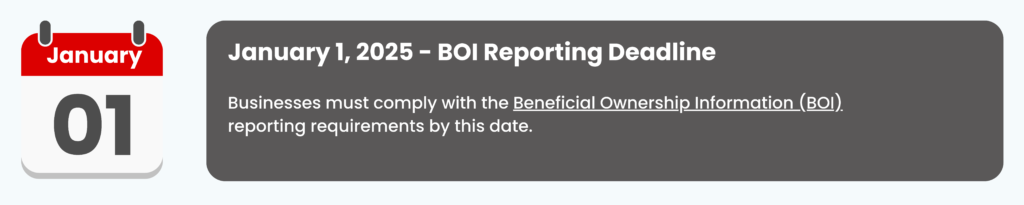

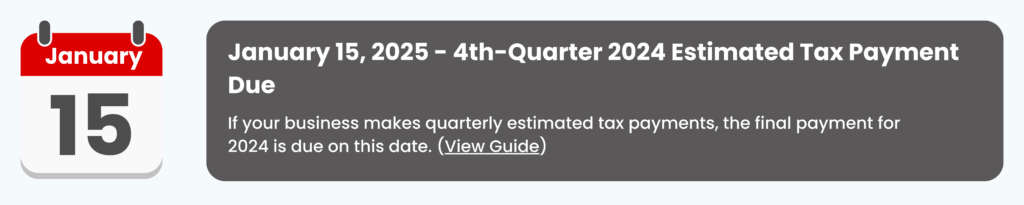

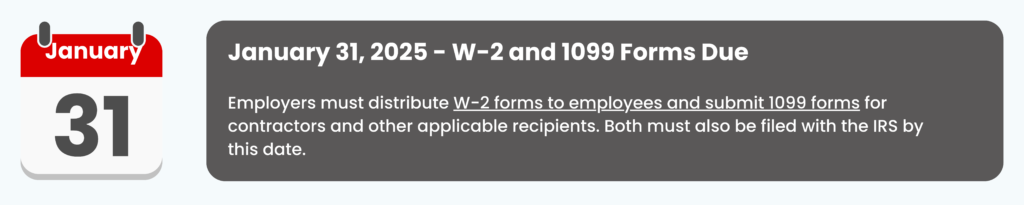

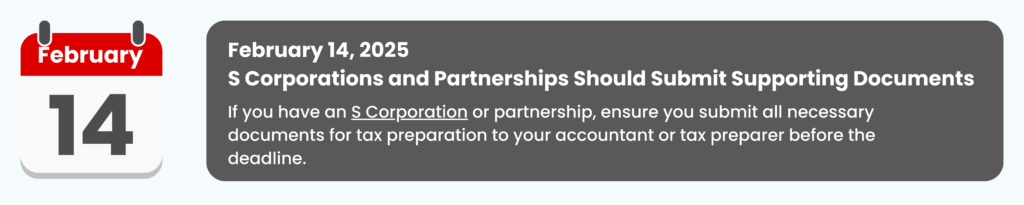

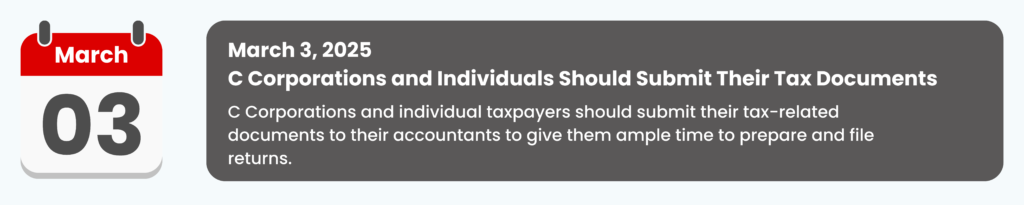

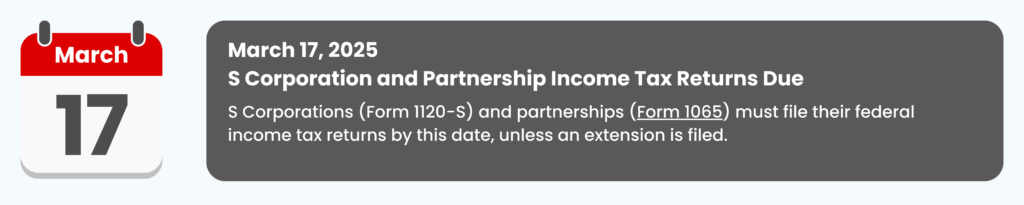

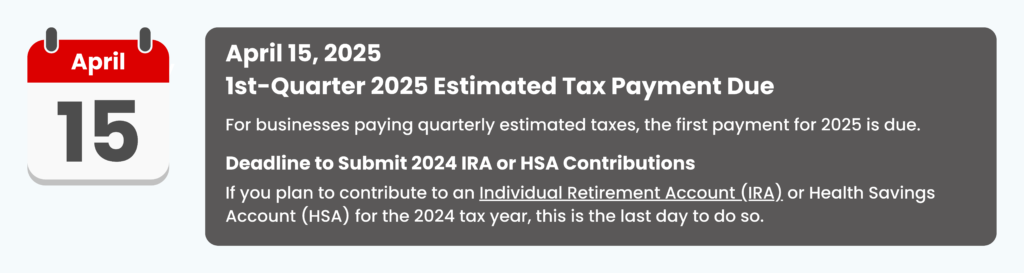

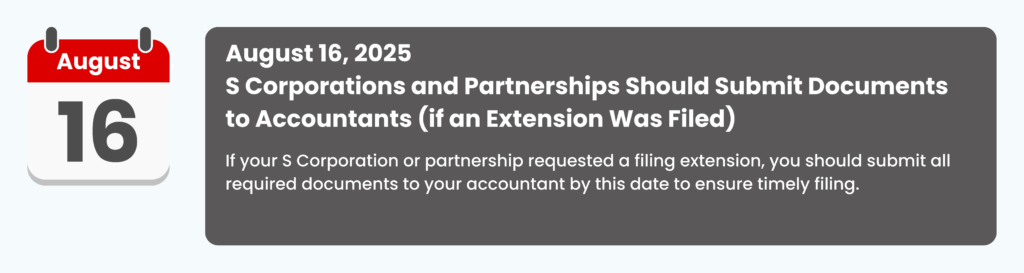

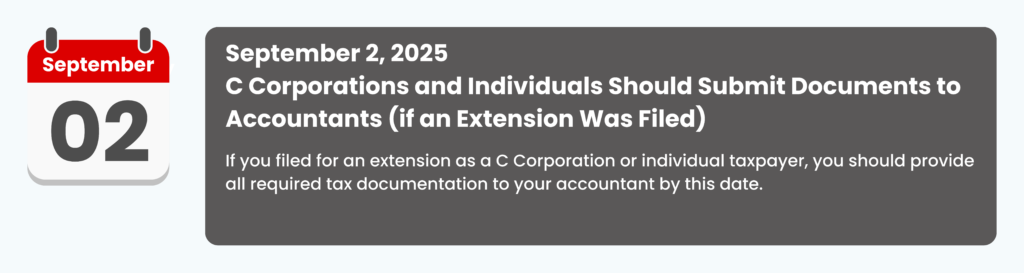

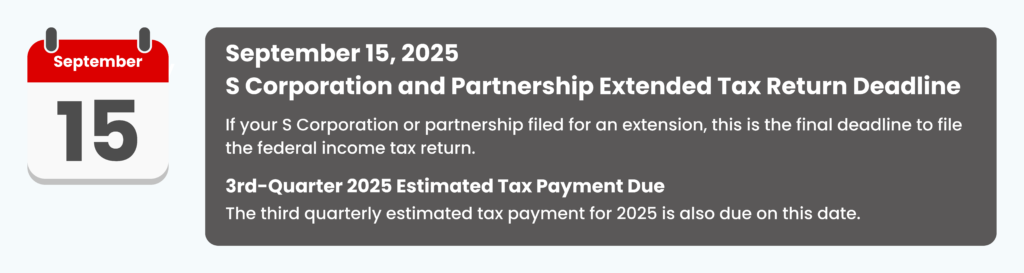

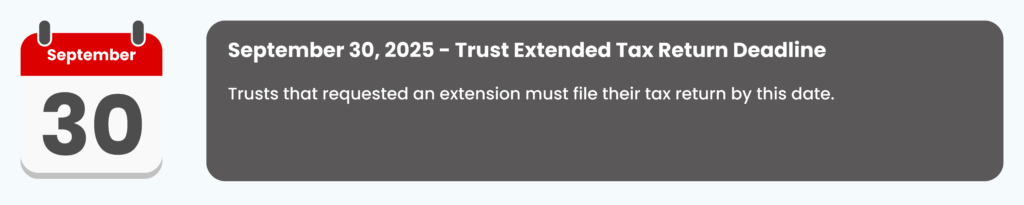

Meeting corporate tax deadlines is crucial for businesses to avoid penalties, ensure compliance, and maintain a healthy financial standing. This blog outlines all the key tax filing deadlines for 2025. We have included deadlines for S Corporations, C Corporations, partnerships, and individual taxpayers with clear explanations to help you stay on track.

Staying on top of corporate tax filing deadlines for 2025 is essential for maintaining financial stability and avoiding costly penalties. By marking key dates on your calendar, organizing tax documents in advance, and consulting with tax professionals, when necessary, businesses can ensure timely compliance. Proactive planning and timely action can save both time and money, allowing companies to focus on growth and operations instead of dealing with IRS complications. Don't wait until the last minute — take control of your tax obligations early to stay ahead of deadlines and keep your business on solid financial ground.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.