Effective accounts receivable (AR) management is essential for accelerating cash flow and ensuring timely payments. To achieve this, businesses must set clear AR goals and adopt the right tools to streamline their processes. While automation plays a crucial role in improving efficiency, it should not be the sole focus—human engagement and communication remain key to resolving disputes and strengthening customer relationships.

Relying on manual AR processes can create bottlenecks and slow down collections, making it harder to achieve long-term financial goals. On the other hand, automation enhances efficiency, reduces errors, and fosters better customer experiences, ultimately leading to sustainable cash flow. However, simply digitizing AR processes isn’t enough; businesses must ensure that automation supports their broader financial and customer service objectives.

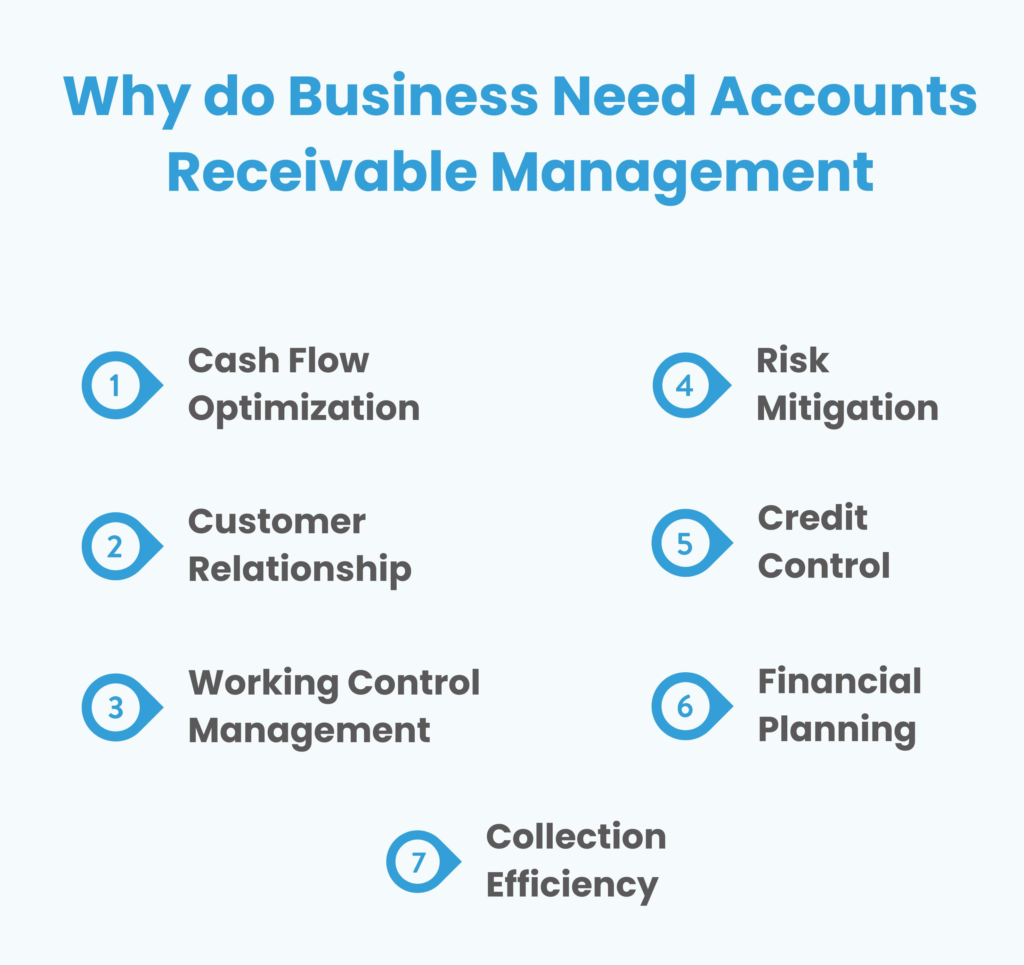

In this blog, we’ll explore seven essential AR goals every finance team should prioritize in 2025. Whether your focus is on improving collections, enhancing customer interactions, or optimizing workflows, these strategies—paired with the right technology—will help drive financial success.

Accounts receivable (AR) goals and objectives are specific, actionable targets set by finance leaders to improve cash flow, efficiency, and overall financial health. These objectives help businesses stay focused, streamline operations, and enhance collections management.

AR goals can range from tactical tasks—such as ensuring invoices are sent promptly—to more strategic initiatives like transitioning to electronic billing or implementing a dispute resolution system. The goals highlighted in this blog represent key priorities that B2B companies should focus on to optimize their receivables process.

A crucial aspect of modern AR management is digital transformation. While businesses recognize the importance of digitization, many have yet to fully automate their AR processes. In fact, even the most widely adopted AR automation tools are used by fewer than 50% of businesses. Embracing digital solutions is essential for improving efficiency, reducing errors, and accelerating collections, making it a key factor in achieving AR success.

