Running a successful printing business takes more than just great printing skills! Even though dealing with money stuff like accounting for printing business might not be super fun, it’s really important for keeping your finances in good shape and making sure your business stays successful in the long run. Here’s why: Strong accounting for printing business helps you track income and expenses, identify they profitable services, and make informed decisions about pricing and inventory. Let’s talk about some important tips for managing the money side of your printing business without making it too complicated or confusing.

Get professional help: Partnering with a CPA for growth

As your printing business scales, the financial complexities can quickly become overwhelming. Unless you possess a strong accounting background yourself, bringing a Certified Public Accountant (CPA) on board becomes essential. Here’s why a CPA is the perfect partner for your growing business:

- Unmatched tax expertise: Tax laws are intricate and constantly evolving. A CPA, having passed rigorous exams and undergone ongoing education, possesses a deep understanding of tax regulations specific to the printing industry. This expertise ensures you navigate tax season with confidence, maximizing deductions and credits to minimize your tax burden.

- Compliance confidence: Beyond tax filing, a CPA can ensure your business adheres to all relevant tax regulations. This includes payroll taxes, sales taxes (if applicable), and any other industry-specific reporting requirements. By staying compliant, you avoid penalties and fines, protecting your business from unnecessary risks.

- Strategic financial guidance: A CPA is more than just a tax preparer. They are your financial advisor. By analyzing your financial data, they can identify trends and uncover areas for improvement. This can lead to cost-saving strategies, optimized pricing models, and informed inventory management decisions that boost your profitability.

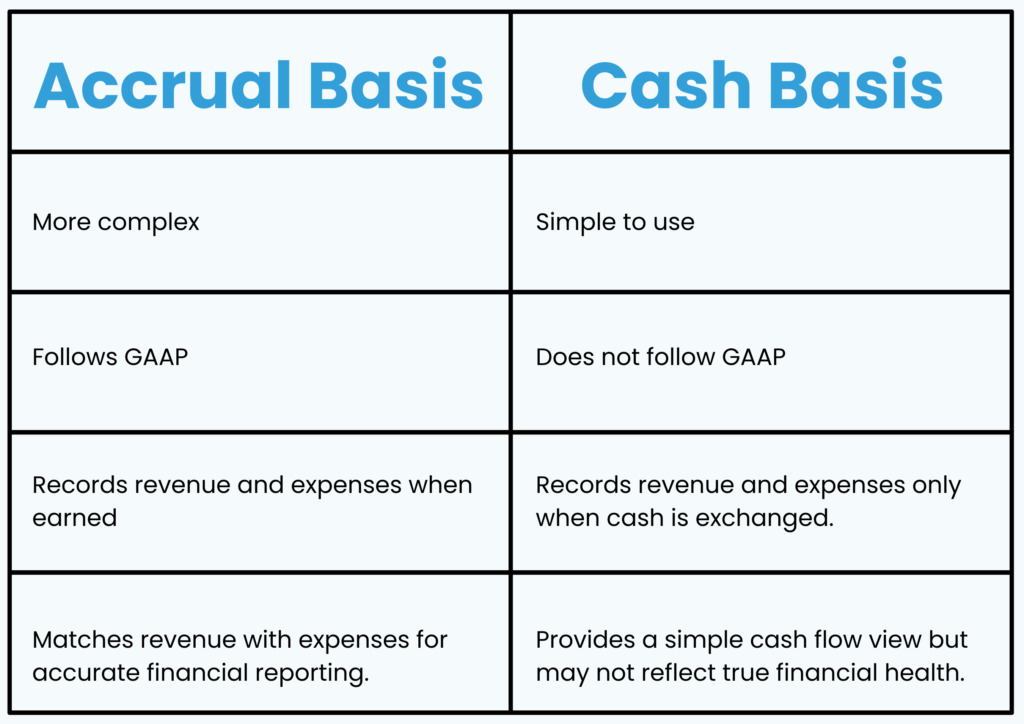

Cash vs. Accrual

Here’s a breakdown of two common accounting methods: cash accounting and accrual accounting, helping you understand which one best suits your growing business.

Also check out our new blog – Top Tax Deductions for Printing Businesses

Cash accounting: Keeping it simple

Imagine a system where you record income only when you receive payment, and expenses only when you pay the bill. That’s the essence of cash accounting. It’s a straightforward approach, perfect for smaller businesses just starting out. Think of it like keeping track of your own personal finances in a notebook. Here’s what cash accounting looks like for your printing business:

- Income: You record a sale only when the customer pays you, whether it’s cash, check, or credit card.

- Expenses: You record an expense only when you pay the bill for materials, equipment, or rent.

Benefits of cash accounting

- Simple and easy to maintain: Cash accounting requires minimal bookkeeping expertise, making it a good fit for smaller businesses.

- Provides clear cash flow picture: You can easily see how much cash is coming in and going out at any given time.

Drawbacks of cash accounting

- Limited financial insights: Since it doesn’t account for outstanding invoices or unpaid bills, cash accounting doesn’t provide a complete picture of your financial health. This can be especially misleading for seasonal businesses like printing business. For example, if you receive a large order in December but the payment isn’t due until January, your December income might appear lower than it actually is.

- Difficulty in profit tracking: Accurately calculating your business’s profit can be challenging with cash accounting, as it doesn’t consider income earned but not yet received, or expenses incurred but not yet paid.

