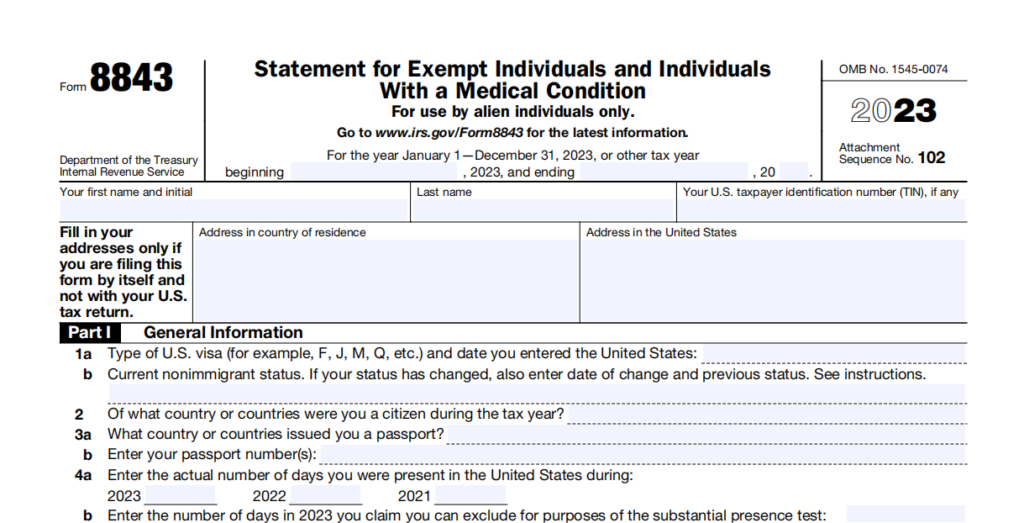

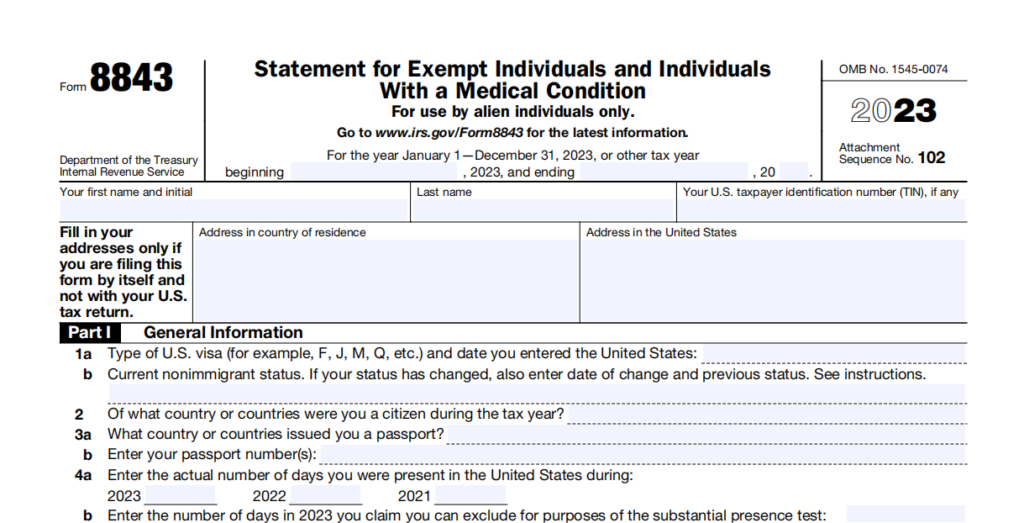

IRS Form 8843 is a tax form for people from other countries to show how many days they were outside the US. It helps figure out how much tax they owe. If you're an F-1 or J-1 student or their dependent and not considered a US resident for tax purposes, you must fill out Form 8843, even if you didn't earn money or file taxes separately. If you are considered a US resident for tax purposes, you don't need to fill out this form. Also, dependents, including children, need to fill out their own Form 8843, separate from the F-1 or J-1 student.