Here are seven important accounts receivable goals that can help your business optimize cash flow, improve efficiency, and enhance customer experiences in the coming year:

Goal 1: Eliminate manual, repetitive, and error-prone AR tasks by automating processes like invoicing, payment reminders, and payment processing.

Goal 2: Streamline B2B payments to offer your customers a more convenient and seamless payment experience.

Goal 3: Automate cash application and financial reconciliation to reduce errors and save time.

Goal 4: Free up your AR team’s time by automating administrative tasks, enabling them to focus on more strategic, high-value activities.

Goal 5: Enhance both the customer payment experience and communication between your team and clients for smoother interactions.

Goal 6: Attract and retain top talent in accounting and finance to ensure your AR team remains strong and capable of meeting business goals.

Goal 7: Provide shared access to real-time data and information for both your customers and AR team via the cloud, fostering better collaboration and transparency.

Tip: Before setting these goals, it's crucial to identify the challenges hindering your current AR processes. Without understanding these obstacles, you may continue to face the same struggles, no matter what your ambitions. If you're unsure about your current pain points, take a quick 6-minute assessment to pinpoint the most pressing issues facing your AR team.

If you haven't already, prioritizing the automation of routine and error-prone AR tasks should be at the top of your agenda for 2025. Automating processes such as invoicing, payment reminders, and payment processing can significantly save time and improve efficiency. These repetitive tasks often take up a large portion of your AR team’s time, preventing them from focusing on higher-value activities.

A recent report shows that 80% of finance executives view reducing time-consuming, error-prone processes as one of the major benefits of AR automation.

Being able to accept secure online payments through your customers’ preferred B2B methods—such as credit, debit, ACH, virtual cards, and bank transfers—offers numerous advantages. These include faster cash conversion, quicker payment collection and processing across multiple sales channels, and optimized processing costs, making this goal highly valuable. In fact, 70% of finance executives view the ability to accept digital payments as a key benefit of AR automation.

Cash application is a critical process in your business, but managing it manually comes with several challenges, including:

By adopting advanced cash application automation technology, you can transform your cash application process, making it faster, more accurate, and efficient. Automation simplifies the task of capturing and reconciling payment data, eliminates manual errors, and accelerates cash flow.

Empower your AR team to focus on what they do best: driving business growth, rather than spending valuable hours on administrative tasks. By addressing inefficiencies, you not only improve team productivity but also create opportunities for career development for your AR professionals.

Automating repetitive tasks like preparing invoices, making collection calls, and processing payments allows your team to shift their attention to customer experience and more strategic initiatives. This shift not only frees up their time but also boosts team morale, as they can tackle more engaging challenges that foster career growth.

Seventy-five percent of finance executives identify increasing team bandwidth for strategic tasks as one of the top benefits of AR automation.

Miscommunication during the invoice-to-cash process can have significant negative effects on revenue.

Fortunately, AR automation tools can help resolve these issues. However, not all AR automation solutions are equally effective—many traditional tools fail to enhance communication between your AR team and customers.

To achieve this goal, it's crucial to choose AR automation solutions that prioritize seamless communication and collaboration. These tools can bridge the gap between pure efficiency and exceptional customer experience, ensuring that your AR team meets efficiency goals while also building strong, collaborative payment experiences.

Sixty-five percent of finance executives cite fostering collaboration and enhancing customer experience as key benefits of AR automation. However, 35% acknowledge that communication difficulties with customers are delaying their revenue collection efforts.

With increasing numbers of employees leaving their jobs or disengaging in their roles, finance leaders must focus on reducing turnover by fostering an environment that promotes long-term remote work and prioritizes employee satisfaction.

Digitizing the billing and payment process helps maintain work-from-home continuity by eliminating the tedious aspects of managing receivables and allowing AR professionals to engage in more strategic work. In fact, 73% of finance executives cite the ability to attract and retain accounting and finance talent as a key benefit of AR automation.

Providing your customers and AR team with continuous access to complete, shared invoice and account information eliminates manual workflows and enhances the customer experience. This not only streamlines processes but also offers a competitive edge that can differentiate your business in the marketplace.

According to 65% of finance executives, offering cloud-based shared access to data and information is a top benefit of AR automation.

How to achieve this accounts receivable goal: The right technology

In 2025, managing accounts receivable is about more than just collecting; it's also about increasing productivity, enhancing client satisfaction, and utilizing automation to achieve sustained financial success. Although technology can expedite procedures, companies must strike a balance between automation and human interaction to preserve solid bonds and guarantee smooth operations.

Establishing specific goals for AR, such removing manual labor, streamlining payments, and improving teamwork, can help businesses increase cash flow, lower errors, and improve their financial standing. The secret is to put in place the appropriate solutions that improve productivity and customer happiness while freeing up your AR team to concentrate on strategic expansion.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.