You've already submitted your 2023 tax return and are expecting a refund. Now, you're eager to track its where abouts.

According to the IRS, the quickest method to receive your tax refund is through electronic filing. If you opted for direct deposit when filing electronically, you can anticipate receiving your refund within approximately 21 days. However, if you chose to mail a paper return, it might take four weeks or longer for your refund to be processed, as per the IRS.

Getting a tax refund can feel like a distant dream, especially while you wait for the money to hit your account. There are several reasons why processing takes time, and the method you choose to file your tax return significantly impacts the timeline. Let's check deeper into the factors that contribute to refund delays and how e-filing stands out compared to paper returns.

The IRS refund process can seem like a black box, but fear not! Here's a breakdown of the key stages your return goes through, along with factors that can influence the processing timeline.

This is the initial step, where the IRS acknowledges they've received your tax return. Here's what happens:

Here's where the real work begins! The IRS meticulously reviews your return to ensure accuracy and prevent fraud. This stage can involve several checks:

Congratulations! If your return passes all the checks and verifications, you're in the final stretch. Here's what to expect:

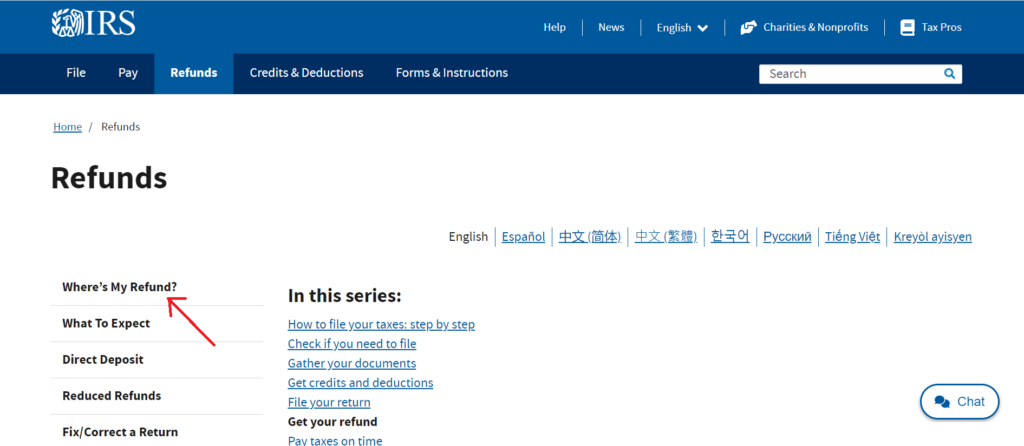

Ever filed your tax return and then impatiently awaited your refund? Wondering where it is and when it might arrive? Fear not, the IRS has a helpful tool called "Where's My Refund?" that can shed light on the whereabouts of your tax return and estimated refund date.

