The Internal Revenue Service adheres to a “pay-as-you-go” system, requiring taxpayers to settle their tax obligations throughout the year rather than facing a large bill come filing season. For employees and recipients of government benefits like Social Security, this system functions seamlessly with automatic tax withholding from paychecks or disbursements. However, self-employed individuals and those with income sources beyond traditional salaries are responsible for making estimated tax payments quarterly. This blog will explore who qualifies for this requirement, outline methods for calculating estimated tax obligations, and detail the relevant payment deadlines for the 2024 tax year, ensuring a smooth and compliant tax filing experience.

What are the estimated tax payments?

Imagine you earn money throughout the year, but unlike a regular job, no taxes are automatically taken out of your paycheck. This applies to people who are self-employed, like freelancers or small business owners.

To avoid owing a giant tax bill at the end of the year, the IRS asks these folks to pay estimated taxes quarterly. It’s like spreading your tax payments out into smaller chunks throughout the year.

Estimated taxes apply to any income you earn that doesn’t have taxes automatically withheld, like money from your business, investments, or renting out a property.

Basically, estimated taxes help you pay taxes as you go, instead of one big chunk later. You’ll still file your regular tax return at year-end, but hopefully you won’t owe much (or you might even get money back) because you’ve already paid throughout the year.

What are the key deadlines for 2024 estimated tax payments?

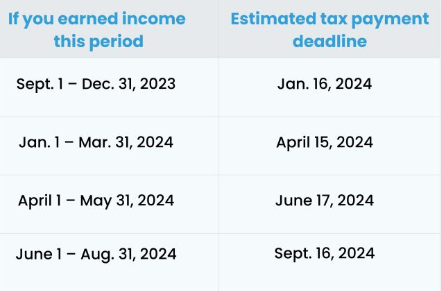

Planning for 2024? Check out the table below for the upcoming estimated tax payment deadlines throughout the year. Remember, these dates may shift to the next business day if they fall on a weekend or holiday.

Good news! You might be able to skip the January 16th payment if you file your 2023 tax return and settle your entire tax bill by that date. No need for double payments in the same month! However, if you’re planning to file your taxes in March or April of 2024, be sure to make this final estimated tax payment by January 16th to avoid any penalties.

How often should I submit estimated tax payments in 2024?

The frequency of estimated tax payments depends on your income situation. Here’s a breakdown:

- Generally required

- If you expect to owe more than $1,000 in taxes after considering any withholding and refundable credits, you’ll likely need to make estimated tax payments quarterly throughout 2024.

- This applies to self-employed individuals, freelancers, independent contractors, and anyone with income that doesn’t have taxes automatically withheld.

- Exceptions

- No income in a quarter: You don’t have to make a payment for a specific quarter if you didn’t earn any income during that period. For example, if your business is seasonal and only profitable during the holiday season, you wouldn’t need to make estimated payments for the first three quarters. However, you’d still need to file the paperwork for all four quarters.

- No tax liability: If you didn’t have any income in 2023 and don’t expect any in 2024, and you also didn’t have any tax liability in the previous year, you wouldn’t need to file or pay estimated taxes.

Do I need to adjust my estimated tax payments for 2024?

Whether you need to adjust your estimated tax payments for 2024 depends on your income situation and how closely your initial estimates align with your actual income throughout the year. Here’s a breakdown to help you decide:

Reasons to adjust your estimated tax payments

- Income changes: If your income has significantly increased or decreased compared to your initial estimates, you should adjust your payments accordingly. For example, if you received a large bonus or started a side hustle, you’ll likely owe more in taxes and should increase your payments to avoid underpayment penalties. Conversely, if your income has dropped, you can adjust your payments downward.

- Tax law changes: Occasionally, tax laws change throughout the year. While not super common, if there are relevant changes that affect your tax liability, you may need to adjust your estimates.

How to adjust your estimated tax payments

- Remaining payment schedule: Consider the remaining estimated tax payment deadlines for 2024 (June 17th, September 16th, and January 15th, 2025).

- Recalculate your estimated tax: Use Form 1040-ES or tax software to re-estimate your total tax liability for 2024 based on your current income and deductions.

- Compare to withholdings: Subtract any income taxes already withheld from your paychecks or other income sources from your estimated tax liability.

- Calculate remaining payments: Divide the remaining tax liability (after subtracting withholdings) by the number of remaining payment quarters. This will give you the adjusted amount you need to pay for each remaining quarter.

What happens If I miss the deadline for 2024 estimated taxes?

Estimated taxes are quarterly payments made throughout the year to prepay your income tax liability. The deadline for the first quarter’s estimated tax payment for 2024 has already passed, but it’s important to understand the consequences of missing a deadline and what steps to take.

Here’s what happens if you miss the deadline for estimated taxes

- Penalties: The IRS charges a failure-to-pay penalty of 0.5% per month, up to a maximum of 25%, on the amount of tax you owe. This penalty is calculated for each month the payment is late.

- Interest: You’ll also be charged interest on any unpaid taxes from the due date until the balance is settled.

