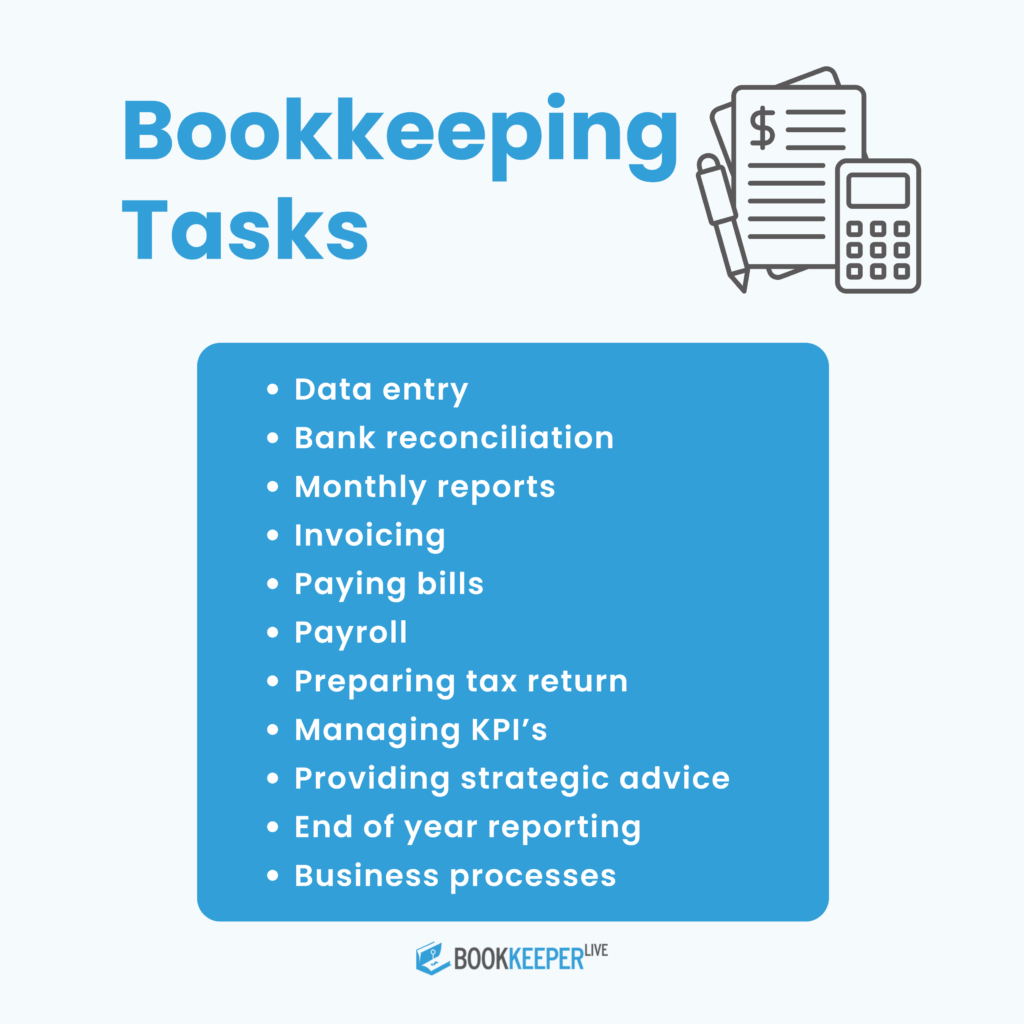

Running a small business requires handling multiple responsibilities and managing finances effectively. As a small business owner, accountability in everyday finances is most needed. This includes your everyday earnings, spending, and taxes owed by the company. While financial management with a small business can get complicated, having a checklist makes the process easier. The article below provides a simplified bookkeeping checklist to follow daily, weekly, monthly, quarterly, and annually, making your work easier

A bookkeeping solution helps small businesses run smoothly without any financial disruption. It helps them stay on track with their financial limits. It provides transparency of money flows, spending, and earnings. Through a bookkeeping solution, you can keep track of your taxes and set a clean record. A good bookkeeping solution also gets enterprises legal protection, ensuring business finances do not mix with personal assets.

A daily bookkeeping checklist consists of small tasks that are often of lower priority and less time-consuming. However, it is important to do it quickly before it piles up and brings in the chance of missing the due date and errors.

Deposit your cash, cheque, or any sort of payment you receive on the same day into your business account. This allows you to have an accurate cash record and ensure timely payments.

Log any new bills as soon as they arrive. Even if you’re not paying immediately, having them in the system helps you track what’s due.

If you accept cash payments, count and record them every day. This keeps your revenue numbers accurate and reduces the chance of errors.

Every time you spend money on your business, whether it’s a fuel bill, supply purchase, or delivery charge, record it. This helps manage budgets and keeps tax deductions accurate.

Once a week, spend time reviewing your records more carefully. This helps you spot issues before they escalate.

Compare your books with your bank statement. Make sure every deposit and withdrawal matches. This helps catch duplicate entries, missed payments, or bank errors.

Check which customers haven’t paid. Send reminders or call them. Delays in collection affect your cash flow.

See what bills are due next week. Pay on time to avoid late fees and keep good relationships with suppliers.

This can include sending statements to clients, updating addresses, or sorting out pending entries. It helps you stay organized and prevents backlogs.

Now, by the end of every month, it is important to look at the big expenses and larger transactions:

Make sure your bank and credit card records match your bookkeeping entries. Fix any mismatches now rather than letting them add up.

If you receive payments through cards, make sure they are being properly deposited into your account. Watch out for delays or processing issues.

