A payroll system is the software or process used to manage, calculate, and distribute wages to employees. It's a critical part of any business, ensuring that employees are paid accurately and on time. For small businesses, a payroll system helps streamline operations, reduce errors, and maintain compliance with labor laws and tax regulations. But beyond those operational aspects, an effective payroll system also boosts employee morale, as timely payments contribute to job satisfaction and trust in the company.

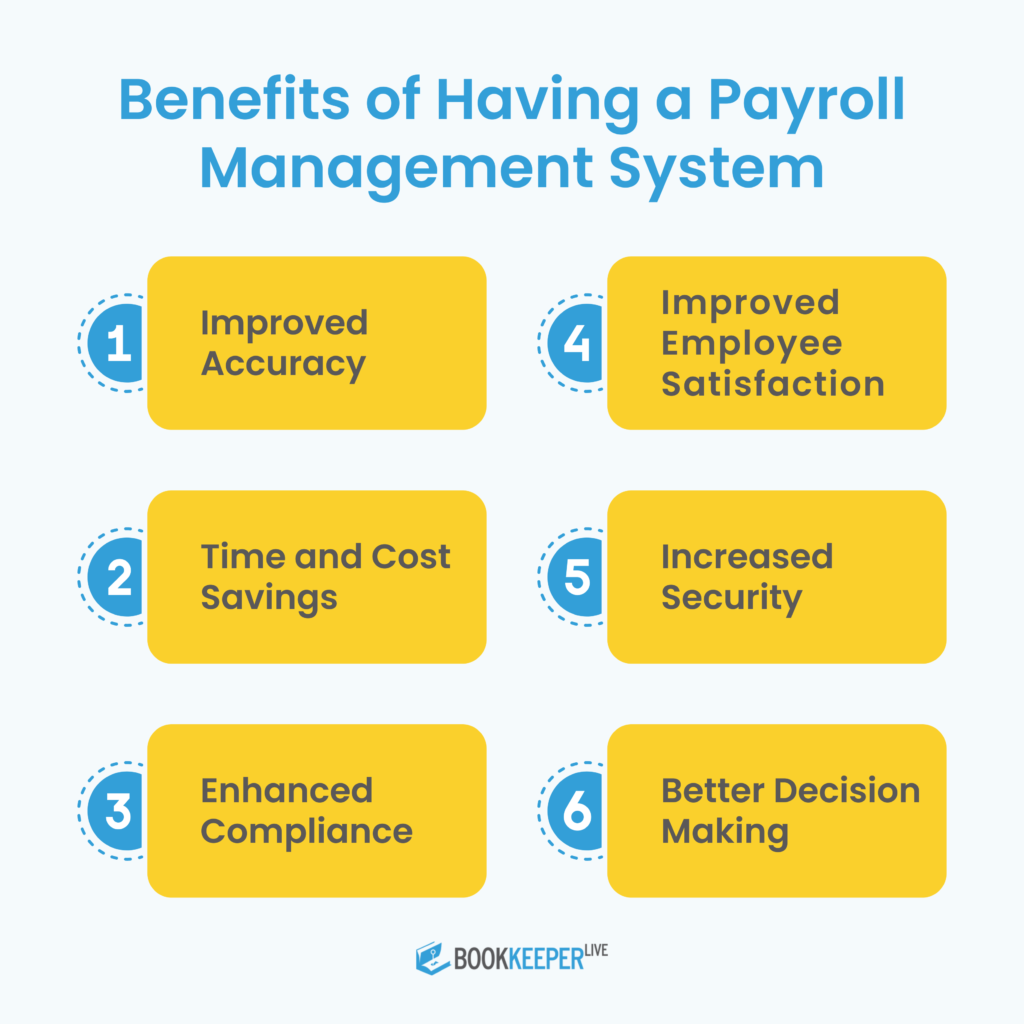

Implementing a well-designed payroll system comes with multiple benefits, especially for small businesses:

Small businesses have several payroll options to choose from, each catering to different needs, business sizes, and budgets. Below are the four main types of payroll systems:

This is typically used by smaller businesses with few employees. In-house payroll is handled manually, typically using spreadsheets or basic accounting tools. While it offers control, it’s labor-intensive and prone to errors, especially when dealing with tax calculations.

Best for: Small businesses with limited budgets and simple payroll structures.

Challenges: Time-consuming and a higher risk of mistakes, especially in tax compliance.

Outsourcing payroll to a third-party provider involves hiring a payroll service company to handle the entire payroll process, including tax filings, employee payments, and compliance.

Best for: Businesses looking to free up time and reduce administrative workload.

Challenges: Bit more expensive than handling payroll in-house, and some businesses may feel they lose control over sensitive info.

Software solutions automate payroll calculations, tax withholdings, and benefits management. These can range from basic to highly sophisticated systems with customizable options for businesses of any size.

Best for: Small businesses looking for an affordable, automated solution that offers some flexibility and ease of use.

Challenges: Requires training to use effectively, and ongoing software updates may add costs.

Cloud-based systems allow businesses to manage payroll from any location, with automatic updates and data backups. They often integrate with other business tools like accounting or HR management software, making them a flexible choice.

Best for: Growing small businesses with remote teams or multiple locations.

Challenges: Subscription fees can add up, and reliable internet access is required.

When choosing a payroll system, it’s important to consider the key features that will make your process easier and more efficient. Here are the top features to look for:

An efficient payroll system is a cornerstone of successful business operations, ensuring that employees are paid accurately and on time while maintaining compliance with tax regulations and labor laws. For small businesses, implementing the right payroll solution can save time, reduce errors, and foster a productive work environment. Whether a company opts for in-house, outsourced, software-based, or cloud-based systems, choosing one that aligns with their specific needs is crucial to maintaining a streamlined and secure payroll process. As businesses grow, investing in a robust payroll system will enhance operational efficiency and provide valuable data insights to guide future decisions.

1. What are the best payroll systems for small businesses in the USA?

Popular payroll systems include Gusto, QuickBooks Payroll, ADP, and Paychex. These platforms offer a mix of affordability, automation, and compliance management suited for small businesses.

2. How much does a payroll system cost for a small business?

Payroll software typically costs between $20 to $200 per month, depending on the number of employees and features. Outsourced payroll services might charge based on employee count or frequency of payroll runs.

3. Can I handle payroll manually for a small business?

Yes, but manual payroll is time-consuming and increases the risk of errors, especially when it comes to tax compliance. Using software or outsourcing payroll is recommended for accuracy and efficiency.

4. How do cloud-based payroll systems work?

Cloud-based payroll systems store data online, allowing businesses to access payroll information from any location with an internet connection. They offer automatic updates and can integrate with other business tools, such as accounting software.

5. What should I look for when choosing a payroll system?

Key features to consider include automation, tax compliance, direct deposit, integration with other business systems, and an employee self-service portal. Additionally, ensure the system is scalable as your business grows.

6. How often should I run payroll for my business?

Most businesses run payroll weekly, biweekly, or monthly, depending on their operations. A payroll system with customizable scheduling options is ideal for adapting to different pay cycles.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.