In the competitive printing industry, success comes from making high-quality products efficiently. Good financial management is crucial for this and having a well-organized Chart of Accounts (COA) is a key part of it. In this blog, we’ll talk about why a COA is important for a printing business and give you a simple COA template with an explanation of how the accounts are organized.

What is a chart of accounts (COA)?

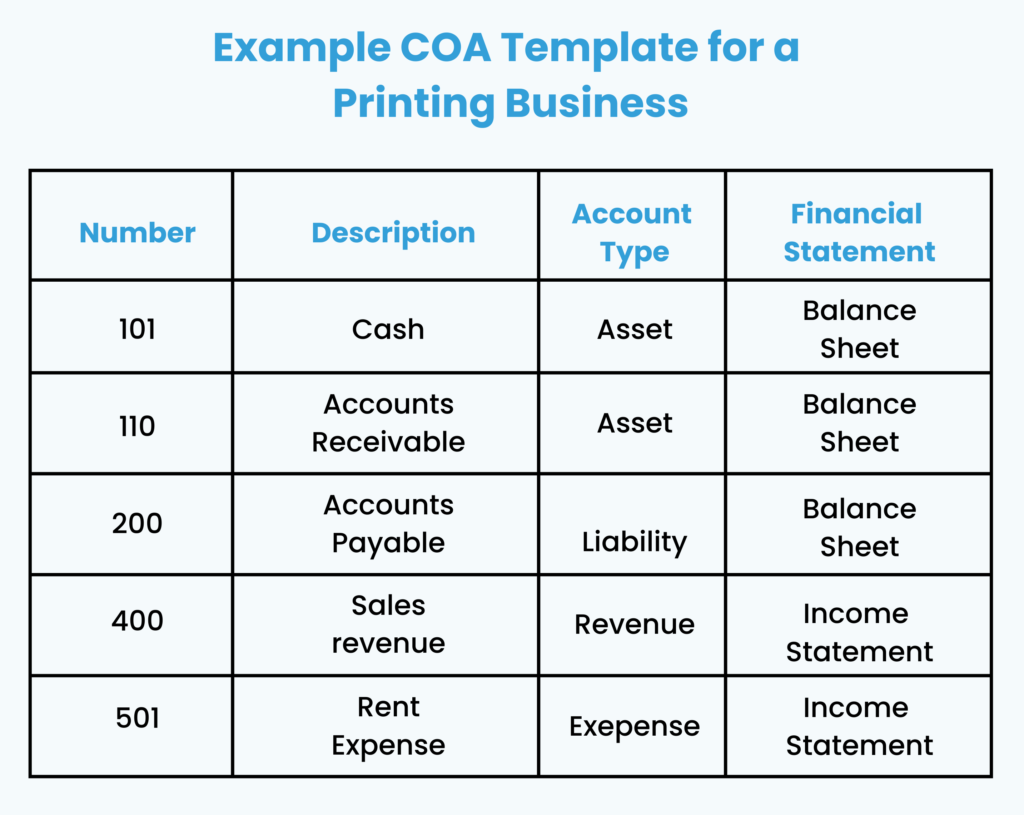

Imagine your business finances as a big library. A Chart of Accounts (COA) is like the well-organized catalog that helps you find any financial record quickly and easily. It’s a list of all the financial accounts used in your printing business, divided into clear sections. Each account has a unique ID and description, making it simple to track your income, expenses, assets, liabilities, and equity.

How a chart of accounts works?

1. Organization of financial data

The COA organizes financial data into categories that reflect the company’s financial structure. This organization allows for a clear and systematic approach to recording and reporting financial transactions.

2. Transaction recording

When a financial transaction occurs, it is recorded in the appropriate accounts within the COA.

For example, a sale would be recorded as an increase in a revenue account and a decrease in inventory (an asset account).

3. Financial reporting

The COA forms the basis for financial statements such as the balance sheet and income statement.

Accurate and detailed accounts ensure that financial statements are precise and reflect the true financial position of the company.

