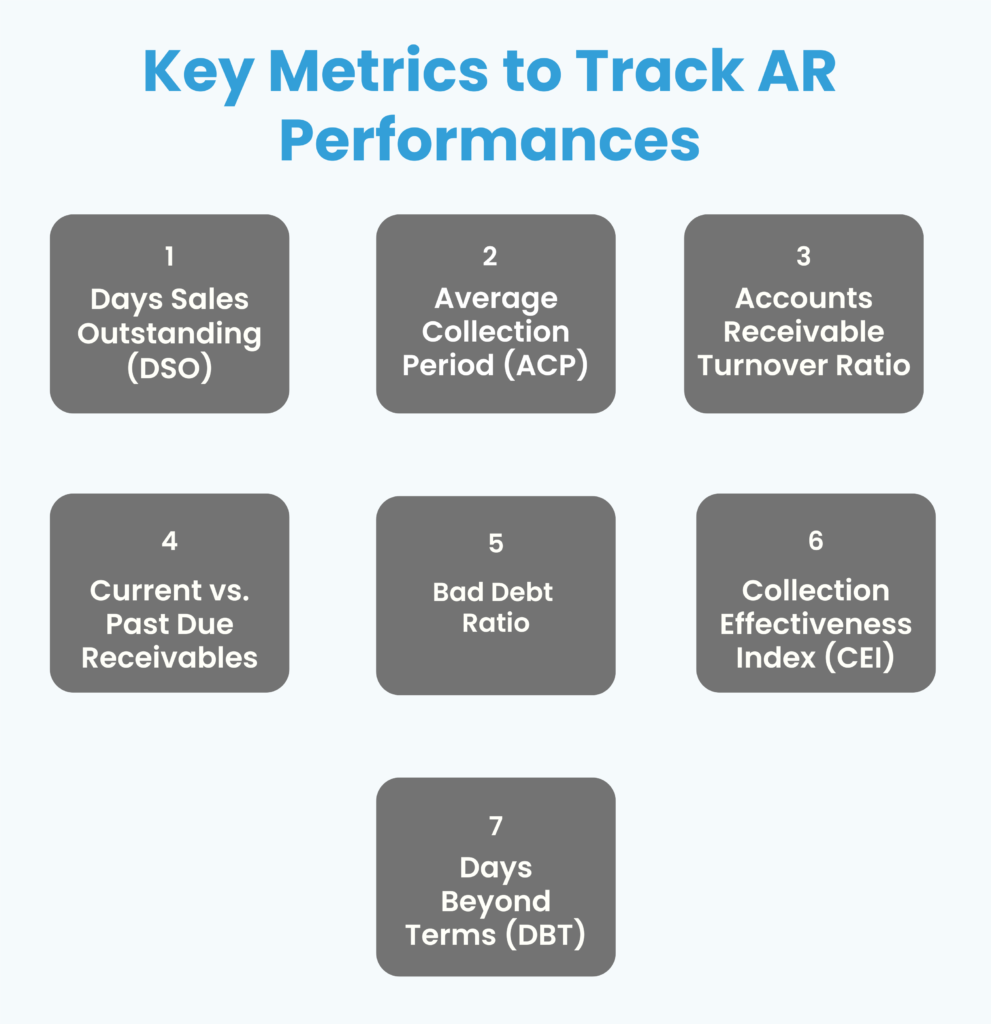

As we are now in a business ecosystem governed by data, managing accounts receivable (AR) key performance indicators (KPIs) is crucial in preserving the cash flow and the overall financial health of a firm. Tracking the right parameters contributes significantly in optimizing the business’ AR processes, lowering the number of overdue invoices, and boosting the efficiency of collections.

It is very important to understand which KPIs are of concern as this will assist in discovering a problem area as well as ensuring that your accounts receivable team is functioning optimally. In the section below we define the 10 most important rules of the accounts receivable KPIs constituents with their calculations and why they matter.

Accounts receivable KPIs refer to any measures taken to enhance the proficiency of business processes related to AR. Keeping in mind that AR is payments expected from clients, monitoring these KPIs ensure that firms do not run dry on cash, nor do they write off bad debts.

Days Sales Outstanding (DSO) measures how quickly a business collects payments from customers after making a sale. It reflects the average number of days it takes to receive payment from credit sales.

The formula for DSO is:

DSO = (Accounts Receivable ÷ Total Credit Sales) × Number of Days

This calculation helps determine the efficiency of a company’s payment collection process. A lower DSO indicates faster collections and stronger cash flow, while a higher DSO may suggest delays in receiving payments, which can impact financial stability.

