Bookkeeping plays a crucial role in managing your business's financial health. It involves recording and organizing financial transactions to provide a clear picture of income and expenses. Until you hire a dedicated bookkeeper, you may be handling this task yourself. Understanding a few key concepts can help you get started effectively. Below are seven essential bookkeeping terms every business owner should know.

The accounting equation highlights the relationship between assets, liabilities, and equity. It ensures that the balance sheet remains accurate and balanced. The formula is:

Equity = Assets - Liabilities

A business is generally considered financially stable if its assets exceed its liabilities. However, some businesses, particularly service-oriented ones, might operate with little or even negative equity.

An accounting ledger is the core tool for recording and categorizing financial transactions. It serves as the foundation of a business’s financial recordkeeping.

Modern accounting software, like QuickBooks Online, simplifies ledger management and provides additional support through expert assistance.

Accrual accounting is a method that records transactions as they happen, regardless of when cash is exchanged.

This approach offers a clearer view of a business’s financial health compared to cash accounting. It’s particularly useful for businesses with inventory or accounts receivable/payable.

Double-entry bookkeeping involves recording every transaction as both a debit and a credit. This system ensures accurate financial records and makes it easier to identify errors.

For instance, purchasing inventory on credit increases the inventory account (debit) and accounts payable (credit), reflecting both the asset gained and the liability incurred.

Inventory refers to products or goods a business owns, whether on hand or in transit, awaiting sale. Proper tracking and management of inventory are critical as it directly impacts financial statements.

AR represents money owed to your business by customers for products or services already delivered. Tracking AR helps ensure timely payments and can guide setting appropriate credit terms.

AP includes amounts your business owes to suppliers or creditors for goods and services. Monitoring AP ensures bills are paid on time, avoiding late fees and maintaining a healthy credit score.

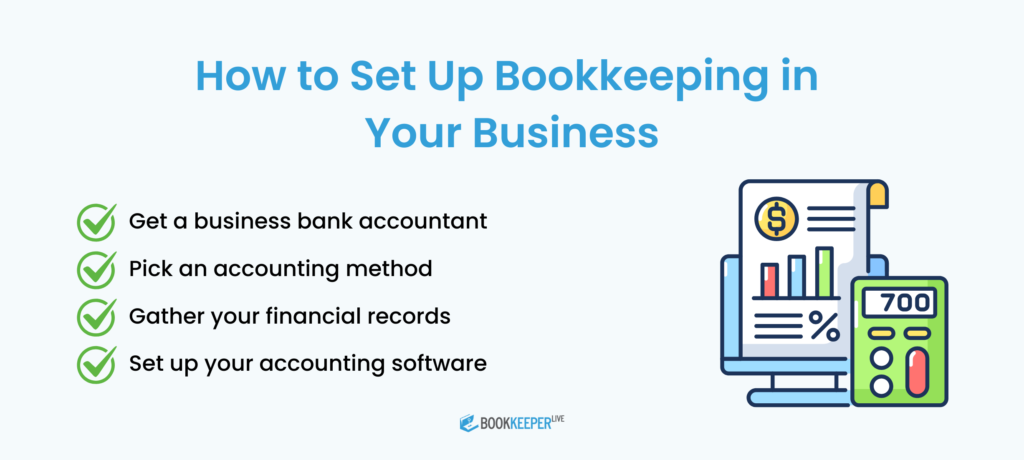

Proper bookkeeping lays the groundwork for financial success by tracking cash flow and enabling informed decision-making. Here are the essential steps:

Separating personal and business finances is crucial. A business checking account is a common choice for daily transactions, offering convenience and safety for managing funds.

Select between cash accounting and accrual accounting, depending on your business needs. Cash accounting tracks real-time cash flow, while accrual accounting records transactions as they occur, ideal for businesses with inventory or credit transactions.

Regularly documenting sales, expenses, and payments is vital for accuracy. Accounting software like QuickBooks can simplify this process, even allowing bank data to be directly imported.

While spreadsheets can work for basic bookkeeping, robust accounting software provides better efficiency and insights. Programs like QuickBooks streamline workflows, generate detailed reports, and offer expert assistance.

Up-to-date records are essential for understanding your financial position. Monitor expenses, invoices, receipts, and payments consistently to avoid errors.

Categorize expenses, keep receipts organized, and record every transaction promptly. Automation tools offered by banks and credit card providers can simplify this process.

Budgets help you manage expected income and expenses, providing a roadmap for financial planning. Use historical financial data to make accurate projections and adjust expenses as needed.

Reconcile your books monthly to identify and correct errors. Double-check entries to ensure accuracy and avoid discrepancies.

The foundation of accurate bookkeeping lies in adhering to these principles:

These rules ensure that financial records are systematically organized and error-free. Double-entry bookkeeping systems are especially reliant on these principles for accuracy.

By mastering these bookkeeping basics, you can set your business on the path to financial success. If time or expertise is a constraint, accounting tools like QuickBooks offer professional support to help you stay on top of your books.

1. What is bookkeeping, and why is it important for my business?

Bookkeeping involves recording, organizing, and managing financial transactions to provide a clear financial picture of your business. It ensures accurate financial reporting, aids in tax preparation, and helps in informed decision-making.

2. How does double-entry bookkeeping help my business?

Double-entry bookkeeping ensures every transaction is recorded as both a debit and a credit, making it easier to identify errors, maintain accuracy, and balance financial records.

3. How often should I update my books?

It’s best to update your books weekly or monthly to ensure accuracy, track cash flow, and identify potential issues early.

4. What tools or software are recommended for bookkeeping?

Popular bookkeeping tools include QuickBooks, Xero, and Wave. These software options simplify recordkeeping, automate processes, and generate detailed reports.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.