Accrual accounting: A more detailed picture

Accrual accounting takes a broader view of your finances. It records income when it’s earned, regardless of when you receive the payment, and expenses when they’re incurred, regardless of when you pay the bill. Imagine it like a detailed financial snapshot of your business, capturing the complete picture of your financial health. Here’s how it applies to your printing business:

- Income: You record a sale as soon as the customer places the order, even if they haven’t paid yet. You’ll then create an “account receivable” to track the outstanding payment.

- Expenses: You record an expense as soon as you receive the invoice for materials, equipment, or rent, even if you haven’t paid yet. This creates an “account payable” to track what you owe.

For efficient management of accounts payable, consider outsourcing to reputable companies with experience in the printing industry. These specialists can streamline your workflow using accounts payable services.

Benefits of Accrual Accounting:

- Accurate financial picture: Accrual accounting provides a more accurate representation of your business’s financial health at any given time. This is crucial for making informed business decisions, especially for seasonal businesses like printing business. For example, it allows you to track income earned during the busy holiday season even if payments haven’t been received yet.

- Improved profit tracking: By considering both earned and unearned income, along with incurred and unpaid expenses, accrual accounting allows for more precise profit calculation.

Drawbacks of accrual accounting

- More complex: Accrual accounting requires a more sophisticated bookkeeping system and may necessitate additional accounting software or professional help.

Choosing the right method for your printing business

The best accounting method for your business depends on several factors, including your size, complexity, and business model.

- For smaller printing business with a steady flow of income and expenses, cash accounting might be sufficient, especially in the beginning.

- However, as your business grows and becomes more seasonal, accrual accounting becomes more advantageous. It provides a clearer picture of your financial health and helps with long-term planning.

Invest in bookkeeping

Implement a robust bookkeeping service to track your day-to-day finances accurately. Start with software like QuickBooks or consider outsourcing to services like BookkeeperLive for larger operations. Digital solutions streamline the process and provide better insights into your business’s financial status.

Establish routine

Just like your consistent printing processes, develop routines for your accounting. This might involve weekly bill payments, check deposits, and monthly expense tracking. Put these routines in writing and display them prominently.

Remember, consistency is key! Especially with tasks like filing sales tax and payroll withholdings. Late reports can result in penalties.

Stay informed

Keep a watchful eye on your key financial metrics: sales, costs, accounts payable, and accounts receivable. A weak system for collecting receivables can put your business at risk. Regularly monitor your bank accounts and credit cards.

Don’t wait until year-end to crunch the numbers. Proactive financial analysis allows you to identify and address potential problems early on. Regularly review your financials and seek guidance from your CPA. The deeper you understand your finances, the better equipped you are to steer your business towards success.

Automation: Streamline your workflow

The good news? Many accounting tasks can be automated in your printing business! Here are some:

- Invoicing: Invest in software that automatically generates invoices based on job details. This saves time, reduces errors, and ensures timely customer billing.

- Bill pay: Automate recurring bill payments to avoid late fees and ensure vendors are paid on time.

- Expense tracking: Integrate your expense tracking software with your credit cards and bank accounts for automatic data entry. This eliminates manual data entry and streamlines expense categorization.

By automating these tasks, you free up valuable time and resources for core business activities. Plus, automation minimizes errors, leading to more accurate financial records.

Track profitability for print jobs

It’s crucial to track the profitability of each print job. This helps you identify your most lucrative offerings and pinpoint areas for improvement. Here’s how:

- Job costing: Track all costs associated with a print job, including materials, labor, and overhead. This allows you to calculate the true cost per job.

- Pricing analysis: Compare your job costs to your selling prices. Are you adequately covering your expenses and generating a profit?

- Profit margin optimization: Use profitability insights to adjust pricing strategies. You might identify opportunities to raise prices on under-valued jobs or explore cost-saving measures for less profitable ones.

By tracking profitability, you gain valuable insights to optimize your pricing and boost your overall bottom line.

Don’t wait until the last minute

Don’t leave financial tasks for the end. Start early to keep things clear and organized. Instead of waiting until deadlines approach, make it a habit to check your finances every month. Also, ask for advice from experts, like a financial advisor. Understanding your money better helps you make smart choices for your printing business.

Bottom line

BookkeeperLive can help your printing business by providing a robust bookkeeping service that tracks your day-to-day finances accurately. This will give you a clearer picture of your financial health and help you with long-term planning. BookkeeperLive can also automate many accounting tasks, such as invoicing, bill pay, and expense tracking. This will save you time and resources, and help to minimize errors in your financial records. By using BookkeeperLive, you can gain valuable insights into your business’s profitability and make better decisions about your pricing and inventory.

FAQs

1. How can I improve my cash flow in my printing business?

- Implement stricter credit policies to reduce outstanding invoices.

- Offer early payment discounts to incentivize faster payments.

- Track inventory closely to avoid overstocking and wasted materials.

- Negotiate better payment terms with suppliers if possible.

. 2. What are some security measures I should take for my printing business finances?

- Use strong passwords and regularly update them.

- Restrict access to financial data only to authorized personnel.

- Invest in anti-virus and anti-malware software.

- Regularly back up your financial data securely.

3. How can I stay up-to-date on accounting regulations for printing busness?

To stay informed, Consult with a CPA who specializes in the printing industry industry and subscribe to industry newsletters or publications for updates.