Does waiting on customer payments leave your printing business feeling like it's running on fumes? Invoice financing can be the game-changer you've been looking for. In this blog, we'll learn about how invoice financing can specifically benefit the printing industry and how to unlock the cash tied up in your outstanding invoices for faster turnaround times, smoother equipment upgrades, and the freedom to take on exciting new projects—all without waiting for your customers to settle their bills.

Certainly! Let's check the concept of invoice finance and its significance for printing businesses in more detail.

Imagine you own a printing company. You've just completed a large printing project for a client, and now it's time to send them an invoice for the work done. However, it's common in many industries, including printing, for customers to take their time in paying invoices. They might have payment terms of 30, 60, or even 90 days before they settle their bill.

Now, while you're waiting for these payments to come in, you still have expenses to cover. You might have bills to pay, employees to compensate, and other operational costs to manage. Additionally, you might want to invest in new equipment, materials, or marketing efforts to grow your business. But without the cash flow from your outstanding invoices, it can be challenging to manage these financial obligations and opportunities effectively. This is where invoice finance steps in as a solution tailored to the needs of businesses like yours in the printing industry.

Invoice finance encompasses two main methods: invoice factoring and invoice discounting.

Just as a high-speed printer saves time and boosts efficiency, invoice financing provides a range of benefits for printing businesses.

The printing industry, despite its evolution, can require significant upfront investment. Whether you're starting a new printing company or looking to expand your existing one, securing capital is crucial. Here's a breakdown of various funding options to fuel your printing press:

This involves using your personal savings or funds from friends and family to finance your business. It's a good option for businesses with lower initial costs or those who want to maintain ownership control. However, it may limit your growth potential.

Traditional banks and credit unions offer various loan options for small businesses. These loans can be used for a variety of purposes, including purchasing equipment, covering operational costs, or financing expansion projects. Carefully consider factors like interest rates, repayment terms, and collateral requirements before opting for a loan.

The Small Business Administration (SBA) in the US offers loan programs specifically designed for small businesses. These loans often come with favorable terms, including lower interest rates and longer repayment periods. Explore SBA loan options to see if they align with your needs.

This financing option allows you to acquire specific printing equipment by spreading the cost out over time. Lenders may require a down payment and secure the equipment itself as collateral.

A line of credit provides access to a revolving pool of funds, similar to a credit card. You can draw on this line of credit as needed, only paying interest on the amount you use. This is a good option for covering ongoing operational expenses or unexpected costs.

Online crowdfunding platforms allow you to raise capital from a large pool of individuals. You can offer rewards or equity in your business in exchange for their investment. This approach can be a good way to build brand awareness and connect with potential customers.

Angel investors are often wealthy individuals who invest in promising startups and small businesses. They can provide not only capital but also valuable mentorship and industry connections. Be prepared to present a compelling business plan and pitch your vision to potential angel investors.

Venture capitalists (VCs) invest in high-growth companies with the potential for significant returns. While securing VC funding can be challenging, it can provide substantial capital for businesses with strong growth potential.

The best funding option for your printing business depends on several factors, including your specific needs, financial situation, and growth goals. Consider these factors when making your decision:

By carefully evaluating your options and choosing the right funding source, you can fuel the growth of your printing business and achieve your entrepreneurial dreams.

While invoice financing offers a powerful tool to boost your printing business's cash flow, managing your finances effectively is crucial for long-term success. That's where BookkeeperLive comes in.

We're an outsourcing accounting service specializing in helping businesses like yours in the printing industry. We take the burden of bookkeeping, accounts receivable, accounts payable, and even payroll off your shoulders, freeing you up to focus on what you do best – creating high-quality printed materials for your clients.

Our team of experienced professionals will handle all your financial tasks with accuracy and efficiency. We'll ensure your invoices are sent out promptly, track outstanding payments, and manage your accounts payable so you can avoid late fees. Additionally, our payroll services ensure your employees are paid on time and accurately, keeping them happy and productive.

1. What is invoice financing?

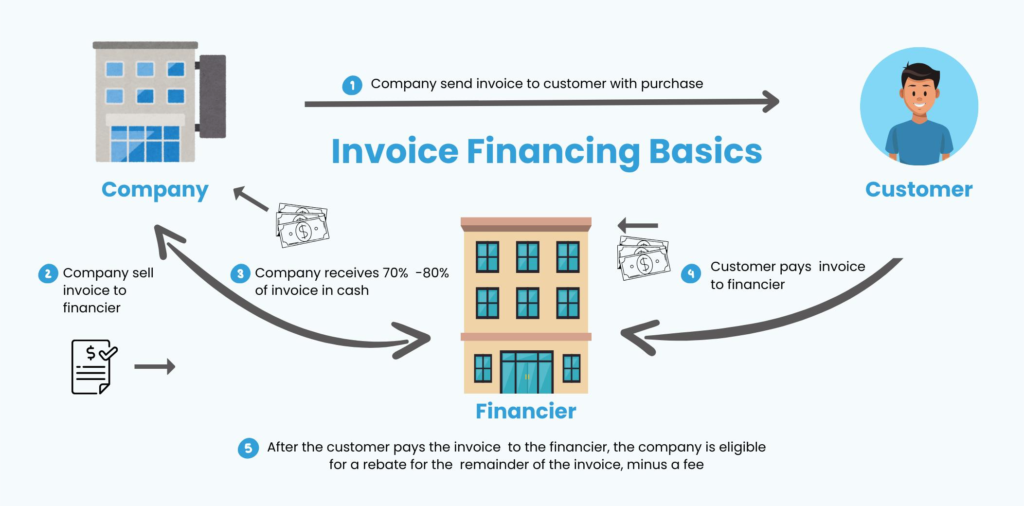

Invoice financing allows you to sell your unpaid invoices to a finance company (factor) at a discount to receive immediate cash.

2. Is invoice financing right for my printing business?

Invoice financing is a good option if you have slow-paying customers and need to improve your cash flow. It's also helpful if you want to invest in new equipment or take on larger projects without waiting for customer payments.

3. What are the typical requirements for invoice financing?

There are three main criteria for invoice financing: the financial health of your business, the creditworthiness of your customers, and the age of your outstanding invoices.

4. What are the tax implications of invoice financing?

The discount you receive on your invoices is typically considered a business expense and is tax-deductible. It's always best to consult with a tax advisor for specific details.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.