It's crucial to note that even if you are a nonresident alien in one of these visa categories and did not earn any income in the U.S., you are still required to file Form 8843.

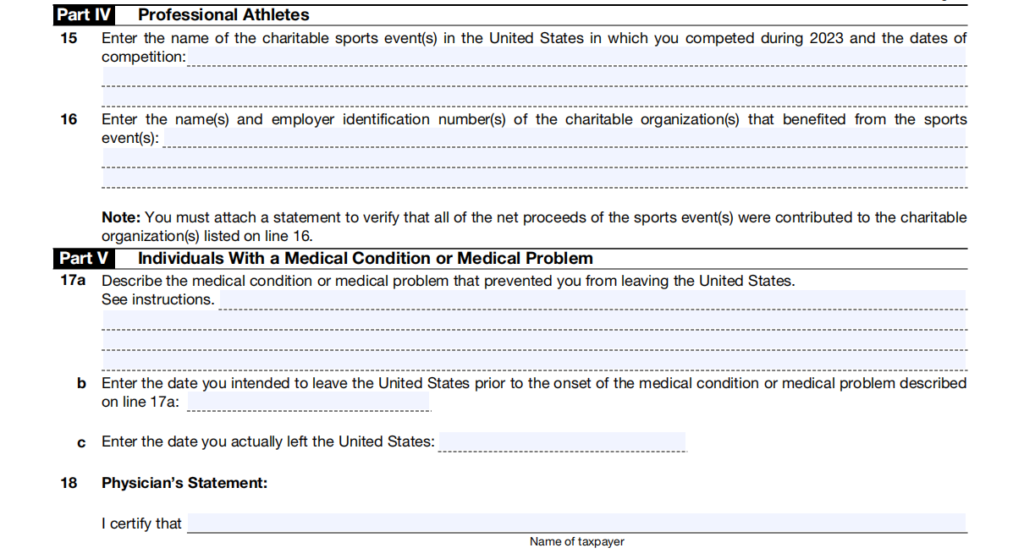

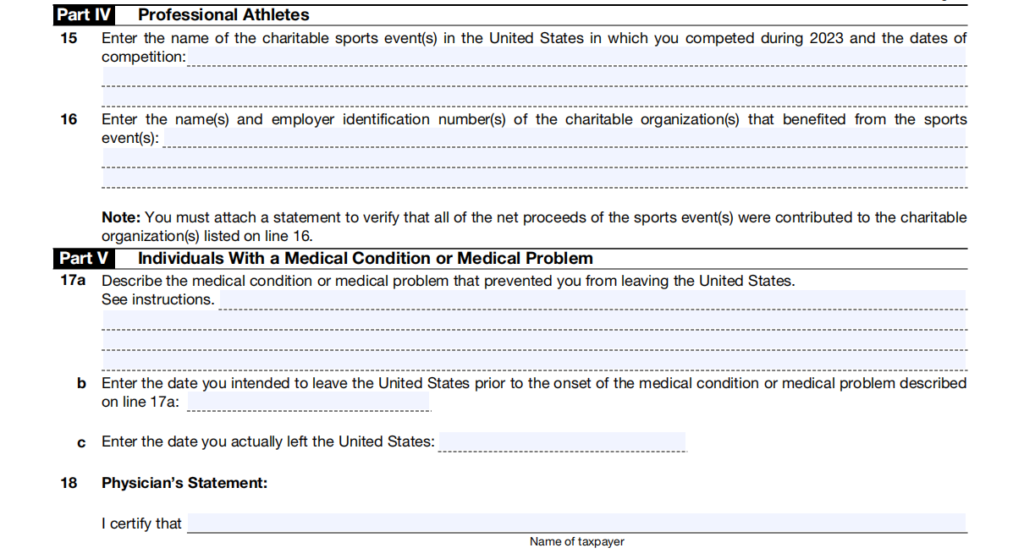

If you're a nonresident alien and you can't leave the U.S. because you're sick, you might be able to exclude some days from the calculation that determines how long you've been physically present in the country for tax purposes. To do this, you'll need to fill out Form 8843, explain why you can't leave, and provide documents supporting your situation.

