The Internal Revenue Service (IRS) recently unveiled its annual inflation adjustments for the 2024 tax year, affecting over 60 key tax provisions. These adjustments, aimed at mitigating the impact of rising prices, encompass modifications to tax brackets, standard deductions, and various other tax credits and thresholds. While formally applicable to income tax returns filed in 2025, understanding these changes now can help individuals and families plan their finances and optimize their tax strategies for the coming year. Let’s explore the details of these IRS tax inflation adjustments, highlighting the most significant changes and their potential implications for taxpayers.

Good news for taxpayers! The standard deduction, which is the amount you can reduce from your taxable income without listing individual expenses, has gone up. If you're married and filing taxes together, it's now $29,200, which is $1,500 more. For single filers, it's $14,600, and for heads of households, it's $21,900. This means you get to keep more money before paying taxes.

In a move reflecting modest inflation, the IRS announced minimal changes to the top marginal tax rates for 2024. The coveted 37% bracket will still ensnare individual single taxpayers earning over $609,350, a mere $4,500 increase from 2023. Similarly, married couples filing jointly face a stagnant threshold of $731,200, just $8,300 higher than the previous year. These figures hold steady despite inflation reaching 6.5% in 2022, potentially impacting middle-income earners more as their wages lag rising prices.

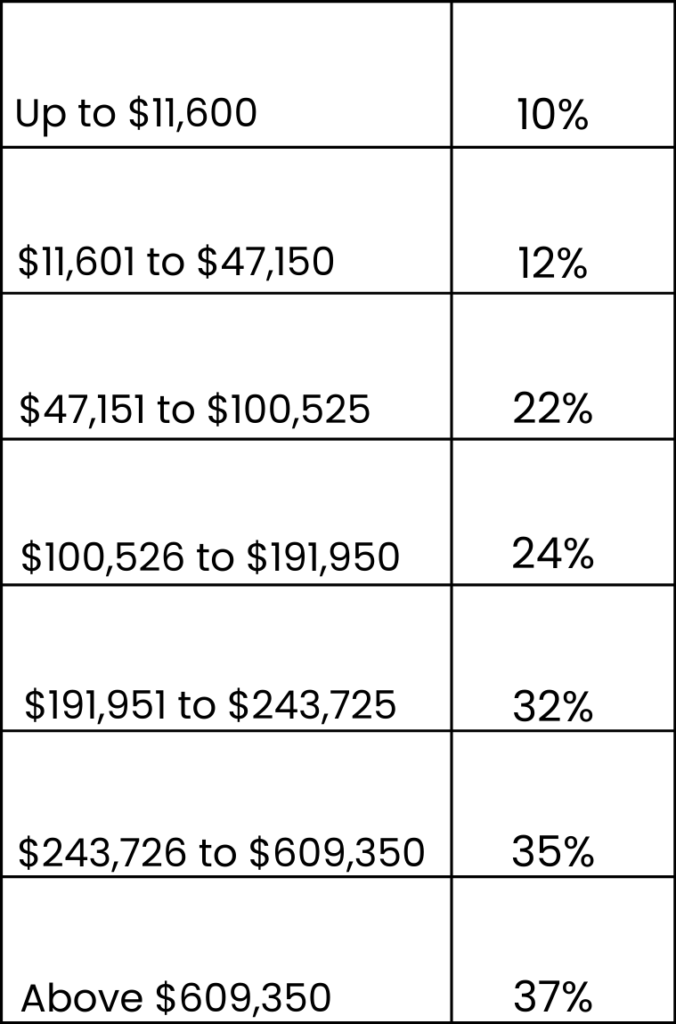

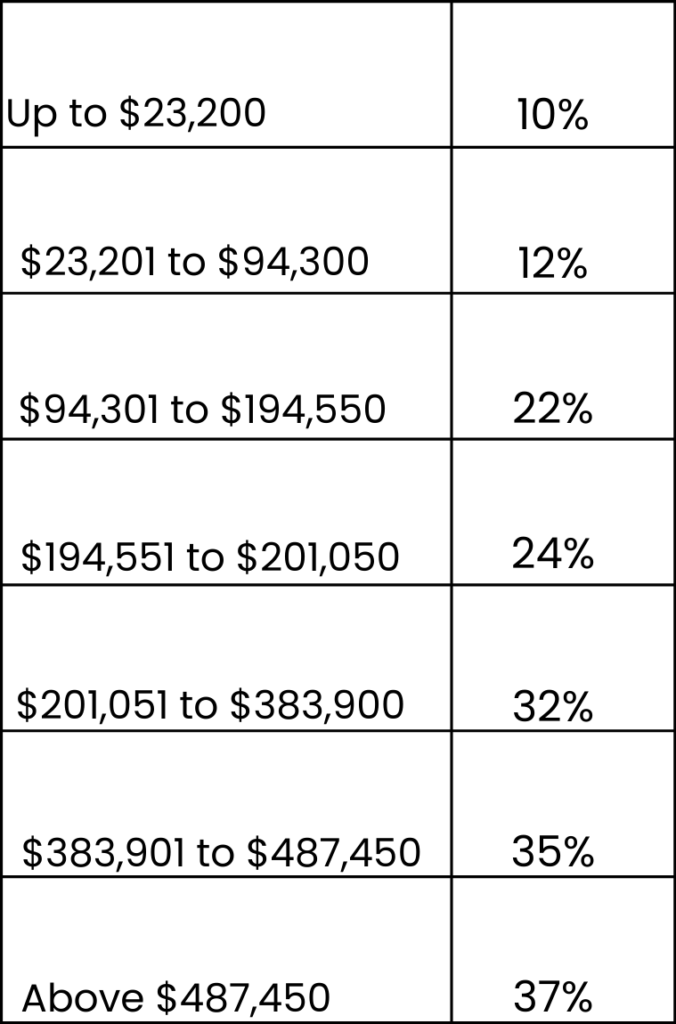

Here's a complete breakdown of the 2024 federal income tax brackets and marginal rates for single filers and married couples filing jointly:

These static top rates might offer a sense of stability for high earners, knowing their tax burden won't drastically shift in the immediate future. However, the lack of adjustment relative to inflation could present challenges for lower- and middle-income families struggling to keep pace with increasing living costs. With wages not rising at the same rate as inflation, a stagnant top bracket could effectively increase the tax burden for those further down the income ladder.

Previously, the AMT exemption for single filers stood at $81,300 and $126,500 for joint filers in 2023. With the adjustments for 2024, those numbers increase to $85,700 for single filers and $133,300 for joint filers. This means a significantly larger portion of middle-income earners will no longer be subject to the AMT for taxes, potentially saving them thousands of dollars.