If a business has $5,000 in outstanding receivables and total credit sales of $50,000 in a month, the calculation for a 30-day period would be:

DSO = (5,000 ÷ 50,000) × 30 = 3 days

This means the company, on average, collects payments within three days.

Monitoring DSO helps businesses evaluate the effectiveness of their accounts receivable process. An increasing DSO may indicate payment delays, inefficient credit policies, or weak collection efforts. Keeping DSO as low as possible ensures a steady cash flow and reduces financial risk.

Average Days Delinquent (ADD) means how many days a delay has been there on average with respect to all invoices from their due dates until the dates of actual payments. Businesses gauge the intensity of late payments to gauge the potential financial risks that might be tied to the overdue accounts

ADD is critical to sustaining positive cash flow because late payments can put a financial strain on the company, leading to a disruption of operations. By keeping a close eye on this metric, firms can identify creeping delays and take necessary steps towards accelerating collections.

This also improves the management of high-risk accounts based on the duration of delinquency. In addition, it will help them fine-tune credit policies and collection strategies.

ADD = Regular DSO – Best Possible DSO

For instance, where the DSO for a company stood at 50 days when the best possible DSO could be pegged at 30 days:

ADD = 50 - 30 = 20 days

The average customer, therefore, took an extra 20 days to pay their invoice.

The high ADD flagging the inefficiency of the collection process in an organization, and steps that can be taken to reduce ADD may include the following:

Take appropriate actions when accounts become significantly overdue. This may involve using collection agencies where such services are to be considered as tracking ADD on a regular basis, providing helpful analysis to improve cash flow management, mitigate financial risk, and enable smoother business operations.

Businesses should be mindful of the scenario, most Add helps businesses positively manage their cash position, reduce financial risks, and provide a more stable environment for business.

It indicates the speed with which a company is turning its receivables into cash. This ratio tells us how frequently, on average, the firm converts credit sales into the cash that it eventually receives from the average balance in accounts receivable for that period.

The formula for calculating accounts receivable turnover ratio is:

ART = Net Credit Sales ÷ Average Accounts Receivable

Thus, let us consider a company that announces net credit sales of $25,000,000 and the average accounts receivable balance of $20,000,000. Therefore, this company will express its accounts receivable turnover as follows:

ART = 25,000,000 ÷ 20,000,000 = 1.25

This implies that within the period the company, on average, collects its receivables approximately 1.25 times.

A high ART shows how good a company is at collecting its dues, which results in good cash flow and less risk of outstanding payments. In contrast, low ART might mean sluggish collections hence cash flow problems or easy credit terms that lengthen the collection periods.

If the business has a low ratio, it means they can do something to help improve collection:

To prevent delays, the invoicing system will be made more concise.

By carrying out regular tracking of the ART, it will further help the business pinpoint inefficiencies in the collection process that have been holding it back, improve cash flow, as well as strengthen financial stability.

CEI is an efficiency gauge of collecting outstanding payments accrued by an enterprise. It essentially informs the company of its ability to recover receivables and thus reduce potential bad debts resulting from unpaid invoices.

CEI is calculated based on the formula:

CEI = [(Beginning A/R + Credit Sales – Ending A/R) ÷ (Beginning A/R + Credit Sales – Ending A/R)] × 100

The company began the month with accounts receivable of $100,000, made credit sales of $200,000, and concluded the month with $120,000 left in receivables outstanding. Therefore, the computation is:

CEI = ($100,000 + $200,000 - $120,000) ÷ ($100,000 + $200,000 - $120,000) × 100 = 100%

A CEI of 100% means that its accounts collect all outstanding balances. The farther the CEI is from 100%, the worse the efforts to collect can be said to be. A lower percentage, however, does not really help much in recovering payment faster.

The CEI shall show just how well the company manages its accounts receivable. A low CEI may indicate problems with poorly executed follow-ups on overdue invoices, inability to communicate well with customers in terms of collections, or billing mistakes. Companies that keep regular tabs on this metric can identify and fix hassles regarding collections before they have an impact on cash flow.

Businesses can boost their CEI from unpaid invoices, maintain a steady cash flow and decrease unpaid invoices through proactive receivables management and an improved collections process.

CEI is an efficiency gauge of collecting outstanding payments accrued by an enterprise. It essentially informs the company of its ability to recover receivables and thus reduce potential bad debts resulting from unpaid invoices.

