As a small business owner, you're constantly juggling a multitude of responsibilities—from managing your team and overseeing day-to-day operations to making strategic decisions that will shape your company's future. With so much on your plate, it can be easy to overlook one of the most critical aspects of running a successful business: maintaining financial health. Regular audits are key to understanding your business's financial standing and ensuring its long-term stability.

Although the term "audit" might bring to mind images of exhaustive examinations and high-stress reviews, audits are incredibly valuable tools that can provide deep insights into your business’s performance. These reviews help uncover potential problems, ensure compliance with laws and regulations, and identify areas for improvement. When viewed from this perspective, an audit is less of a burden and more of a regular financial "check-up" to keep your business healthy.

An audit is a thorough check of a business's financial records, including its statements, transactions, and how it runs its operations. The goal is to make sure everything is correct, complete, and follows industry rules and legal requirements. During an audit, financial records are carefully reviewed to confirm their accuracy and spot any mistakes or issues.

Audits can be done by your own team or by outside experts. Either way, they are important for confirming the accuracy of your financial data, ensuring your business follows the rules, and building trust in your company's credibility.

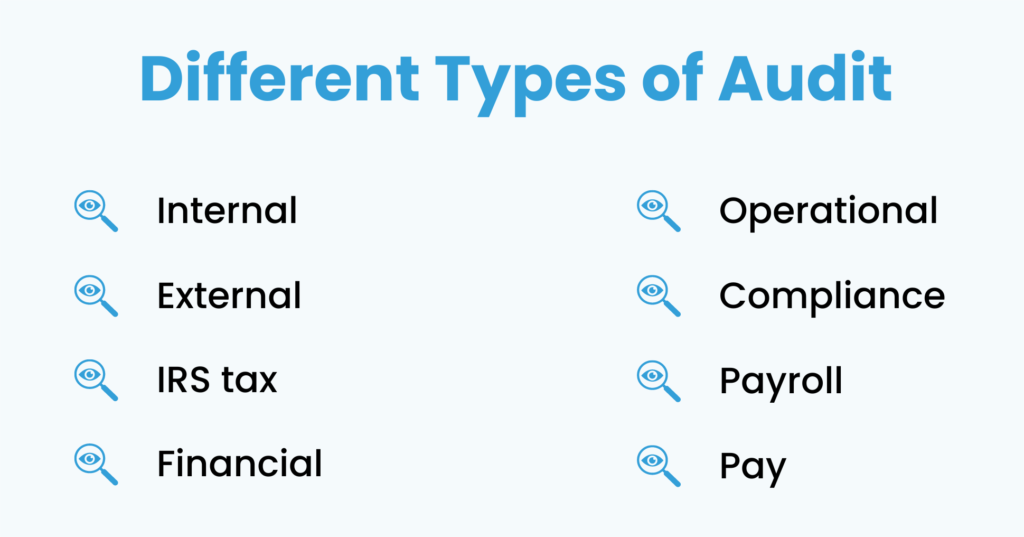

Audits come in many forms, each serving a specific purpose. Below are the most common types of audits small businesses should consider:

Internal audits are conducted by your own employees or an internal audit department. This type of audit provides a close-up view of your business’s operations, offering an opportunity to identify areas where improvements can be made. Internal audits are typically focused on risk management, operational efficiency, and compliance with internal policies. They offer business owners a proactive tool to review financial data, assess internal controls, and address any concerns before they become larger issues.

External audits are performed by independent third-party auditors, who review your financial statements and business operations without bias. These audits provide an objective assessment of your financial health, which can be especially important when you need to secure funding from investors or banks, or when regulatory bodies require verification. The impartial nature of external audits gives added confidence to lenders, investors, and shareholders that your financial statements accurately reflect the company’s performance.

An IRS audit involves a thorough examination of your tax returns by the Internal Revenue Service to ensure accuracy. While receiving a notification for an IRS audit can be intimidating, it's essential to remember that it is an opportunity to identify and correct any mistakes in your tax filings. These audits can focus on income, deductions, and credits, and may reveal areas where your business has miscalculated or unintentionally violated tax rules. Preparing for a tax audit with thorough documentation and organized records is crucial to minimize potential penalties or adjustments.

Financial audits are focused on verifying the accuracy of your financial statements. They ensure that your financial data complies with Generally Accepted Accounting Principles (GAAP). These audits review your balance sheets, income statements, and other financial documents to ensure they fairly represent your business’s financial position. Financial audits are essential for businesses looking to attract investors, as they enhance the reliability and trustworthiness of your financial reports.

These audits review the efficiency and effectiveness of your business operations and workflows. Unlike financial audits, operational audits focus more on performance and resource management than purely financial outcomes. By identifying inefficiencies, waste, and redundancies, operational audits can lead to improvements in workflow, productivity, and overall business profitability.

Every business must follow certain legal and regulatory guidelines, from industry-specific standards to labor laws and environmental regulations. Compliance audits help you verify that your business adheres to all these rules. By conducting compliance audits, you can avoid legal troubles, fines, and penalties for non-compliance while maintaining a positive reputation with regulatory authorities.

Payroll audits help ensure that your employees are being paid correctly and that your business is compliant with wage and hour laws. By reviewing payroll records, employment contracts, and tax filings, payroll audits can identify discrepancies such as incorrect payments, misclassified employees, or errors in tax deductions. Regular payroll audits help prevent costly mistakes and ensure that your payroll processes are running smoothly.

Pay equity audits are increasingly important in today’s workplace, as businesses strive to ensure fair and equal compensation practices. These audits assess whether employees are paid fairly based on their job responsibilities, qualifications, and experience—regardless of gender, race, or ethnicity. Pay equity audits help businesses maintain transparency, avoid potential discrimination lawsuits, and build a more inclusive workplace culture.

Although audits require time and resources, their benefits far outweigh the effort. Here are some of the key advantages of conducting regular audits:

While the thought of audits may initially seem overwhelming, they are a vital part of safeguarding your business's financial health and success. Conducting regular audits—whether internal or external—helps ensure the accuracy of your financial records, improve operational efficiency, and mitigate risks. With the insights gained from audits, you’ll be better positioned to make informed decisions, build credibility, and steer your business toward long-term success.

If you’d like to explore the various audit options or need help deciding which type of audit is right for your business, we’re here to help. At BookkeeperLive, we offer outsourcing solutions for financial audits, operational reviews, and compliance check-ups. Making audits part of your regular business routine through outsourcing is an investment in your future success.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.