Ever dreamed of having two passports, opening doors to new opportunities and exciting adventures? Dual citizenship, the legal status of belonging to two nations simultaneously, makes this dream a reality. But before you pack your bags, Let’s look closely at the details!

What is dual citizenship?

Dual citizenship means being a citizen of two or more countries at the same time. It can happen if you are born to parents from different countries, get citizenship through marriage or becoming a citizen, or inherit citizenship from your family. Not every country allows dual citizenship, but for those that do, there are both good and not-so-good things to think about.

Does the US allow dual citizenship?

Ever dreamed of having two passports? Under US law, it’s totally fine to be a citizen of both the USA and another country. No matter if you were born with dual citizenship, became a US citizen first or later, or became a citizen of another country first, you can rock both!

There’s no limit on how many citizenships you can have (although juggling more than a couple might get a bit crazy!). So, theoretically, you could be a citizen of the US and, say, ten other countries, if you really wanted to! (But hey, don’t overdo it!)

- Remember, this applies no matter how you became a dual citizen:

- Born with two citizenships? No worries!

- If you became a US citizen first and want to add another, you can go for it!

- If you started as a citizen of another country and then joined the US club, you’re welcome aboard!

The benefits of dual citizenship

- Passport power: Say goodbye to visa hassles in many countries! Holding two passports often means smoother travel and visa-free entry to a wider range of destinations. Think spontaneous weekend trips to Europe or exploring Asia without extra paperwork.

- Double the opportunities: Dual citizenship can unlock doors to education and professional opportunities in both countries. Imagine studying medicine in Germany or starting a business in your ancestral homeland. It expands your horizons and career possibilities.

- Cultural immersion: Dive deeper into different cultures and perspectives! With dual citizenship, you’re not just a tourist – you’re part of the fabric of two societies. Celebrate unique traditions, learn new languages, and gain a richer understanding of the world.

- Security and flexibility: Feeling unsure about your home country? Dual citizenship offers a “Plan B” if needed. It provides flexibility and a sense of security, knowing you have another home base if circumstances change.

- Family connections: Preserve your heritage and connect with family across borders! Dual citizenship allows you to pass it on to your children, strengthening ties to your roots and ensuring future generations can enjoy its benefits.

However, remember, like any adventure, it comes with responsibilities. Be aware of potential tax complexities, military obligations in some countries, and navigating bureaucratic hurdles. Weigh the pros and cons carefully and consider consulting with experts to ensure it aligns with your goals and circumstances.

Being a citizen of two places can sometimes mean:

- More taxes to pay: You might end up paying taxes in both countries.

- Extra responsibilities: Double the citizenships, double the duties (like voting in both places).

Having dual citizenship, especially with the United States, can create complex tax questions. While it brings exciting benefits like expanded travel opportunities, it’s crucial to understand your tax obligations in both countries to avoid complications.

The US Taxes worldwide

Unlike most other developed nations, the US taxes its citizens based on citizenship, regardless of where they live or earn income. This means that even if you reside in your other country of citizenship and earn income there, you’ll likely still need to file US tax returns and potentially pay US taxes.

Double taxation concerns

This worldwide taxation system can lead to double taxation. Imagine paying taxes on the same income to both the US and your other country. Fortunately, tax treaties exist between the US and many other nations to alleviate this burden.

How to obtain dual citizenship?

Dual citizenship, the sought-after status of being a citizen of two countries, opens a plethora of opportunities. Whether it’s immersing yourself in diverse cultures, enjoying broader travel options, or exploring potential tax benefits, it’s a dream worth pursuing. But how does one navigate the journey towards achieving this coveted status? A country’s citizenship can be obtained in a variety of ways. Let us examine a few of the most prevalent common examples.

The journey begins with self-reflection. Understand your motivations and identify the countries that interest you. Research the citizenship policies of each nation, as they have unique requirements and limitations. Some key considerations include:

- Jus soli (right of soil): This grants citizenship automatically to individuals born within the country’s borders.

- Jus sanguinis (right of blood): Citizenship is granted through descent, often from a parent or grandparent.

- Naturalization: Acquiring citizenship through residency, marriage, or meeting specific criteria.

- Investment: Some countries have citizenship programs that allow you to become a citizen in exchange for significant investments.

