of the 1099 form will pop up. If you want to see it in detail, unselect the ‘Alignment’ box and click ‘PDF.’

- Press ‘Open PDF in preview’ to check all the details.

- Finally, click ‘Print’ to print the finished form.

Efficient financial management across industries with QuickBooks

QuickBooks for farmers is a valuable tool that helps agricultural businesses manage their finances efficiently. Farmers can use QuickBooks to keep track of income and expenses, monitor cash flow, and generate reports for better financial insights. It allows them to categorize transactions related to planting, harvesting, equipment maintenance, and other farm activities. With features like invoicing and inventory tracking, QuickBooks simplifies the process of managing sales and monitoring inventory levels. Additionally, farmers can use QuickBooks to generate reports that aid in budgeting, tax preparation, and overall financial planning. Overall, QuickBooks proves to be a helpful resource for farmers in maintaining organized and accurate financial records for their agricultural operations.

Financial management for landlords with QuickBooks

QuickBooks offers specialized features for landlords to simplify their financial management. Tailored tools enable landlords to track rental income, manage expenses, and generate reports for a comprehensive view of their property finances. This includes features like rent invoicing, expense categorization, and tax preparation assistance, streamlining the accounting process for property owners. Utilizing QuickBooks for landlords can enhance efficiency in managing rental properties and provide a clearer financial picture.

Streamlining service-based businesses with QuickBooks

For service-based businesses, QuickBooks offers tools tailored to manage the intricacies of service transactions. Whether it’s tracking billable hours, invoicing clients, or managing project expenses, QuickBooks provides a centralized platform for service businesses to monitor their financial health. Service providers can create detailed invoices, track payments, and generate financial reports to gain insights into their revenue streams and expenses. With features like project tracking and expense categorization, QuickBooks helps service-based businesses maintain financial accuracy and streamline the billing process, ultimately contributing to improved profitability.

Construction and contracting financial management with QuickBooks

QuickBooks is a valuable asset for construction and contracting businesses, providing specialized features to manage complex financial aspects unique to the industry. Contractors can utilize features like job costing, progress invoicing, and expense tracking to keep detailed records of each project’s financial performance. The ability to create estimates and track actual costs against budgets helps contractors maintain control over their projects and improve overall profitability. QuickBooks for construction also facilitates compliance with industry-specific accounting standards and simplifies the preparation of financial documents required for bidding on new projects.

E-commerce financial tracking and reporting with QuickBooks

E-commerce businesses can leverage QuickBooks to manage their financial transactions seamlessly. With integrations for popular e-commerce platforms, QuickBooks can automatically import sales data, track inventory levels, and manage expenses related to online sales. E-commerce entrepreneurs can benefit from features like order tracking, sales tax management, and financial reporting tailored to the unique needs of online businesses. QuickBooks helps e-commerce businesses stay on top of their finances, analyze sales performance, and make informed decisions to optimize their online operations.

Conclusion

Creating a 1099 form in QuickBooks is a helpful process for businesses when they work with people or businesses who are not regular employees. By following the steps we’ve discussed, you can easily generate this important document for individuals who provide services to your business.

Now, armed with this knowledge, you can efficiently handle your tax reporting responsibilities and ensure that everyone gets the forms they need. Don’t hesitate to revisit these steps whenever you need a refresher, and you’ll be a QuickBooks 1099 pro in no time!

Certainly! If you are in the USA and in need of a QuickBooks certified bookkeeper, “BookkeeperLive” is here to assist you. We are an outsourcing firm that caters to your Quickbooks accounting needs based on your time zone and preferences. Additionally, you have the opportunity to avail the first free trial without any hassle. Simply provide your details, and we will deliver accurate accounting right to your desk.

FAQs

1. Can I file 1099 forms electronically?

Yes, you can file 1099 forms electronically using the IRS’s e-filing system. QuickBooks also provides an option for electronic filing for added convenience.

2. What if there’s an error on a 1099 form?

If you spot an error on a 1099 form after it has been issued, you may need to correct it. Consult with a tax professional to determine the appropriate steps for correction.

3. Are there different types of 1099 forms?

Yes, there are various types of 1099 forms, each designated for different types of income. The most common is the 1099-MISC for reporting miscellaneous income, but there are others like 1099-INT for interest income and 1099-DIV for dividend income.

4. What happens if I don’t file 1099 forms?

Failure to file 1099 forms or filing them late can result in penalties from the IRS. It’s essential to meet the deadlines and fulfill your reporting obligations.

5. Do I need to keep copies of 1099 forms for my records?

Yes, it’s crucial to retain copies of all 1099 forms for at least four years. This helps in case of an audit or if you need to reference them for any reason.

6. Can I use QuickBooks for 1099 reporting If I have multiple contractors?

Absolutely! QuickBooks is designed to handle multiple contractors efficiently. You can set up each contractor in the system, track their payments, and generate individual 1099 forms seamlessly. QuickBooks for contractors streamlines the process, making financial management smoother and more efficient.