CEI = [(Beginning A/R + Credit Sales – Ending A/R) ÷ (Beginning A/R + Credit Sales – Ending A/R)] × 100

The company began the month with accounts receivable of $100,000, made credit sales of $200,000, and concluded the month with $120,000 left in receivables outstanding. Therefore, the computation is:

CEI = ($100,000 + $200,000 - $120,000) ÷ ($100,000 + $200,000 - $120,000) × 100 = 100%

A CEI of 100% means that its accounts collect all outstanding balances. The farther the CEI is from 100%, the worse the efforts to collect can be said to be. A lower percentage, however, does not really help much in recovering payment faster.

The CEI shall show just how well the company manages its accounts receivable. A low CEI may indicate problems with poorly executed follow-ups on overdue invoices, inability to communicate well with customers in terms of collections, or billing mistakes. Companies that keep regular tabs on this metric can identify and fix hassles regarding collections before they have an impact on cash flow.

Businesses can boost their CEI from unpaid invoices, maintain a steady cash flow and decrease unpaid invoices through proactive receivables management and an improved collections process.

The Write-Off Ratio is a percentage of debt that a business regards as irrecoverable, eventually writing it off as bad debt. It speaks volumes about how efficiently a company manages credit risk and recovers money from the debtors.

Write-Off Ratio = (Bad Debt Expense ÷ Total Accounts Receivable) × 100

Thus, in the given case, it would be equal to 10%. For example, if a company has $100 in bad debts and its total accounts receivable balance is $1,000, then (100 ÷ 1,000) × 100 = 10%. The lower the ratio, the better sign of strong credit control and efficient collections.

This is important in the following ways:

Here are a few practical ways to enhance collections if you feel your write-offs are too high:

Better credit management and stronger collection efforts will help the business reduce the financial losses that impede cash flow and ultimately will result in financial stability.

Whereas the Right Party Contact Rate is a critical measure used in gauging the degree to which a company achieves success in contacting the right person responsible for processing payments, whether made through emails, phone calls, or text messages, effective communication with the person directly leads to more certain payments within the due date.

When businesses fail to get in touch with the right decision-maker, it only means more delays due to miscommunications leading to further unnecessary back-and-forth which eventually slows cash flow.

RPC Rate = (Successful Contact Attempts ÷ Total Contact Attempts) × 100

For instance, if for payment reminders a company made 100 phone calls and reached the right person every 90 times, the calculation would be:

A higher RPC percentage is more significant in the sense that communication efforts are effective, while a lower RPC percentage means either contact details are outdated or outreach strategies are ineffective.

Tracking RPCs will make businesses:

Practical Solutions to Improving a Low RPC Rate:

By keeping better records and being a bit smarter in the way businesses reach out with potential solutions, they could achieve a higher RPC rate in accelerating payment collection and maintaining a high level of efficiency in the accounts receivable process.

It gives us much insight into what a company would spend to collect a payment from a client. It would include wages, the cost of communications (email, phone calls, or postage), and other tools or resources used in the process.

Payment collections maintain a positive cash flow, but high costs can eat away at profit margins. The metric will track and improve the process to ensure that businesses do not have to pay unnecessary costs to collect payments. This is why monitoring and improving the operational cost per collection metric is so important.

In accurately reporting and monitoring cost of collections, it provides visibility to potential inefficiencies including high costs, manual-heavy processes, outdated methods of collection, and ineffective payment-making behavior by customers.

If you find that your collection costs are higher than expected, try out these practical strategies:

With technology and sharpened collection strategies, businesses can slash collection costs, accelerate efficiency, and keep themselves financially fit.

This is a fundamental metric where one can observe the extent to which a firm takes time to collect dues from its customers. The lower the DDO, the better it is, being indicative of the efficiency in collections, which in turn helps in keeping operational costs under check and maintaining a steady cash flow.

The formula to calculate DDO is:

DDO = (Total Days Invoices Have Been Outstanding) ÷ (Average Number of Invoices Per Day)

This is a rough estimate of how many days you would take each year to collect all monies outstanding from all customers.

A high DDO signals lag in collections leading to bad cash flow and profitability, even if sales are apparently going well. Major reasons are normally:

If possible, try implementing these strategies to quicken collections and DDO:

Through proactive management of the days sales or deductions outstanding, a company stands to make better cash, reduce financial risk, and improve overall operational efficiency.

It provides the very basic indicator of inefficiencies in the invoicing process. Normally, high numbers of revisions reflect the fact that errors might have been made in the previous versions, there is a system glitch, or there was a miscommunication about credit terms and conditions of service. The errors eventually lead to delays in payments, confusion, and strained customer relationships, all of which weigh down cash flows and future sales.