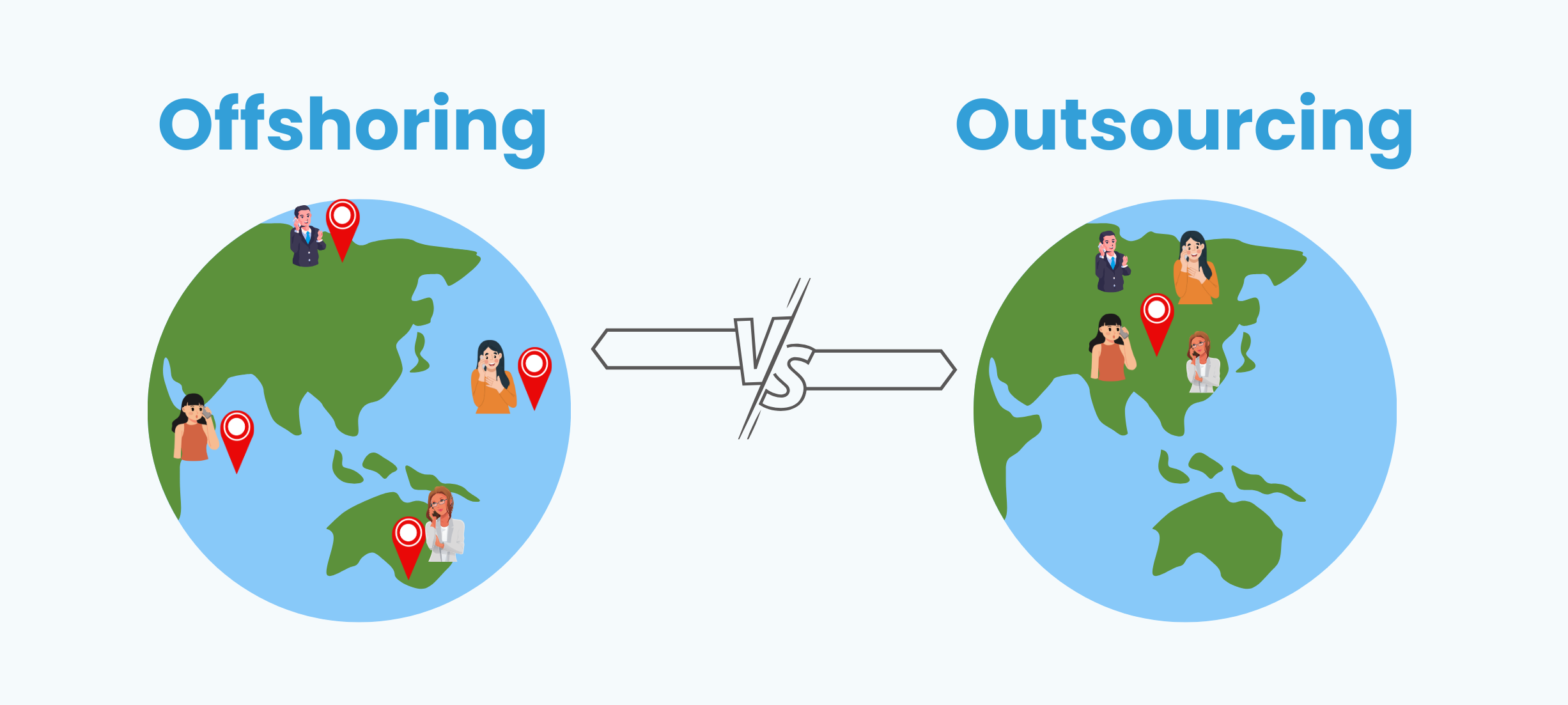

Exploring countries that allow dual citizenship

Each country has its own unique set of rules when it comes to dual citizenship. Before pursuing citizenship in a second country, it’s crucial to understand the specific regulations you’ll need to follow.

Firstly, not every country allows dual citizenship. Some, like China, may require you to give up any previous allegiances when becoming a citizen. Others, like Austria, might only allow it under strict conditions like marriage or investment.

In many countries where dual citizenship is allowed, like Ireland, Italy, and Germany, recognize it, often based on ancestry. The Americas are generally open as well, with countries like Canada, Argentina, and the USA welcoming those born within their borders.