Minimizing the damage

- File your tax return as soon as possible: Even if you miss an estimated tax payment deadline, filing your return on time (or with an extension) helps avoid a failure-to-file penalty, which can be even steeper than the failure-to-pay penalty.

- Pay what you owe: Submitting a payment with your tax return will help reduce the amount of interest and penalties you accrue.

- Consider an installment agreement: The IRS offers options to spread out your tax debt over time. You can explore an installment agreement on the IRS website or by calling them directly.

Important Note: There’s no penalty for underpayment of estimated taxes if the amount you owe is less than certain thresholds based on your prior year’s tax liability. You can find details on these thresholds on the IRS website https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes.

Remember, it’s always best to pay your estimated taxes on time to avoid penalties and interest charges. If you’re unsure how much you owe, consulting a tax professional is recommended.

How to calculate estimated taxes?

There are two convenient ways to pay your estimated taxes:

1. By mail

- Fill out Form 1040-ES, which is available from the IRS website.

- Include a check or money order made payable to the “United States Treasury” for your estimated tax payment.

- Mail the completed form and your payment to the address listed on the instructions for Form 1040-ES.

2. Online

- Use IRS Direct Pay, a secure system on the IRS website .

- You can pay from your checking or savings account without mailing a check.

While calculating your estimated tax payments yourself involves some effort, it’s definitely doable. Here’s a breakdown of the process with strategies to make it easier:

Gather information

- Prior year tax return: This is your goldmine. Look at your previous year’s tax return (Form 1040) to understand your income, deductions, and tax liability. This provides a solid baseline for estimating your current year’s taxes.

Estimate your income

- W-2s and 1099s: Collect your income statements (W-2s for salaried jobs and 1099s for freelance income). Use these to estimate your total income for the current year. Consider any expected income changes like a raise or additional income sources.

- Adjustments: Factor in any income adjustments you might qualify for, such as contributions to a retirement account.

Estimate deductions and credits

- Review common deductions: Research common deductions you might be eligible for, like student loan interest, charitable contributions, or mortgage interest (if you own a home). The IRS website has a helpful resource for this https://www.irs.gov/credits-and-deductions.

- Itemized vs. standard deduction: Analyze if itemizing deductions will benefit you more than taking the standard deduction. The standard deduction amount typically increases each year, so compare it to your total itemized deductions.

Calculate estimated tax liability

- Tax brackets: Research the current tax brackets for your filing status (single, married filing jointly, etc.).

- Tax calculation: Once you have your estimated taxable income (after adjustments and deductions), use the tax brackets to calculate your estimated tax liability. Many tax software programs offer free estimated tax calculators you can utilize.

Strategies for accuracy

- Track quarterly income: Monitor your income flow throughout the year. If you have significant income fluctuations, adjust your estimated tax payments accordingly to avoid underpayment penalties.

- Consider self-employment tax: If you’re self-employed, factor in self-employment tax, which covers Social Security and Medicare contributions typically deducted from employee paychecks.

- Err on overpayment: It’s better to slightly overpay your estimated taxes than underpay. Any overpayment will be refunded with interest when you file your actual tax return.

Remember, this is a general guideline. The complexity of your tax situation may necessitate consulting a tax professional for personalized advice.

How BookkeeperLive can help you?

Figure out how much tax you owe ahead of time can be confusing. But don’t worry! BookkeeperLive is here to help you through it. Here’s how they can make it easy:

- Streamlined information gathering: BookkeeperLive can collect your prior year’s tax return and income statements (W-2s and 1099s) electronically, saving you time and ensuring all the necessary information is at hand.

- Income tracking and adjustments: They can set up a system to monitor your income flow throughout the year, automatically factoring in adjustments like retirement contributions.

- Deduction and Credit Expertise: BookkeeperLive’s professionals can analyze your situation to identify all relevant deductions and credits you qualify for, maximizing your tax savings.

- Tax calculation & software navigation: They can handle the complex calculations using professional software, ensuring your estimated tax liability is accurate.

- Peace of mind: With BookkeeperLive managing your estimated taxes, you can avoid the worry of underpayment penalties and have the confidence that your taxes are handled by a qualified professional.

BookkeeperLive doesn’t just offer estimated tax help – they are your one-stop shop for all your tax needs. They can handle everything from bookkeeping and payroll to tax preparation services and filing, ensuring your finances are in order throughout the year.

FAQs

1. Are there penalties for underpaying estimated taxes?

Yes, there can be penalties for not paying enough in estimated taxes throughout the year. The penalty is based on the amount of tax you underpaid and the length of time it was underpaid.

2. How much should I pay in estimated taxes?

Ideally, your estimated tax payments should be spread out evenly throughout the year. So, you would aim to pay 25% of your total tax liability each quarter. You can estimate your tax liability using your tax return from the previous year.

3. What if my income is variable throughout the year?

You can adjust your estimated tax payments throughout the year to reflect changes in your income. The IRS allows you to annualize your income, meaning you can base your estimated payments on your income for the portion of the year that has already passed.

4. What happens if I overpay my estimated taxes?

The good news is you will receive a refund when you file your tax return.