Bookkeeping is an essential task for businesses of all sizes. Whether you decide to manage it yourself or hire a professional, understanding the associated costs is vital to making informed financial decisions for your company. In this guide, we’ll break down the various options and price points for small business bookkeeping services, helping you choose the right solution for your needs.

Bookkeepers play a critical role in managing your business's financial health. Their primary responsibility is to keep accurate records of all financial transactions, allowing business owners to analyze the data and make informed decisions. The tasks that a bookkeeper performs include:

Having accurate financial data enables small business owners to identify areas for growth, manage cash flow effectively, and remain compliant with tax laws.

When businesses first start, many owners take on the bookkeeping themselves to save costs. While this approach may work initially, as your business grows, it’s likely you’ll need help managing the increasing volume of transactions.

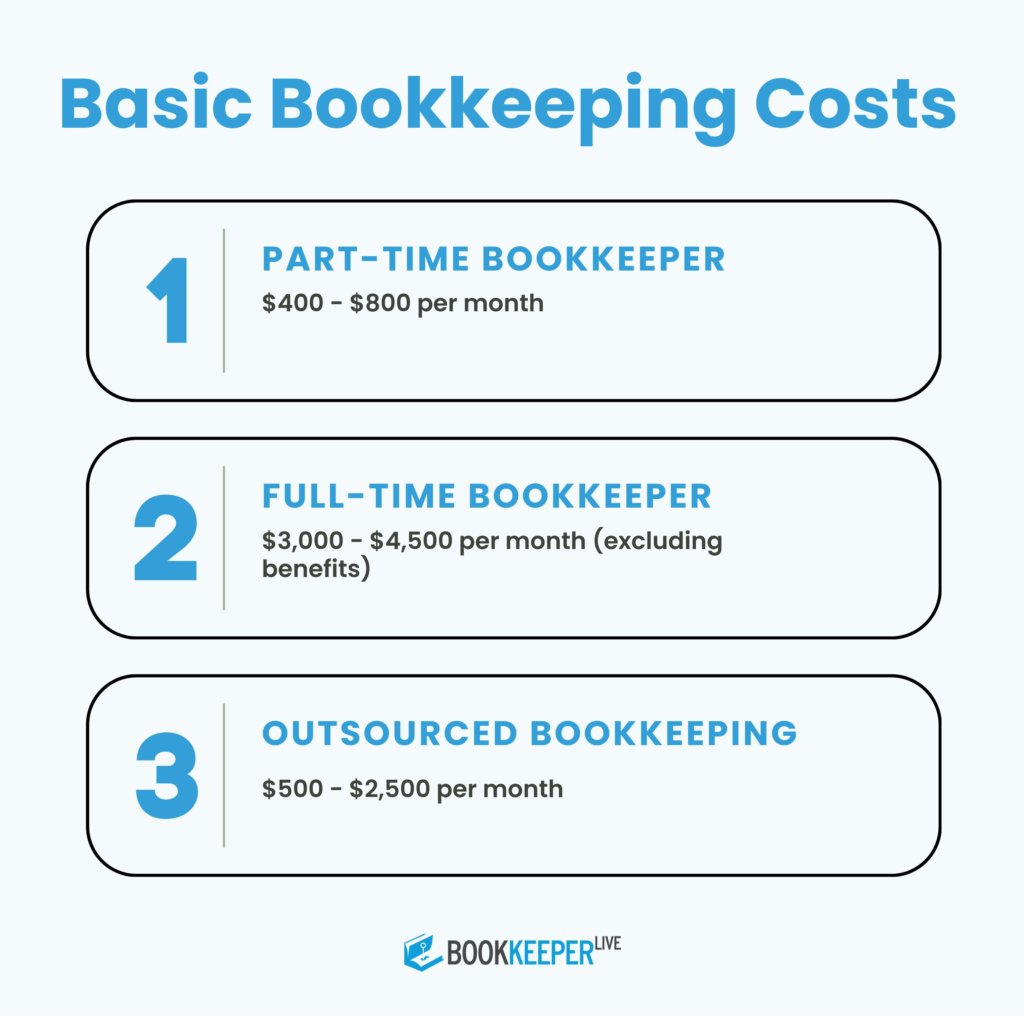

Bookkeepers can be hired part-time, full-time, or through outsourced services. Here’s a breakdown of typical costs:

It’s important to weigh the cost of hiring a professional bookkeeper against the value of your time. If managing your financial records starts taking you away from growing your business, outsourcing the task may be the most cost-effective solution.

Part-time bookkeepers can assist with tasks such as data entry, reconciling accounts, and managing timesheets. This option is often more affordable, making it a popular choice for small businesses that can manage some of the accounting responsibilities in-house.

The cost of hiring a part-time bookkeeper typically ranges from $20 to $50 per hour, depending on location, experience, and the complexity of tasks. Part-time bookkeepers may be an ideal solution if you only need help with basic tasks such as invoicing and accounts payable.

However, one downside to part-time bookkeeping is the potential for errors. It’s crucial to regularly review the work to ensure accuracy, especially if you’re managing larger volumes of transactions.

A full-time bookkeeper handles the day-to-day financial operations of your business, including tracking transactions, managing payroll, and preparing tax filings. For businesses with more complex financial needs, full-time bookkeepers provide greater oversight and ensure that your books are always up to date.

The annual salary for a full-time bookkeeper typically ranges from $35,000 to $55,000, excluding benefits, which can add an additional 20% to their salary. While this is a more significant investment, full-time bookkeepers bring peace of mind to business owners by ensuring financial stability.

Outsourcing your bookkeeping to a third-party provider is a cost-effective option for many small businesses. You can customize the services you need and only pay for what you use, making it a flexible solution. Outsourced bookkeeping typically costs between $500 to $2,500 per month, depending on the services provided and the size of your business.

One of the key advantages of outsourcing is the ability to access professional expertise without the overhead costs of hiring an in-house employee. Outsourcing is also ideal for businesses that need more advanced bookkeeping services, such as preparing detailed financial reports or managing multiple accounts.

BookkeeperLive is a comprehensive bookkeeping and accounting service designed for small businesses. With its expert team and advanced tools, BookkeeperLive helps automate and streamline your financial tasks, so you can focus on growing your business. Whether you're a freelancer, small business owner with employees, or working with contractors, BookkeeperLive has tailored solutions to meet your needs.

Key features include professional invoicing and payment processing, expense tracking with easy receipt management, and time tracking for projects and teams. In addition, BookkeeperLive provides robust financial reporting, tax reminders, and seamless integration with accounting software to manage your business efficiently. Plus, with access to expert advice, whether you manage bookkeeping in-house or outsource it, BookkeeperLive ensures your finances are handled with care.

Several factors influence the cost of bookkeeping services. Understanding these variables can help you estimate the expenses and choose the right bookkeeping solution for your business:

Deciding whether to hire a bookkeeper or manage your finances in-house depends on your business’s needs and resources. If bookkeeping is taking up too much of your time or becoming too complex to manage, hiring a professional could free up valuable time to focus on growing your business. Additionally, experienced bookkeepers bring expertise that can help you avoid costly mistakes and ensure that your business remains financially healthy.

Bookkeeping is essential to running a successful business, but the costs can vary based on your specific needs. Whether you hire a part-time, full-time, or outsourced bookkeeper, it’s important to understand the different cost factors and make an informed decision. For many small businesses, outsourcing bookkeeping can offer both cost savings and expert service, allowing you to focus on what you do best—growing your business.

By weighing the options and considering your business's growth stage, you can choose a bookkeeping solution that meets your financial needs and budget.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.