4. Budgeting and financial analysis

A well-structured COA aids in budgeting and forecasting by providing clear categories for anticipated revenues and expenses.

It also facilitates financial analysis, enabling the identification of trends, cost control, and performance measurement.

Also check out our new blog – What Is Cash Flow Management?

Importance of a COA in a printing business

In the fast-paced world of printing, where margins can be tight, a COA is more than just an organizational tool; it’s a strategic advantage. Here’s why:

- Accurate financial reporting: A well-structured COA ensures accurate recording of every transaction, leading to reliable financial statements. This is crucial for informed decision-making, tax preparation, and attracting investors.

- Cost control and efficiency: By tracking specific printing-related expenses (paper, ink, equipment maintenance) in dedicated accounts, you can pinpoint cost drivers and identify areas for improvement.

- Profitability analysis: A detailed COA allows you to analyze profitability by job type, client, or even specific equipment. This empowers you to adjust pricing strategies and optimize your service offerings.

- Benchmarking and growth: A standardized COA facilitates comparisons with industry benchmarks, helping you identify areas where your business excels or needs improvement. This paves the way for targeted growth strategies.

Creating a customized COA for your printing business

The provided template is a starting point. Consider these factors for customization:

- Business size and complexity: Larger businesses may need more detailed account breakdowns (e.g., separate accounts for different paper types).

- Printing services offered: If you offer specific printing services like brochures or banners, create dedicated income and expense accounts for them.

- Software integration: Ensure your chosen COA structure integrates seamlessly with your accounting software.

Remember, a well-designed COA is an investment in your printing business’s financial health. By taking the time to customize it, you’ll gain a clear view of your finances, identify areas for optimization, and ultimately, achieve long-term success.

Creating a Customized COA for Your Printing Business

The provided template is a starting point. Consider these factors for customization:

- Business Size and Complexity: Larger businesses may need more detailed account breakdowns (e.g., separate accounts for different paper types).

- Printing Services Offered: If you offer specific printing services like brochures or banners, create dedicated income and expense accounts for them.

- Software Integration: Ensure your chosen COA structure integrates seamlessly with your accounting software.

Remember, a well-designed COA is an investment in your printing business’s financial health. By taking the time to customize it, you’ll gain a clear view of your finances, identify areas for optimization, and ultimately, achieve long-term success.

Chart of accounts variations

Non-profit chart of accounts: Non-profit organizations have a unique financial structure compared to for-profit businesses. Their COAs often place a special emphasis on tracking restricted and unrestricted funds, ensuring transparency with donors about how their contributions are used.

Debit and credit chart of accounting: Certainly, debits and credits are the foundation of double-entry accounting, the system used by most businesses. They represent two sides of a transaction and ensure everything is balanced.

BookkeeperLive: Your printing partner for success

Running a printing business is tough. Keeping track of finances can be even tougher. That’s where BookkeeperLive steps in. We connect you with our expert accountants who know the printing industry, especially when it comes to setting up a Chart of Accounts (COA). Think of a COA as your financial filing system. With BookkeeperLive, you’ll get an accountant that makes sense for your business, so you can focus on what you do best – printing!

FAQs

1. Is There a single COA format?

No, there isn’t a one-size-fits-all format for a chart of accounts. The ideal COA structure depends on the size and complexity of your printing business. However, most COAs follow a standardized hierarchical structure with core categories like assets, liabilities, equity, revenue, and expenses. These categories can then be further divided into sub-categories for more granular detail. An accountant can guide you in creating a COA that best suits your business needs.

2. What are the costs associated with hiring an accountant?

Accountant fees vary based on experience, location, and services needed. Some accountants charge hourly rates, while others may offer retainer fees for ongoing services. This can include assistance with setting up a customized chart of accounts (COA) to best organize your financial data.

3. How do I find the right accountant for my printing business?

Need a printing-savvy accountant? BookkeeperLive connects you with experienced pros for your Chart of Accounts (COA) and tax needs. Find your perfect financial fit, all in one place!