This form can feel overwhelming because it has several sections. The good news is you don't need to fill them all out! Only focus on the sections that apply directly to you and your situation.

For example, if you haven't changed your visa status since entering the US, you can skip the section about reporting a change of status.

Think of it like a choose-your-own-adventure book for taxes. You only need to follow the path that relates to your specific circumstances.

1 . a) Country of issuance: Indicate the country that issued your passport.

b) Passport number: Enter your passport number exactly as it appears on the document.

2. Days present in the United States: Fill in the number of days you were physically present in the US for the past three years (including the tax year you're filing for). Note down the exact number of days present in each year.

Check the box that best describes your reason for exemption:

This information is intended for general understanding and shouldn't be considered tax advice. Always consult with a qualified tax professional to ensure accurate filing based on your specific circumstances.

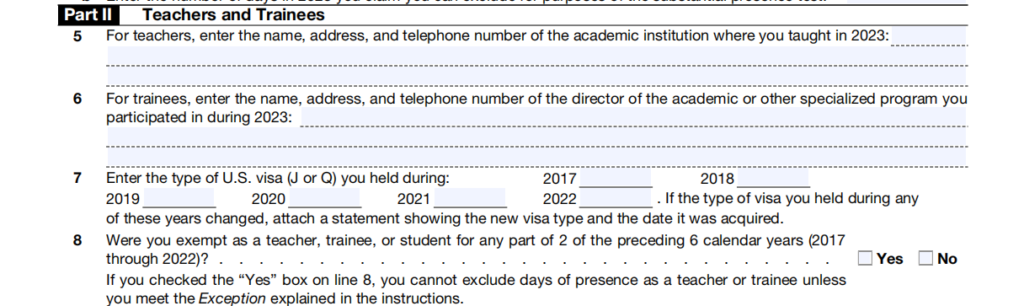

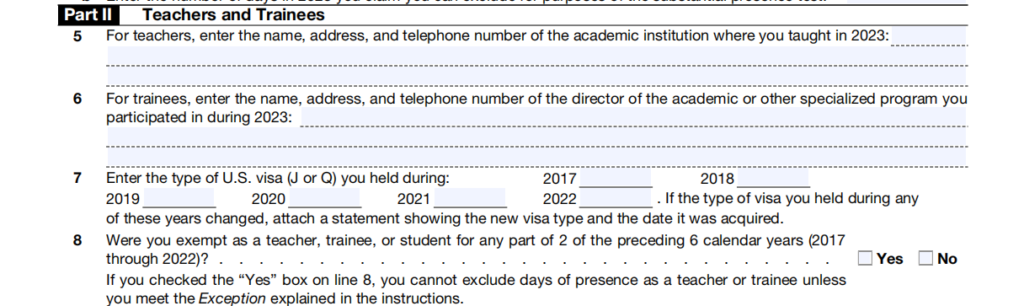

While Part 2 of Form 8843 requires information specific to teachers and trainees claiming exemption from the substantial presence test, it does not directly ask for details about the academic institution or program itself.

However, Part 2 does require information that indirectly references the institution or program:

While Part 2 of Form 8843 requires information specific to teachers and trainees claiming exemption from the substantial presence test, it does not directly ask for details about the academic institution or program itself.

