Ecommerce starting on Amazon often turns out to be a first venture for many entrepreneurs. Amazon offers a user-friendly platform with an easy path to revenue. With growing sales, it quite easily occurs that sellers focus all their attention on sales rather than the back-office tasks, especially accounting. Success for Amazon sellers will come from building an account in a solid foundation that might give assurance for tax compliance and the accuracy of tracking of its finances. Good news is that beginning is simple-along with being much more accessible with the right tools, which connects Amazon with accounting software like QuickBooks.

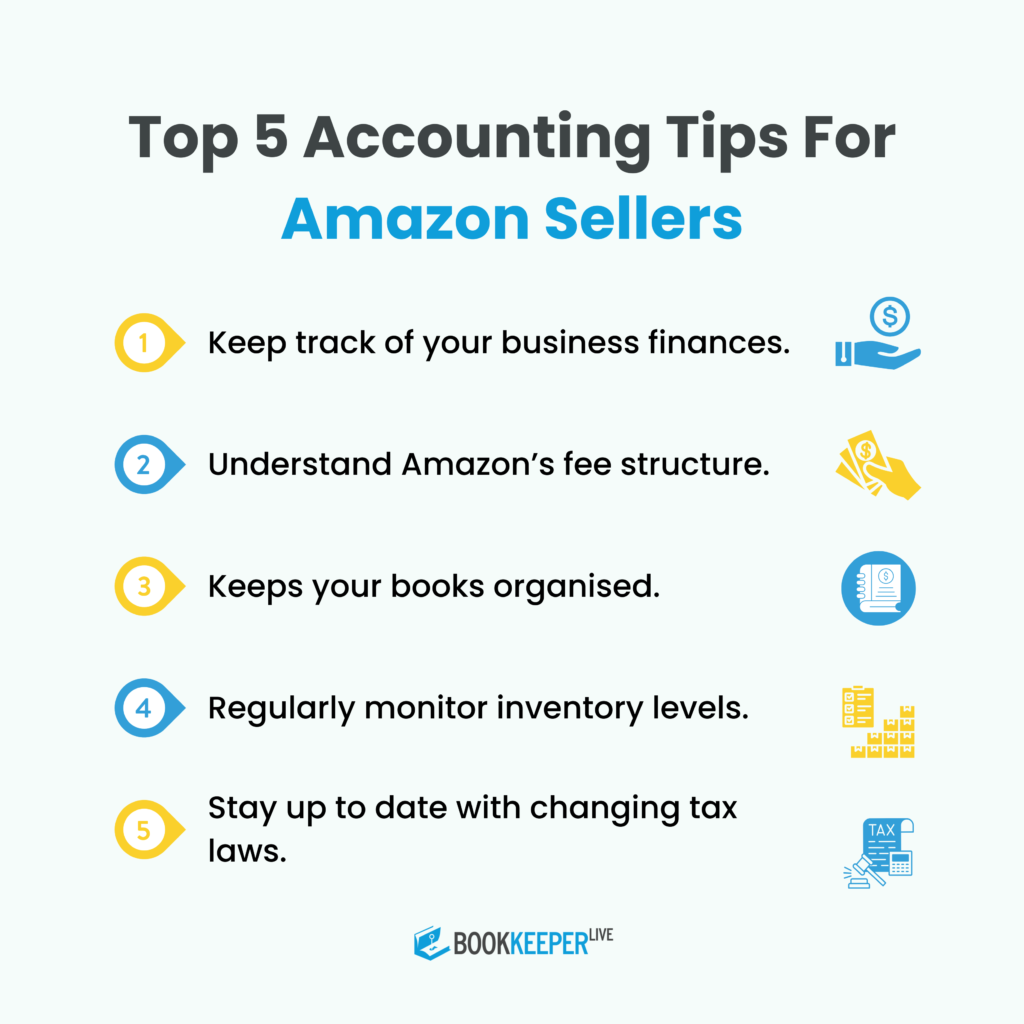

Here's a quick guide on helping you understand the basics of accounting as an Amazon seller as well as how to stay compliant and organized.

Developing an effective accounting system for your business is of great importance, especially as your Amazon business grows. An accountant should be implementing practices that will scale your business. Most Amazon sellers use summary or journal entry accounting-it can be easier and less time-consuming to use than more detailed transactional methods.

At the onset, you can probably do it on a small-scale using Excel or even by hand. But when the business has already grown, it is now the time to finally commit to accounting software. Tools such as QuickBooks are extremely popular among sellers as they are able to track everything—revenue and expenses, as well as payments and cash flow—so doing so makes sure you're accurate in your financials while dealing with your Amazon store.

Tax compliance is one of the most significant challenges faced by Amazon sellers, especially as ecommerce continues to grow. Given that each state in the U.S. can impose its own sales tax regulations, staying compliant can be a complex and daunting task. Failure to comply with the varying sales tax laws could result in costly fines, penalties, and even legal issues. This is why understanding the nuances of sales tax compliance for Amazon sellers is critical for maintaining the health and longevity of your business.