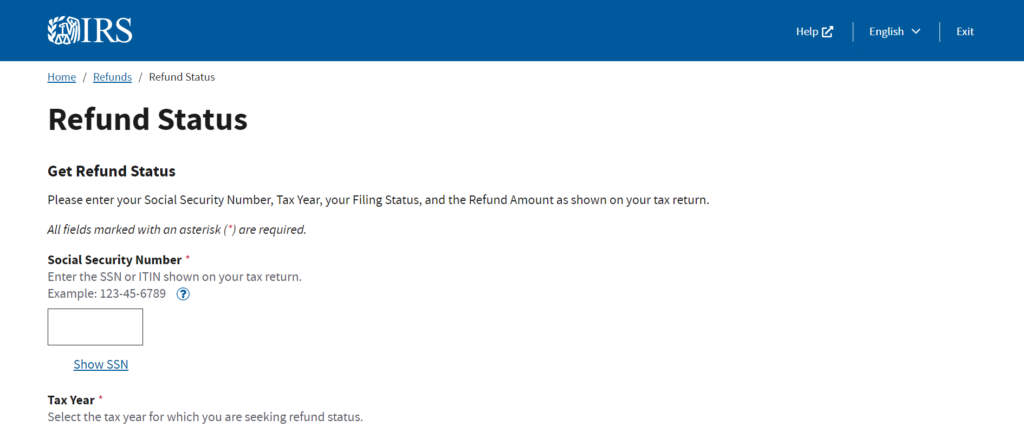

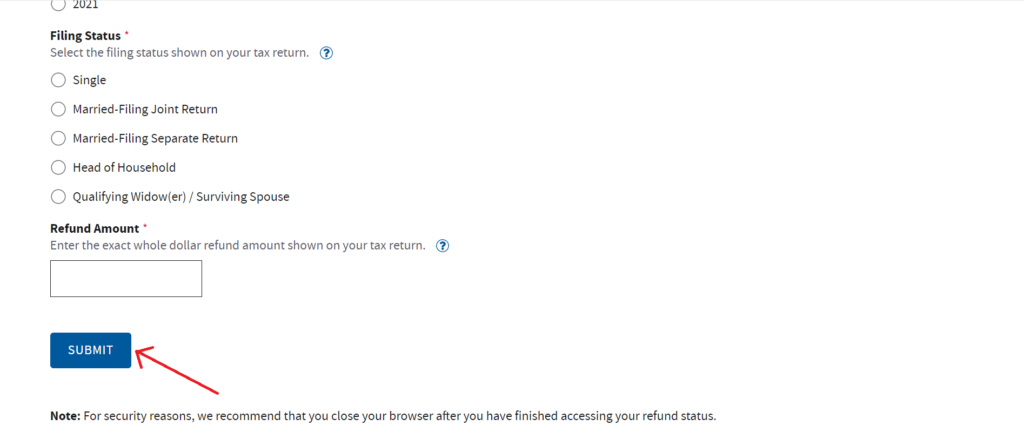

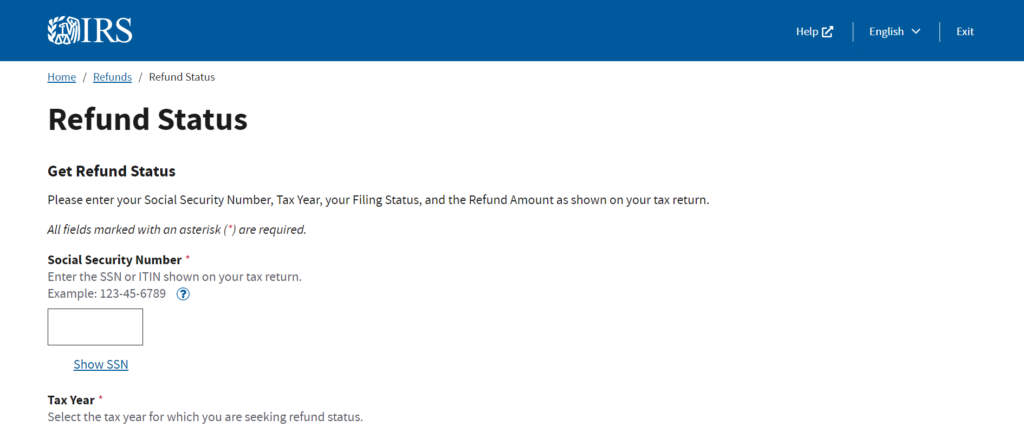

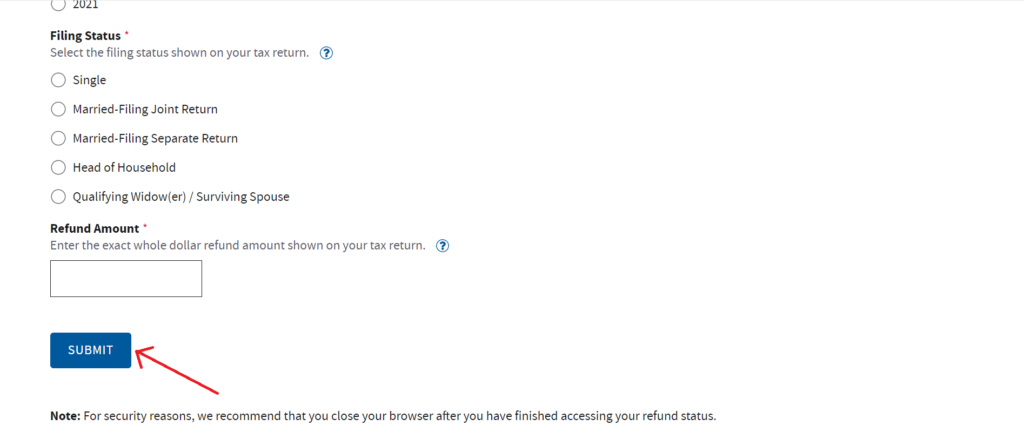

To utilize "Where's My Refund?" effectively, you'll need to gather a few key pieces of information:

The process is simple and straightforward:

The tool will display the current status of your tax return. Here are some possible messages you might see:

By using "Where's My Refund?" and having the necessary information readily available, you can demystify the refund process and gain peace of mind knowing where your tax return stands.

Check out the blog - What Impact Does the New U.S. International Tax System Have?

The IRS2Go app is your handy mobile companion, letting you track your refund status from anywhere, anytime.

IRS2Go is super easy to start using. Just a few simple steps and you're all set!

Tax season can be confusing, and with both federal and state income taxes to consider, it's natural to wonder about the differences between your federal and state tax refunds. Here's a breakdown to help you understand them better:

Do you have a plan for your tax refund this year? Getting a tax refund can be a great chance to make progress toward your financial goals. Let's discuss some smart ways to use your tax return to improve your financial situation.

While the IRS system is a helpful tool for checking your basic tax refund status, it may not be enough for everyone. For those with more complex tax situations or lingering questions, BookkeeperLive can offer a comprehensive solution. Their expert tax preparation service goes beyond simply checking the IRS website. They can ensure your return is filed accurately in the first place, minimizing the risk of errors that could delay your refund.

