The Internal Revenue Service (IRS) recently unveiled its annual inflation adjustments for the 2024 tax year, affecting over 60 key tax provisions. These adjustments, aimed at mitigating the impact of rising prices, encompass modifications to tax brackets, standard deductions, and various other tax credits and thresholds. While formally applicable to income tax returns filed in 2025, understanding these changes now can help individuals and families plan their finances and optimize their tax strategies for the coming year. Let’s explore the details of these IRS tax inflation adjustments, highlighting the most significant changes and their potential implications for taxpayers.

Highlights of the inflation adjustments

- Standard deduction

Good news for taxpayers! The standard deduction, which is the amount you can reduce from your taxable income without listing individual expenses, has gone up. If you’re married and filing taxes together, it’s now $29,200, which is $1,500 more. For single filers, it’s $14,600, and for heads of households, it’s $21,900. This means you get to keep more money before paying taxes.

- Marginal rates

In a move reflecting modest inflation, the IRS announced minimal changes to the top marginal tax rates for 2024. The coveted 37% bracket will still ensnare individual single taxpayers earning over $609,350, a mere $4,500 increase from 2023. Similarly, married couples filing jointly face a stagnant threshold of $731,200, just $8,300 higher than the previous year. These figures hold steady despite inflation reaching 6.5% in 2022, potentially impacting middle-income earners more as their wages lag rising prices.

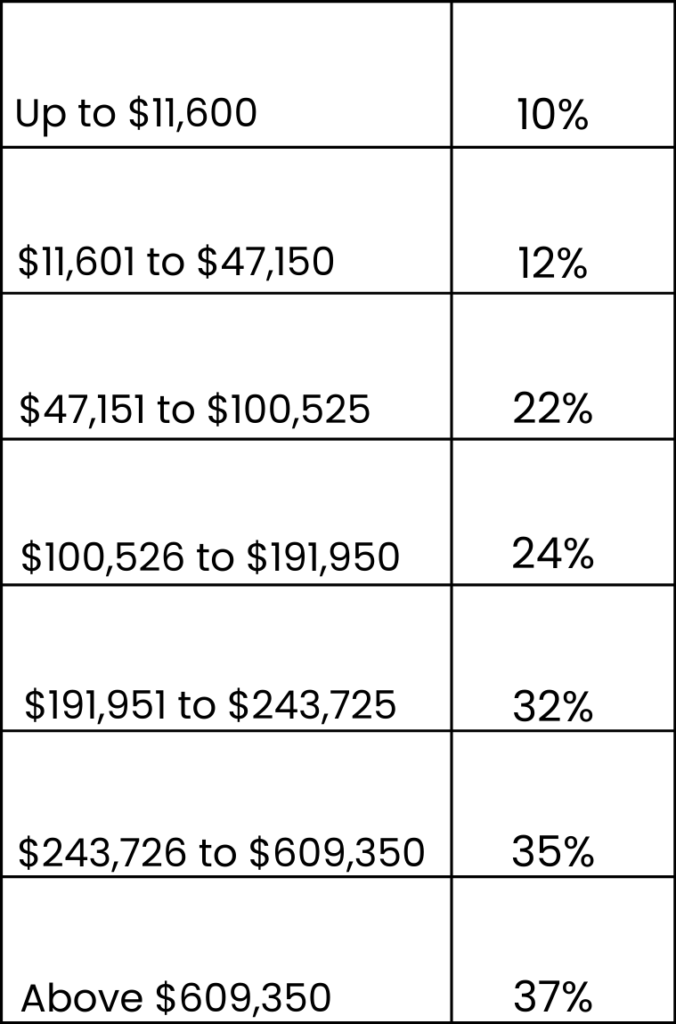

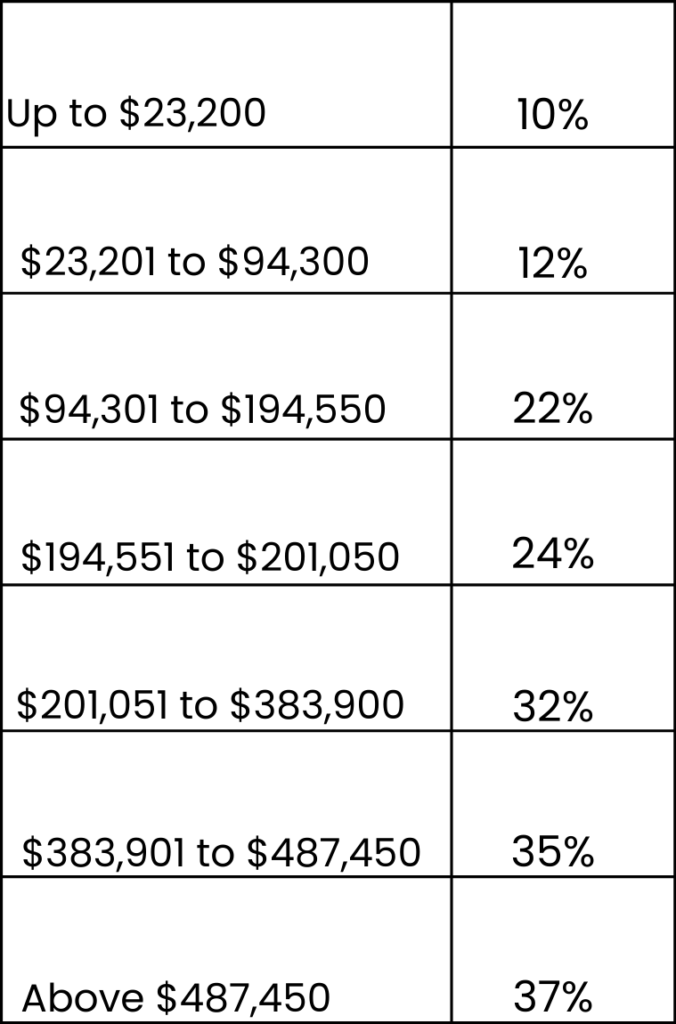

The other rates are:

