Tax season is one of the most important periods in businesses regardless of their size. Having the right planning and meeting tax deadlines on time can ensure the prevention of penalties and make sure the financial management is smooth and fine. For corporations, LLCs, and sole proprietors, staying atop tax deadlines is fundamental for compliance and financial well-being. This blog will outline the key business tax deadlines for 2025, covering corporations, LLCs, and sole proprietors, along with a brief comparison of 2024 deadlines to prepare you for the future.

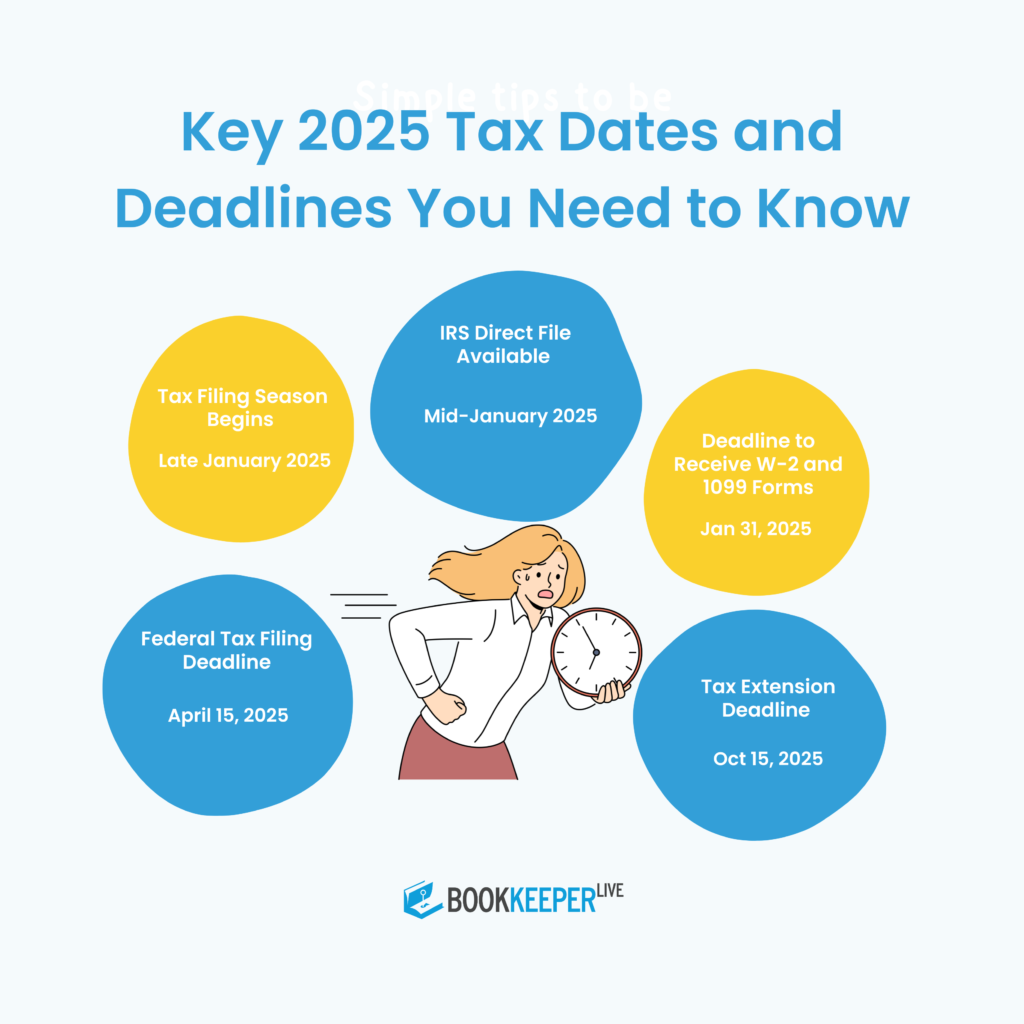

Business tax deadlines vary depending on the type of business entity. Here is a general overview of important deadlines that all business owners should mark on their calendars:

January 31, 2025 – By January 31, 2025, employers are required to distribute Copy B of Form 3921 to their employees. This date also marks the deadline for filing and delivering W-2 forms to employees.

Feb 17, 2025 - Businesses are required to provide Form 1099-B to employees by February 17, 2025

However, these are general deadlines on taxes. Different types of business entities have particular deadlines which need to be met. Now let's take a closer look at specific deadlines for corporations, LLCs, and sole proprietors.