Dual citizenship countries: An all-inclusive list

- Albania

- Angola

- Argentina

- Armenia

- Australia

- Austria (with permission)

- Bahamas

- Barbados

- Belgium

- Belize

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil (with rare exceptions)

- Bulgaria

- Canada

- Chile

- Colombia

- Costa Rica

- Côte d’Ivoire

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Dominica

- Dominican Republic

- Ecuador

- El Salvador

- Estonia

- Fiji

- Finland

- France

- Gabon

- The Gambia

- Georgia

- Germany

- Ghana

- Greece

- Grenada

- Guatemala

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hungary

- Iceland

- India (Overseas Citizenship of India)

- Indonesia (until age 18)

- Ireland

- Israel

- Italy

- Jamaica

- Japan (with restrictions)

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kyrgyzstan

- Latvia (with exceptions)

- Lebanon

- Lesotho

- Liberia

- Liechtenstein

- Lithuania (with exceptions)

- Luxembourg

- Macedonia (North Macedonia)

- Madagascar

- Malawi

- Malaysia (with restrictions)

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico (with rare exceptions)

- Micronesia, Federated States of

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Namibia

- Nauru

Conclusion

As you can see, there are many countries around the world that allow dual citizenship. This can be a great option for people who have ties to multiple countries or who want to expand their opportunities. However, it is important to carefully consider the laws of both countries involved before applying for dual citizenship. You should also consult with an immigration attorney to make sure that you meet all of the requirements.

How Bookkeeperlive can help

Bookkeeperlive can help you with all aspects of managing your dual citizenship, from understanding the tax implications to complying with reporting requirements. We can also help you to navigate the complex process of applying for dual citizenship. Here are some specific ways we can help:

- Tax preparation service: We can help you prepare your US and foreign tax returns, ensuring that you are complying with all tax laws and reporting requirements.

- Understanding tax treaties: We can help you understand how tax treaties between the US and your other country of citizenship may affect your tax obligations.

- Foreign bank account reporting: We can help you comply with US reporting requirements for foreign bank accounts.

- FATCA and FBAR: We can help you understand and comply with the Foreign Account Tax Compliance Act (FATCA) and the Report of Foreign Bank and Financial Accounts (FBAR).

- Dual citizenship planning: We can help you plan for the tax implications of dual citizenship, such as estate planning and retirement planning.

FAQs

1. Does the USA allow dual citizenship?

Yes, the USA does allow dual citizenship. There is no law against US citizens holding citizenship in another country. However, it’s important to note that the other country’s laws on dual citizenship might differ.

2. Are there any downsides to having dual citizenship?

While there are many benefits to dual citizenship, there are also potential downsides to consider:

- Taxation: You may have to file taxes in the US and your other country of citizenship. This can be complex and expensive.

- Military obligations: Some countries have mandatory military service, which could apply to you even if you live in the US.

- Voting: You may be eligible to vote in elections in both countries, but there could be restrictions depending on your residency status.

- Disclosure requirements: You may be required to disclose your dual citizenship status to the US government or other authorities.

3. How do I find out if another country allows dual citizenship?

The best way to find out if another country allows dual citizenship is to consult with their embassy or consulate in the US. You can also find information on their official government website.

4. What are the benefits of having dual citizenship?

There are many potential benefits to having dual citizenship, including:

- Travel: You may be able to travel visa-free to more countries.

- Living and working abroad: You may have more opportunities to live and work in another country.

- Investing and doing business: You may have more investment and business opportunities in another country.

- Cultural connections: You may have deeper cultural connections to another country.

5. I am a US citizen and want to apply for citizenship in another country. What should I do?

Before applying for citizenship in another country, it’s crucial to:

- Research the laws of both countries: Understand the requirements, potential implications, and any restrictions related to dual citizenship.

- Consult with an immigration attorney: Seek professional guidance to navigate the legal complexities and ensure a smooth process.

- Disclose your intentions to the US government: If required, inform the US authorities about your plans to acquire another citizenship.

Remember, this is just a starting point. It’s advisable to conduct thorough research and seek professional advice tailored to your specific situation before making any decisions about dual citizenship.