Go through your accounts receivable list. Contact anyone who hasn’t paid you. Regular follow-ups prevent cash crunches.

Pay your staff. Double-check the salaries, deductions, and tax amounts. If payroll is complex, consider using a payroll provider.

If you sell products, match physical stock with what’s in your system. This helps calculate the cost of goods sold (COGS) and prevents stock shortages or overstocking.

Prepare key reports like:

Review your profit and loss with your business partner, manager, or advisor. See what went well and where you spent more than expected.

For quarterly business tasks, businesses must focus on doing their taxes and other financial filings with the help of the accounting or finance team.

Most businesses are required to pay taxes every three to four months. Calculate your estimated tax and pay on time to avoid penalties.

Check your estimated state tax and review the type and amount of tax your business is required to pay such as sales tax, professional tax, and other taxes. Check due dates and make sure you don’t miss the due date.

Review the profit and loss (P&L) statement, balance sheet, and cash flow report for the last three months. This analysis will help you understand your business transactions better and help you make a better plan for the next quarter.

Compare your existing transaction with your estimated budget. If required, revise your budget plan for the next quarter to maintain accurate records and generate income value.

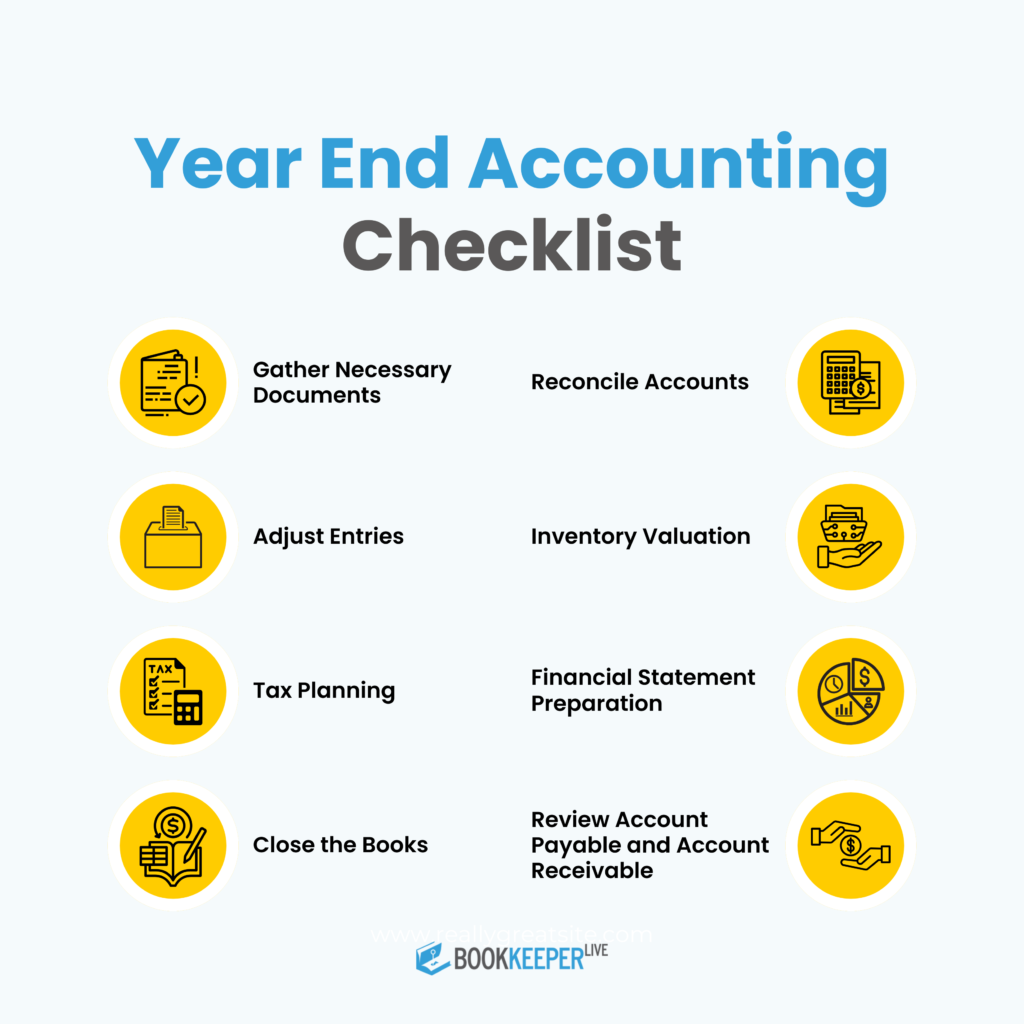

The annual bookkeeping checklist task will give you the clarity to prepare the financial records for the next year. File your annual taxation, review the bookkeeping system, and review your contracts and accounts.

Review your fixed assets and ensure that your latest assets are on your books and remove the ones that you no longer own. This includes machinery, computers, vehicles, and more. Business that follow GAAP should also list their intangible assets, like goodwill.

Prepare and file your business tax returns. You may need to file federal, state, and local taxes depending on your business type.

Make all year-end adjustments. Reconcile final numbers. Lock the books so you can start the new year fresh and accurate.

If you have employees or contractors, you need to send them tax forms before the annual deadline, which is required by law.

Smart bookkeeping enables financial clarity and helps business improve their financial planning to gain maximum advantage of their earning and profits. Bookkeeping is not just about having a clean record but also about upscaling your business and improving decision-making. Outsourced bookkeeping service like BookkeeperLive can help you maintain all the required checklists and keep you on track of all your financial records. If you choose to bookkeeping yourself, follow the list diligently to maintain a clean financial record and keep your business compliant with the law.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.