Furthermore, BookkeeperLive's tax professionals can help you understand your tax liability and develop strategies to optimize your return. This can involve uncovering deductions you may have missed and ensuring you claim all the credits you're entitled to. Ultimately, BookkeeperLive can help you maximize your refund and minimize your tax obligations, leaving you with peace of mind and potentially more money in your pocket.

1. What if I made a mistake on my tax return? Can I amend it?

Yes, you can amend your return using Form 1040X. However, amending may delay your refund, so it's best to try to file accurately the first time.

2. What if the IRS says my refund has been deposited but I haven't received it?

First, double-check your bank account to ensure it wasn't deposited into a different account. If you're still having trouble, allow an additional 5 business days for the deposit to reflect in your account. After that, you can contact the IRS for further assistance.

3. I filed jointly with my spouse. Can we both track the refund status?

Yes! Both you and your spouse can track the refund status using the IRS "Where's My Refund?" tool. You'll each need to enter your own Social Security number, filing status (Married Filing Jointly), and the exact refund amount from the joint tax return.

4. My refund status says "processing." What does that mean?

"Processing" means the IRS is still reviewing your return. This is the most common status, but it doesn't give a specific timeframe for receiving your refund.

You've already submitted your 2023 tax return and are expecting a refund. Now, you're eager to track its where abouts.

According to the IRS, the quickest method to receive your tax refund is through electronic filing. If you opted for direct deposit when filing electronically, you can anticipate receiving your refund within approximately 21 days. However, if you chose to mail a paper return, it might take four weeks or longer for your refund to be processed, as per the IRS.

Getting a tax refund can feel like a distant dream, especially while you wait for the money to hit your account. There are several reasons why processing takes time, and the method you choose to file your tax return significantly impacts the timeline. Let's check deeper into the factors that contribute to refund delays and how e-filing stands out compared to paper returns.

The IRS refund process can seem like a black box, but fear not! Here's a breakdown of the key stages your return goes through, along with factors that can influence the processing timeline.

This is the initial step, where the IRS acknowledges they've received your tax return. Here's what happens:

Here's where the real work begins! The IRS meticulously reviews your return to ensure accuracy and prevent fraud. This stage can involve several checks:

Congratulations! If your return passes all the checks and verifications, you're in the final stretch. Here's what to expect:

Ever filed your tax return and then impatiently awaited your refund? Wondering where it is and when it might arrive? Fear not, the IRS has a helpful tool called "Where's My Refund?" that can shed light on the whereabouts of your tax return and estimated refund date.

To utilize "Where's My Refund?" effectively, you'll need to gather a few key pieces of information:

The process is simple and straightforward:

The tool will display the current status of your tax return. Here are some possible messages you might see:

By using "Where's My Refund?" and having the necessary information readily available, you can demystify the refund process and gain peace of mind knowing where your tax return stands.

Check out the blog - What Impact Does the New U.S. International Tax System Have?

The IRS2Go app is your handy mobile companion, letting you track your refund status from anywhere, anytime.

IRS2Go is super easy to start using. Just a few simple steps and you're all set!

Tax season can be confusing, and with both federal and state income taxes to consider, it's natural to wonder about the differences between your federal and state tax refunds. Here's a breakdown to help you understand them better:

Do you have a plan for your tax refund this year? Getting a tax refund can be a great chance to make progress toward your financial goals. Let's discuss some smart ways to use your tax return to improve your financial situation.

While the IRS system is a helpful tool for checking your basic tax refund status, it may not be enough for everyone. For those with more complex tax situations or lingering questions, BookkeeperLive can offer a comprehensive solution. Their expert tax preparation service goes beyond simply checking the IRS website. They can ensure your return is filed accurately in the first place, minimizing the risk of errors that could delay your refund.

Furthermore, BookkeeperLive's tax professionals can help you understand your tax liability and develop strategies to optimize your return. This can involve uncovering deductions you may have missed and ensuring you claim all the credits you're entitled to. Ultimately, BookkeeperLive can help you maximize your refund and minimize your tax obligations, leaving you with peace of mind and potentially more money in your pocket.

1. What if I made a mistake on my tax return? Can I amend it?

Yes, you can amend your return using Form 1040X. However, amending may delay your refund, so it's best to try to file accurately the first time.

2. What if the IRS says my refund has been deposited but I haven't received it?

First, double-check your bank account to ensure it wasn't deposited into a different account. If you're still having trouble, allow an additional 5 business days for the deposit to reflect in your account. After that, you can contact the IRS for further assistance.

3. I filed jointly with my spouse. Can we both track the refund status?

Yes! Both you and your spouse can track the refund status using the IRS "Where's My Refund?" tool. You'll each need to enter your own Social Security number, filing status (Married Filing Jointly), and the exact refund amount from the joint tax return.

4. My refund status says "processing." What does that mean?

"Processing" means the IRS is still reviewing your return. This is the most common status, but it doesn't give a specific timeframe for receiving your refund.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Enter the code, fill out the form, and unlock financial clarity with a free trial.