December can be a smart time to think about outsourcing your tax returns. As the year comes to a close, many people find themselves caught up in the holiday hustle and bustle. In the midst of festivities and gift-giving, the thought of tackling tax paperwork might not be on the top of your joyous to-do list. Outsourcing your tax returns in December could be a great idea because it allows you to hand over the financial nitty-gritty to experts, giving you more time to focus on enjoying the holiday season. Let’s explore why this might be a good move and how it can make your December a little less stressful.

December: crunch the numbers on outsourcing your tax returns

December is cold, and it’s not just the holiday season – tax time is here too. With deadlines and paperwork piling up, you might think about outsourcing your tax returns to make things easier. But is December the right time for it? Let’s look at the facts and numbers to help you decide. As the year comes to a close, many individuals are considering personal tax preparation outsourcing to streamline the process and alleviate the stress associated with year-end tax responsibilities.

Here are some insights based on available data

- Growing trend: Studies suggest that outsourcing accounting tasks is a growing trend in the US. A report by Upwork found that 37% of businesses planned to outsource financial tasks in 2022, up from 28% in 2021.

- Small businesses leading the way: A survey by Clutch revealed that 45% of small businesses use outsourcing for accounting services.

The case for outsourcing

- Time crunch: The average American spends a whopping 13.6 hours on tax preparation, according to the Intuit Tax Preparation and Filing Survey. Outsourcing can free up this valuable time for holiday festivities or simply enjoying the season without the stress.

- Peak season anic: December is prime time for tax professionals, leading to potential backlogs and delays. Data from the National Association of Tax Professionals (NATP) reveals that 70% of tax professionals experience increased workload during this period. Outsourcing early can ensure your return gets the attention it deserves.

- Stress relief: A 2023 NAEA survey found that 62% of Americans find tax preparation stressful. Outsourcing can alleviate this burden, allowing you to focus on enjoying the season without the financial anxieties.

- Expertise matters: T Tax laws are notoriously complex and constantly evolving. Hiring an accountant professional can maximize your deductions and minimize your tax liability, potentially saving you money in the long run.

Let’s check the statistics data

- Millennials lead the charge: The NAEA survey also found that 70% of millennials are interested in outsourcing their tax returns. This generation, known for embracing technology and convenience, recognizes the value of professional help.

- The rise of e-filing: The IRS reports that 92% of individual tax returns are now filed electronically. Many tax preparation services offer secure online portals and document sharing, making outsourcing easier and more convenient than ever.

Before you leap

- Start early: Don’t wait until December 23rd to start your search! Research and contact potential tax professionals in early December or January to avoid the rush and ensure you find the right fit.

- Do your homework: Check credentials, qualifications, and experience before entrusting your financial data to anyone. Look for positive online reviews and reputable associations.

- Communication is key: Maintain clear and consistent communication with your tax preparer throughout the process. Ask questions, clarify any doubts, and stay proactive.

- Review and revise: Before submitting your return, thoroughly review it yourself and ask questions about anything unclear. Remember, it’s your responsibility to ensure accuracy.

December: The verdict?

Whether December is the right time for you to outsource your taxes depends on your individual needs and priorities. Weigh the data against your personal circumstances and comfort level. If you value your time, prioritize stress-free holidays, and have complex tax requirements, outsourcing can be a strategic move.

Does outsourcing tax enhance efficiency and productivity?

Outsourcing your taxes can be a productivity powerhouse! Imagine trading stressful hours deciphering forms for a smooth, efficient process handled by experts. You’ll free up valuable time and mental energy, boosting your focus and performance in other areas. Plus, tax professionals have the tools and expertise to navigate complexities quickly, leaving you free to conquer your day with sharpened focus and a lighter tax burden. It’s like a productivity superpower, unlocking your full potential while you skip the tax-season scramble. So, unleash your inner efficiency ninja and consider outsourcing for a stress-free, productive tax season!