Tracking the number of revisions in the invoice for every month, indeed provides the company with the following advantages:

Several factors would cause the need for regular revisions in invoices, such as:

The formula for DDO is:

DDO = (Total Days Invoices Have Been Outstanding) ÷ (Average Number of Invoices Per Day)

This allows us to get the aggregate number of days that it takes to bring in all outstanding payments over a certain period.

For instance, if your invoices have been outstanding for a total of 900 days and on average your business processes 30 invoices per day, then the DDO would be calculated as:

DDO = 900 ÷ 30 = 30 days

That is, on average, the company has to wait for thirty days to realize payments from customers.

Here are some factors causing your business to have long cycles:

Tracking, the frequency of which invoices are corrected can help companies:

—Spot the weaknesses in their process of invoicing-Errors would often lead to patterns that could facilitate the adoption of targeted improvements.

—Reduce payment delays-Corrections are directly proportional to the time taken to approve the invoice and collect payments as scheduled.

—Strengthen customer relationships-With correct billing, you can gain trust, and disputes can be minimized.

—Improve general efficiency-Invoicing streamlined saves time, saves money, and galvanizes the working environment.

Almost regularly revising invoices in your company will root into single or more categories below:

Improved invoicing accuracy reduces the number of revisions, which in turn accelerates the process of paying providers and improving provider satisfaction. Here are some steps by which business firms can minimize these revisions:

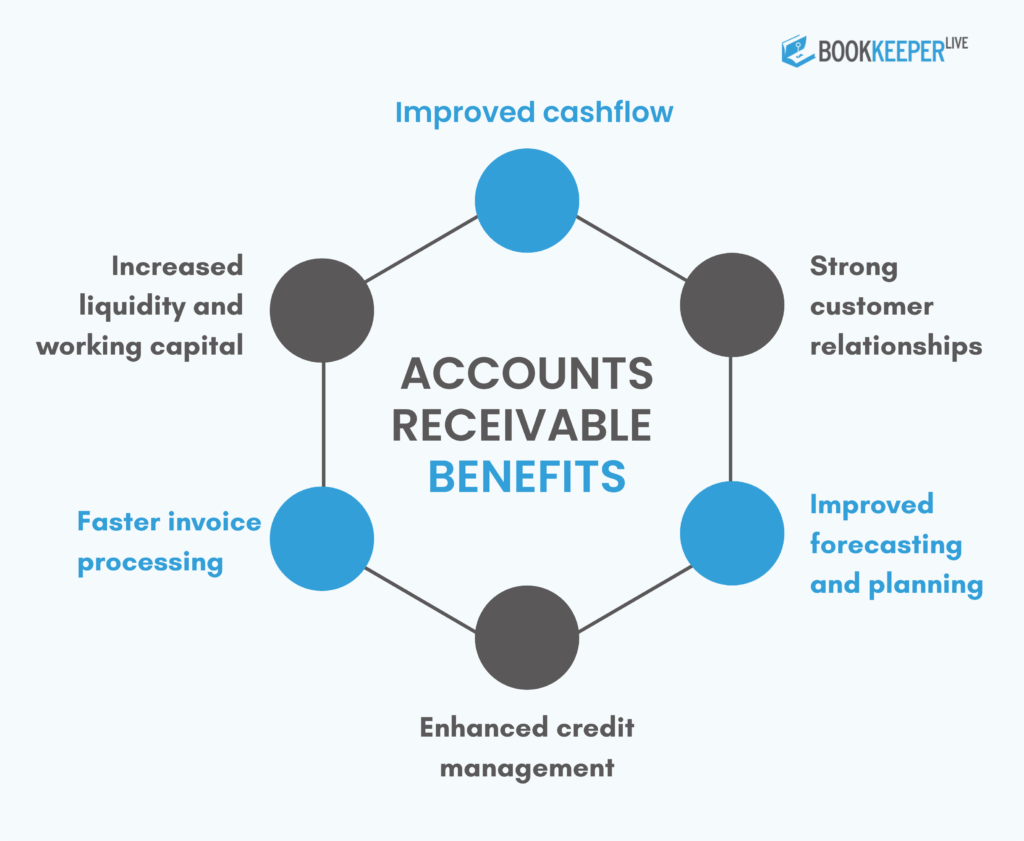

Tracking key Accounts Receivable performance indicators is extremely important in keeping cash healthy; it ensures the financial stability of a business. The tracking involved, in its turn, will help a company monitor and speed up its initiative on outstanding invoices and will enable it to collect more efficiently, hence reducing the vulnerability to financial risks.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.