Here’s a complete breakdown of the 2024 federal income tax brackets and marginal rates for single filers and married couples filing jointly:

Single filers

Married couples filing jointly

These static top rates might offer a sense of stability for high earners, knowing their tax burden won’t drastically shift in the immediate future. However, the lack of adjustment relative to inflation could present challenges for lower- and middle-income families struggling to keep pace with increasing living costs. With wages not rising at the same rate as inflation, a stagnant top bracket could effectively increase the tax burden for those further down the income ladder.

The increased alternative minimum tax (AMT) exemption in 2024

Previously, the AMT exemption for single filers stood at $81,300 and $126,500 for joint filers in 2023. With the adjustments for 2024, those numbers increase to $85,700 for single filers and $133,300 for joint filers. This means a significantly larger portion of middle-income earners will no longer be subject to the AMT for taxes, potentially saving them thousands of dollars.

More changes to pay attention to

- Retirement saving gets a boost: Sock away more in your 401(k) and IRAs! The contribution limit for 2024 rises to $23,000, $500 more than 2023. Early birds aged 50 and above can still be caught up with a $7,500 contribution limit.

- Gifting gets grander: If you’re feeling generous, the annual gift exclusion rises to $17,000, allowing you to shower loved ones with tax-free goodies without raising any IRS eyebrows.

- Earned Income Tax Credit: Working families with low to moderate incomes get a little extra help. The maximum Earned Income Tax Credit for those with three or more qualifying children creeps up to $7,830, offering welcome financial support.

Here are some additional statistics to consider

- The percentage of taxpayers falling into the top 37% bracket is expected to remain around 1.4%, highlighting its limited impact on most Americans.

- The median household income in the US in 2022 was $67,521, far below the thresholds for the top bracket, further emphasizing its effect on a relatively small portion of the population.

- Tax brackets, unlike the minimum wage, are not automatically adjusted for inflation. Congress needs to pass legislation to make such adjustments, further complicating the issue.

- It’s important to stay informed about all tax changes and consult with a financial professional to understand how they might affect your specific situation. While the static top rates offer a sense of stability for some, it’s crucial to consider the broader economic context and potential disparities in impact across different income brackets.

Effects on various tax filers

- Low-income earners: The increased standard deduction and Earned Income Tax Credit could translate to a lower tax burden or even a refund for low-income filers.

- Middle-income earners: The modest tax bracket adjustments and inflation-adjusted thresholds for deductions and credits could mean slightly lower taxes or slightly larger refunds for many middle-income filers.

- High-income earners: While high-income earners might pay slightly more in taxes due to the higher standard deduction benefiting lower-income individuals, the increased tax brackets and other adjusted thresholds could provide some offsetting benefits.

Tax bracket adjustment: A modest shift

Remember those tax brackets, the tiered system that determines your tax rate? They’re also inching upwards slightly for 2024, reflecting the rise in living costs. The changes are modest, around 5%, ensuring you don’t get bumped into a higher bracket simply because your grocery bill went up.

The bottom line? You’ll likely pay the same or slightly less in taxes compared to 2023, unless your income skyrockets into a higher bracket territory.

The takeaway: It’s all about keeping things fair

When prices go up because of inflation, it might seem like you’re getting more money in your paycheck. But at the same time, everything becomes more expensive. So, they’re adjusting the rules for taxes to make sure you don’t end up paying more just because your daily expenses went up.

It’s like having a secret helper that makes it easier for you when things get more expensive. This way, you might save some of the money you worked hard for.

So, stay calm and do your tax filing preparation. Even if going into all the details of the tax code isn’t everyone’s favorite thing, knowing about these yearly changes can give you peace of mind. And who knows, you might find a little extra money in your pocket when it’s tax season in 2025!

Conclusion

Considering the IRS’s recent declaration of yearly inflation adjustments for the tax year 2024, it becomes crucial for taxpayers to stay informed about these changes for a better financial understanding.

At BookkeeperLive, we offer expert assistance to individuals and small businesses with bookkeeping and tax services in managing their finances amidst evolving tax landscapes. Our professional services are tailored to simplify the complexities of tax compliance and optimise financial strategies effectively.

Explore BookkeeperLive’s free trial for reliable support in tax prep. Stay informed and confident in your financial decisions.

FAQs

1. How much did the standard deduction increase for 2024?

- Married filing jointly: Up $1,500 to $29,200.

- Single and married filing separately: Up $750 to $14,600.

- Heads of household: Up $1,100 to $21,900.

2. Will my tax bracket change in 2024?

Your tax bracket will likely increase slightly (around 5%) to adjust for inflation. This means you’ll likely pay the same or slightly less in taxes unless your income significantly increases.

3. Do I need to do anything different to claim these adjustments?

The adjustments are automatically applied when you file your 2024 tax return (due in 2025). You don’t need to take any additional action.

4. I want to give someone a gift. Did the annual gift exclusion change?

Yes, the annual gift exclusion increases to $17,000 per recipient in 2024.

5. How will these changes affect my specific tax situation?

Consulting a tax advisor or hiring an accountant is recommended for personalised advice based on your income, deductions, and credits.

6. What other tax changes should I be aware of for 2024?

Stay updated on additional legislation or IRS announcements that might impact your tax liability.