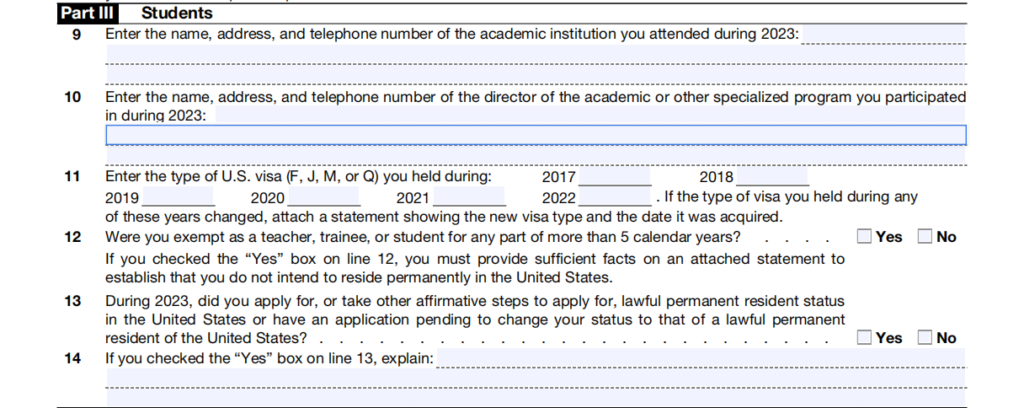

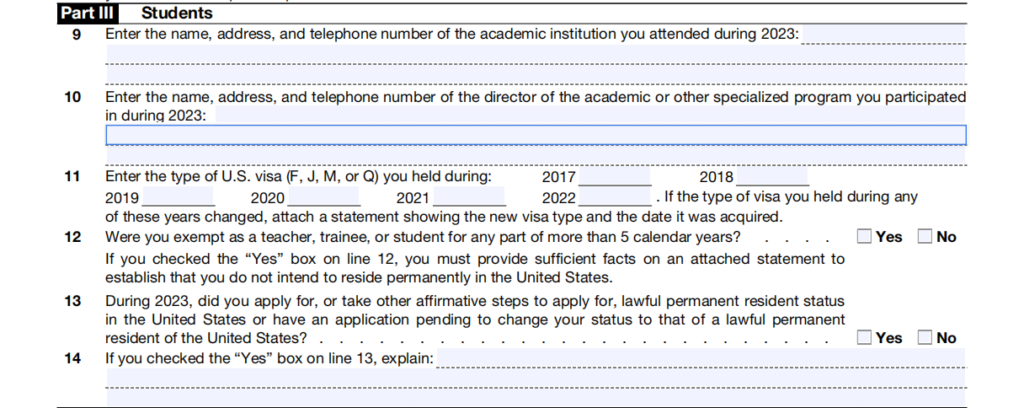

If you are studying in the United States with an F-1 visa or a J-1 visa (along with your family members), when filling out part 3 of form 8843, you should:

There may be rare exceptions where an F or J visa student might need to consider Parts 4 or 5. However, these are highly specific situations and usually involve a significant change in their visa status or purpose of stay. In such cases, it's crucial to consult with a qualified tax professional for guidance on proper form completion and filing requirements.

This information is presented for general understanding and should not be considered tax advice. Always consult with a tax professional, such as BookkeeperLive, for personalized guidance and ensure accurate filing based on your specific circumstances. Additionally, refer to the official IRS instructions for Form 8843 for further details: IRS Form 8843 instructions.

Form 8843, used by nonresident aliens to claim exemption from the substantial presence test for tax purposes in the US, has different filing procedures depending on your circumstances. Here's a breakdown to help you navigate the process:

Tax time can be confusing, especially if you're from another country and in the US on certain visas like F, J, M, or Q. Trying to figure out if you have to fill out Form 8843 can be like finding your way through a maze.

But don't worry, BookkeeperLive is here to help! We've made it easy to understand Form 8843, who needs to fill it out, and how to do it right. It's also a good idea to talk to a tax expert for advice that fits your situation.

Remember, filling out the right tax forms is important to avoid getting in trouble and to follow the rules from the IRS. Let BookkeeperLive help you through tax time with confidence!

1. Who needs to file Form 8843?

2. When is the deadline to file Form 8843?

3. How do I file Form 8843?

4. Do I need to file Form 8843 if I have an F-1 visa?

You only need to file Form 8843 if you are claiming exemption from the substantial presence test under specific situations, such as having a qualifying medical condition or being a teacher or researcher on a cultural exchange program.