Remember those tax brackets, the tiered system that determines your tax rate? They're also inching upwards slightly for 2024, reflecting the rise in living costs. The changes are modest, around 5%, ensuring you don't get bumped into a higher bracket simply because your grocery bill went up.

The bottom line? You'll likely pay the same or slightly less in taxes compared to 2023, unless your income skyrockets into a higher bracket territory.

When prices go up because of inflation, it might seem like you're getting more money in your paycheck. But at the same time, everything becomes more expensive. So, they're adjusting the rules for taxes to make sure you don't end up paying more just because your daily expenses went up.

It's like having a secret helper that makes it easier for you when things get more expensive. This way, you might save some of the money you worked hard for.

So, stay calm and do your tax filing preparation. Even if going into all the details of the tax code isn't everyone's favorite thing, knowing about these yearly changes can give you peace of mind. And who knows, you might find a little extra money in your pocket when it's tax season in 2025!

Considering the IRS's recent declaration of yearly inflation adjustments for the tax year 2024, it becomes crucial for taxpayers to stay informed about these changes for a better financial understanding.

At BookkeeperLive, we offer expert assistance to individuals and small businesses with bookkeeping and tax services in managing their finances amidst evolving tax landscapes. Our professional services are tailored to simplify the complexities of tax compliance and optimise financial strategies effectively.

Explore BookkeeperLive's free trial for reliable support in tax prep. Stay informed and confident in your financial decisions.

1. How much did the standard deduction increase for 2024?

2. Will my tax bracket change in 2024?

Your tax bracket will likely increase slightly (around 5%) to adjust for inflation. This means you'll likely pay the same or slightly less in taxes unless your income significantly increases.

3. Do I need to do anything different to claim these adjustments?

The adjustments are automatically applied when you file your 2024 tax return (due in 2025). You don't need to take any additional action.

4. I want to give someone a gift. Did the annual gift exclusion change?

Yes, the annual gift exclusion increases to $17,000 per recipient in 2024.

5. How will these changes affect my specific tax situation?

Consulting a tax advisor or hiring an accountant is recommended for personalised advice based on your income, deductions, and credits.

6. What other tax changes should I be aware of for 2024?

Stay updated on additional legislation or IRS announcements that might impact your tax liability.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.