Understanding important tax deadlines is essential for both C-corporations and S-corporations to remain compliant and avoid penalties. Below is a comprehensive guide to the key dates and filing requirements for 2025.

Any corporation that had an employee exercise an Incentive Stock Option (ISO) during the tax year must submit a Copy A of Form 3921 for each ISO exercise by an employee.

This deadline applies to businesses filing by mail. If you plan to file Form 3921 electronically, the deadline is March 31, 2025

Missing the deadline can result in fines, starting at $60 per form if filed within 30 days after the deadline. The longer the delay, the higher the penalties.

Form 3921 is not required for ISO exercises by nonresident alien employees who do not receive a Form W-2.

Employees who exercised ISOs in 2024 must report the transaction on their 2024 tax return, as the IRS treats ISO exercises as taxable events. Employers are required to provide Form 3921, which contains the necessary information for tax reporting.

S-corporations with a fiscal year ending on December 31 must file Form 1120-S by this date.

If your fiscal year does not end on December 31, refer to IRS guidelines to determine your specific filing deadline.

S-corporations may request a filing extension until September 15, 2025, by submitting Form 7004 (Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns) by March 17, 2025.

Corporations with employees who exercised an ISO during the tax year must file Form 3921 for each employee. This deadline applies to those submitting the form electronically.

If filing by mail, the deadline is February 28, 2025

To file Form 3921 electronically, businesses must obtain authorization from the IRS by applying for a Transmitter Control Code (TCC). Once the TCC is received, companies can create an account in the IRS Filing Information Returns Electronically (FIRE) system to submit the form. Keep in mind that processing a TCC application may take several weeks, so it's best to plan.

Failing to meet the deadline can result in a penalty of $60 per form for delays up to 30 days past the due date, with fines increasing the longer the filing is delayed.

Form 3921 is not required for nonresident alien employees who exercise ISOs and do not receive a W-2.

Employees who exercised ISOs in 2024 must report these transactions on their 2024 tax returns. The necessary information is included in Form 3921, which is provided to employees by their employer.

C-corporations with a fiscal year ending on December 31 must file Form 1120 by this date.

Important note

If a corporation's fiscal year does not end on December 31, the filing deadline may differ. Refer to IRS guidelines for the correct due date.

C-corporations may request a filing extension by submitting Form 7004. The extension must be filed by April 15, 2025, to receive additional time to file Form 1120.

LLCs can be classified for tax purposes as partnership, corporation, or disregarded entities. Deadlines would vary based on the type of classification the LLC has assumed. Most LLCs are considered a pass-through entity for taxation purposes. The following deadlines are very important:

March 15, 2025 – Deadline for classified LLCs treated as a partnership to file Form 1065 Return of Partnership Income. Members of the LLC should receive Schedule K-1 to report on their personal tax returns.

LLCs and other pass-through entities, like partnerships and S-corporations, must provide a Schedule K-1 to their partners or shareholders by March 17, 2025. This form outlines each person’s share of the business's income, deductions, and credits, which they will need to report on their personal tax returns.

Sole proprietors report their business income and expenses on their personal tax return using Form 1040 with Schedule C to report profits or losses from the business. Since they do not file a separate business tax return, it’s essential to track these key deadlines:

April 15, 2025 – Deadline to file Form 1040 for the 2024 tax year, which includes business income reported on Schedule C. If you need more time, you can request an extension, moving the filing deadline to October 15, 2025.

June 15, 2025 – Due date for the Q2 estimated tax payment for the 2025 tax year.

September 15, 2025 – Due date for the Q3 estimated tax payment for the 2025 tax year.

October 15, 2025 – Final due date to submit Form 1040 if you requested an extension for the 2024 tax return. This filing includes any business income reported on Schedule C.

January 15, 2026 – Due date for the Q4 estimated tax payment for the 2025 tax year.

Staying on top of business tax deadlines is crucial for maintaining compliance, avoiding penalties, and ensuring smooth financial operations. Proper planning, timely filing, and understanding the unique deadlines for your specific business entity — whether it's a corporation, LLC, or sole proprietorship — can save you from last-minute stress. Marking these key dates on your calendar and seeking professional guidance when necessary can make tax season far more manageable. By being proactive and organized, you’ll not only meet your tax obligations but also support your business's long-term financial health and stability.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.