5. What should I do if my visa status changed while I was in the US?

On Form 8843, report both your initial visa type and your current visa status, along with the date of any change.

IRS Form 8843 is a tax form for people from other countries to show how many days they were outside the US. It helps figure out how much tax they owe. If you're an F-1 or J-1 student or their dependent and not considered a US resident for tax purposes, you must fill out Form 8843, even if you didn't earn money or file taxes separately. If you are considered a US resident for tax purposes, you don't need to fill out this form. Also, dependents, including children, need to fill out their own Form 8843, separate from the F-1 or J-1 student.

It's crucial to note that even if you are a nonresident alien in one of these visa categories and did not earn any income in the U.S., you are still required to file Form 8843.

If you're a nonresident alien and you can't leave the U.S. because you're sick, you might be able to exclude some days from the calculation that determines how long you've been physically present in the country for tax purposes. To do this, you'll need to fill out Form 8843, explain why you can't leave, and provide documents supporting your situation.

This form can feel overwhelming because it has several sections. The good news is you don't need to fill them all out! Only focus on the sections that apply directly to you and your situation.

For example, if you haven't changed your visa status since entering the US, you can skip the section about reporting a change of status.

Think of it like a choose-your-own-adventure book for taxes. You only need to follow the path that relates to your specific circumstances.

1 . a) Country of issuance: Indicate the country that issued your passport.

b) Passport number: Enter your passport number exactly as it appears on the document.

2. Days present in the United States: Fill in the number of days you were physically present in the US for the past three years (including the tax year you're filing for). Note down the exact number of days present in each year.

Check the box that best describes your reason for exemption:

This information is intended for general understanding and shouldn't be considered tax advice. Always consult with a qualified tax professional to ensure accurate filing based on your specific circumstances.

While Part 2 of Form 8843 requires information specific to teachers and trainees claiming exemption from the substantial presence test, it does not directly ask for details about the academic institution or program itself.

However, Part 2 does require information that indirectly references the institution or program:

While Part 2 of Form 8843 requires information specific to teachers and trainees claiming exemption from the substantial presence test, it does not directly ask for details about the academic institution or program itself.

If you are studying in the United States with an F-1 visa or a J-1 visa (along with your family members), when filling out part 3 of form 8843, you should:

There may be rare exceptions where an F or J visa student might need to consider Parts 4 or 5. However, these are highly specific situations and usually involve a significant change in their visa status or purpose of stay. In such cases, it's crucial to consult with a qualified tax professional for guidance on proper form completion and filing requirements.

This information is presented for general understanding and should not be considered tax advice. Always consult with a tax professional, such as BookkeeperLive, for personalized guidance and ensure accurate filing based on your specific circumstances. Additionally, refer to the official IRS instructions for Form 8843 for further details: IRS Form 8843 instructions.

Form 8843, used by nonresident aliens to claim exemption from the substantial presence test for tax purposes in the US, has different filing procedures depending on your circumstances. Here's a breakdown to help you navigate the process:

Tax time can be confusing, especially if you're from another country and in the US on certain visas like F, J, M, or Q. Trying to figure out if you have to fill out Form 8843 can be like finding your way through a maze.

But don't worry, BookkeeperLive is here to help! We've made it easy to understand Form 8843, who needs to fill it out, and how to do it right. It's also a good idea to talk to a tax expert for advice that fits your situation.

Remember, filling out the right tax forms is important to avoid getting in trouble and to follow the rules from the IRS. Let BookkeeperLive help you through tax time with confidence!

1. Who needs to file Form 8843?

2. When is the deadline to file Form 8843?

3. How do I file Form 8843?

4. Do I need to file Form 8843 if I have an F-1 visa?

You only need to file Form 8843 if you are claiming exemption from the substantial presence test under specific situations, such as having a qualifying medical condition or being a teacher or researcher on a cultural exchange program.

5. What should I do if my visa status changed while I was in the US?

On Form 8843, report both your initial visa type and your current visa status, along with the date of any change.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Enter the code, fill out the form, and unlock financial clarity with a free trial.