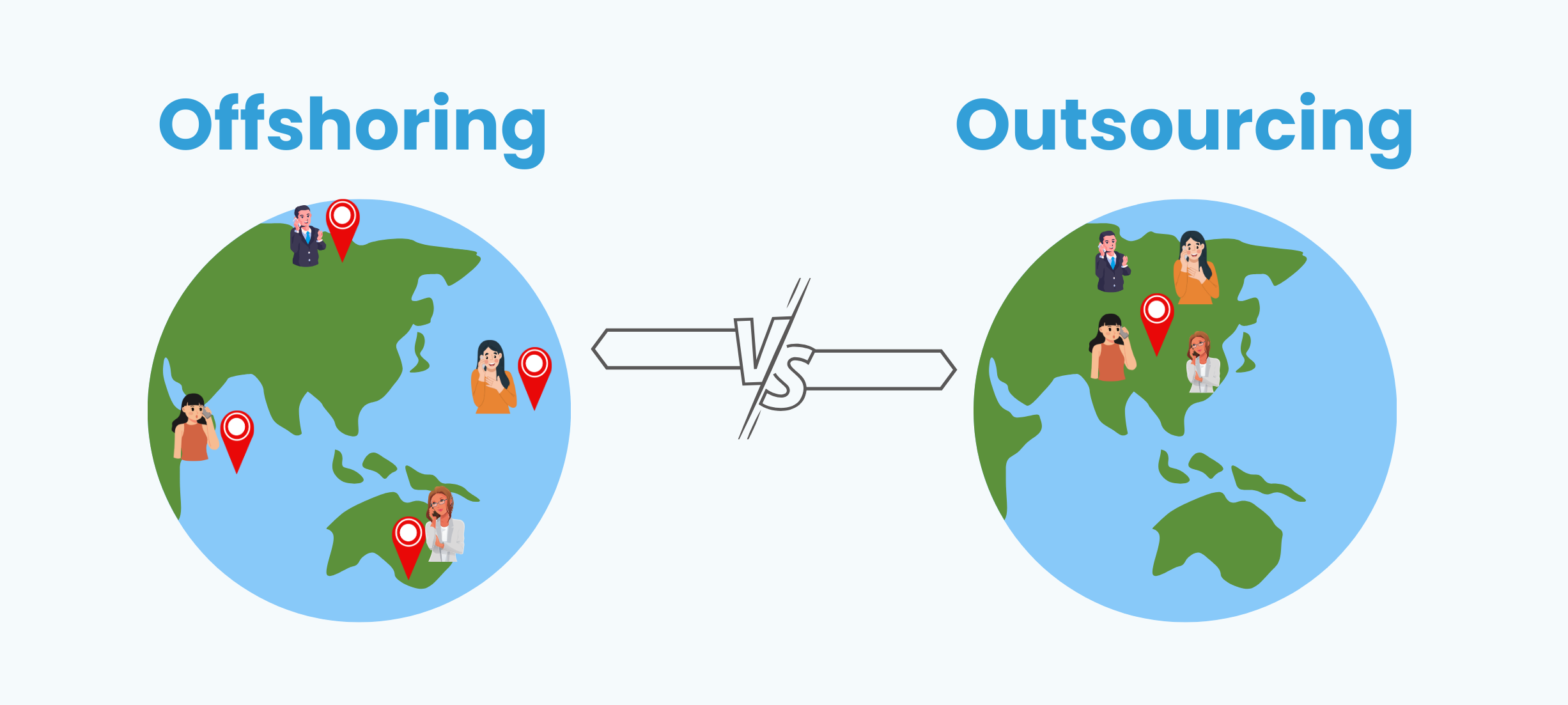

December tax outsourcing for USA businesses

Although December might appear late in the process, outsourcing tax returns proves not only possible but also a strategic decision. It enables you to access specialized expertise, lessen your workload, and efficiently address your clients’ needs during the tax season.

Nevertheless, it’s essential to emphasize the importance of selecting the right outsourcing partner. Conduct thorough research and evaluation of potential providers. Seek a firm with a track record in handling USA tax returns, a grasp of the season’s urgency, and the ability to swiftly adapt to your unique requirements.

Therefore, for any business, startup, or individual in the USA considering outsourcing tax accounting in December, proceed with confidence! It presents a viable solution to navigate the tax season smoothly and excellently. Just ensure thoughtful planning and a wise choice of your outsourcing partner, and you’ll enjoy the advantages of a streamlined and stress-free tax season.

How can BookkeeperLive help?

BookkeeperLive can be your reliable partner in the upcoming tax season. With expertise in accounting, bookkeeping, and tax preparation, they simplify complex financial tasks, making it easier for you. Their services ensure accuracy, timeliness, and compliance with tax regulations, allowing you to focus on your business while leaving the financial details in capable hands. BookkeeperLive is here to make your tax season stress-free and efficient, providing the support you need for smooth financial operations.

FAQs

Is it too late to outsource my tax return in December?

Not necessarily! While December is a peak season for tax professionals, many are still accepting new clients. Early communication is key, and you might even benefit from expedited service due to the urgency.

How much will it cost to outsource my tax return?

Fees vary depending on the complexity of your return, the services you need, and the provider you choose. Generally, expect to pay more than DIY filing, but potentially less than hiring a full-time accountant.

What types of tax returns can be outsourced?

Most tax professionals can handle both individual and business returns, including complex ones with investments, self-employment income, or foreign income, particularly during the self-assessment tax season.

Can I trust an outsourcing company with my sensitive financial information?

Reputable tax professionals prioritize data security and have robust protocols in place. Look for companies with certifications and positive online reviews.

What are some things to look for in a tax outsourcing company?

- Experience: Choose a company with experience handling returns similar to yours.

- Qualifications: Ensure the professionals have relevant certifications and memberships in professional associations.

- Reputation: Check online reviews and references to gauge client satisfaction.

- Communication: Choose a company that offers clear communication methods and responds promptly to your questions.

- Security: Verify their data security measures and compliance with privacy regulations.