As your business grows, it can get quite cumbersome to manage such a high volume of deals. Automation will depend on accuracy and time-saving. If the two are connected, then any sales data from the Amazon store could automatically be incorporated into your accounting platform. Even activities like tracking inventory and reconciling payments can be automated.

For example, deposits from Amazon are made every two weeks, with only the net total showing. Without detailed breakdowns, you might have no easy way of knowing what is selling and what profits you are making or how much you are paying in fees. If you integrate your Amazon store with QuickBooks, you'll see a degree of itemized, real-time financial data that helps you make the right decisions and tracks your profits accurately.

Along with the automation of the managing of the levels of inventory, you can synch orders, quantities, and prices across numerous platforms. Therefore, you will be assured that the inventory levels are correct and that new products can easily be listed from QuickBooks to other marketplaces.

Once you've started scaling your business, certain challenges will pop up that mean spreadsheets and manual processes are too small for what you need. Here are five signs that it is time to automate your Amazon accounting:

Amazon's flexibility in their return policy makes accounting cumbersome. Manually handling returns creates several errors, such as writing off damaged inventory or inadvertently expensing something twice. Automation really helps you manage returns efficiently, thereby ensuring cash flow and an accurate number of existent inventory.

The bigger your product catalog is, the more complicated your inventory gets. What might have started as a manageable business has transformed into a tangled chaos of multiple sales channels, locations, and return flows. Automation simplifies inventory tracking, which reduces mistakes and errors that otherwise would end up costing too much, like stock being out of place at the wrong time.

There is no way you can address thousands of transactions without automation. Automated bookkeeping for Amazon can free up some of the resources that you previously applied to the reconciliation process, and you can then use the time to expand your business.

Just like your business is growing, the fees you pay to Amazon are increasing as well. Monthly subscription fees now contribute along with the referral fees and other marketplace charges, which add up very quickly. The automated accounting systems monitor and keep track of fees in a way that ensures this doesn't eat into overall profit dollars.

The sales tax laws are too complex and exhausting to understand. It becomes hard for sellers to manage their tax obligations in different states and jurisdictions. You can look after all your sales tax obligations while becoming busy with scaling up the business without worry related to compliance with the help of automated bookkeeping.

No matter where you are in your Amazon selling journey, accounting and bookkeeping can quickly become overwhelming as your business grows. Efficient financial management is crucial, and with the right tools, it can become seamless. That’s where BookkeeperLive comes in – an expert service designed to handle all your accounting needs, allowing you to focus on what you do best: growing your business.

BookkeeperLive offers Amazon sellers a full suite of accounting and bookkeeping services that ensure your finances are accurate, compliant, and organized. By integrating directly with Amazon and other ecommerce platforms, BookkeeperLive simplifies everything from tracking sales and managing inventory to handling taxes and fees. With their experienced team, you can rest easy knowing that your accounting is in expert hands.

While accounting is not the most glamorous part of managing an ecommerce business, it will definitely be one of the most critical ones. Building a strong foundation, staying on top of all tax compliance, and automating key processes will ensure the ultimate success of your Amazon store. Once you have the right accounting tools and strategies in place, you can focus on growing your business while keeping your finances accurate and tax compliant.

1. Do Amazon sellers need to collect and pay sales tax?

Yes, Amazon sellers are typically responsible for collecting and remitting sales tax in states where they have a "nexus." This could be due to inventory stored in a state (through Amazon FBA) or other activities that establish a physical presence. Many sellers use sales tax automation software like TaxJar or Avalara to simplify this process.

2. What are the benefits of automating accounting for Amazon sellers?

Automation helps reduce manual errors, saves time, and provides real-time financial insights. By integrating Amazon accounts with accounting software, sellers can track inventory, fees, returns, and sales tax obligations efficiently. This setup is especially beneficial for sellers managing high transaction volumes.

3. When is the right time to outsource accounting for an Amazon business?

Many Amazon sellers choose to outsource accounting when they reach a volume of transactions that's difficult to handle manually. Indicators include high transaction volumes, complex tax obligations, or if returns and fee tracking are becoming overwhelming. Outsourcing allows sellers to focus on growth and reduce the risk of errors.

4. How does sales tax work for Amazon FBA sellers?

Sales tax for FBA sellers can be complex because Amazon may store inventory in multiple states, creating a nexus in each of those locations. Sellers are required to collect and remit sales tax in states where they have a nexus. Amazon provides sales tax collection services, but sellers must ensure accurate tax filings.

5. How do Amazon sellers handle returns in accounting?

Returns impact both inventory and cash flow. Sellers should track returns carefully, adjust inventory, and ensure that returned items are reconciled in their accounting records. Automation can help by updating inventory levels and creating journal entries to account for refunds and restocking.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.