Looking to simplify your tax filing process in 2025? This blog provides all the essential information you need to navigate the upcoming tax season with ease. From the key deadlines to when tax season officially kicks off, we’ll cover everything, including tips on when to expect your federal and state refunds and how to avoid common filing pitfalls. Stay updated and make tax season simple.

April 15, 2025, is the tax deadline for the majority of Americans. While this is the final date to file, it’s not the only day to do so. Waiting until the last minute can lead to longer wait times for assistance, increased stress, missing documents, or an unexpected tax bill that may be difficult to manage.

Filing early is often a smarter choice. It allows you ample time to organize necessary documents, understand your tax obligations or refunds, and seek professional help if needed. Additionally, filing early reduces the risk of identity theft, as it limits the time available for fraudsters to submit false returns using your information.

By preparing and filing ahead of time, you can make tax season significantly less stressful and more efficient.

Filing your taxes early may protect you from identity theft. According to CNBC, the IRS detected over 1 million tax returns in 2023 as having identity theft potential and claimed refunds of $6.3 billion. Filing your taxes sooner will reduce the likelihood that thieves will use your identity to file a false tax return in your name.

Tax season begins in late January 2025, when the IRS starts accepting returns, and ends on April 15, 2025. These three months are when most people file their tax returns or request extensions if they need more time.

During this period, taxpayers also settle their tax payments or set up payment plans if they can’t pay the full amount right away. The IRS provides options for spreading out payments, such as:

Whether you’re filing early or closer to the deadline, it’s important to stay organized and prepared to avoid unnecessary stress.

The IRS usually processes refunds within 21 days after receiving electronically filed tax returns, provided there are no mistakes or issues needing further review. If you file a paper return, the refund process can take up to eight weeks or longer. No matter how you file, submitting your return sooner can help you receive your refund faster.

Errors or missing information on your return can cause delays, so it’s important to review your documents carefully before filing. If the IRS requires additional details to complete the process, they will contact you.

To get your refund as quickly as possible:

You can check the progress of your refund through the IRS's 'Where's My Refund?' tool. or similar services. Some tax preparers also offer tax refund advance loans, allowing you to access your money the same day your return is processed.

State refund processing times vary depending on where you live and how you file. Generally, filing your state return electronically and choosing direct deposit will help you get your refund faster—often within a few weeks. Filing by mail, however, typically takes longer.

Each state has its own schedule for processing refunds. Many states also offer online tools to track the status of your refund.

As with federal refunds, filing early and ensuring your information is accurate can speed up the process of receiving your state refund.

Missing the tax deadline can lead to penalties and fines if you owe taxes, but don’t panic—there are ways to reduce the financial impact.

If you owe taxes:

1. Submit your tax return promptly to reduce penalties and interest fees.

2. Even if you are unable to pay the entire amount, make as much as you can.

3. Think about arranging a payment plan with the IRS to pay the amount you owe in installments.

Even though there's no penalty for filing late if you're getting a refund, it's smart to file early to get your money faster.

You may qualify for penalty relief if you have a valid reason for filing late, such as a natural disaster or serious illness. Remember, requesting an extension by April 15, 2025, gives you until October 15, 2025, to file your return, but any taxes owed are still due by April 15.

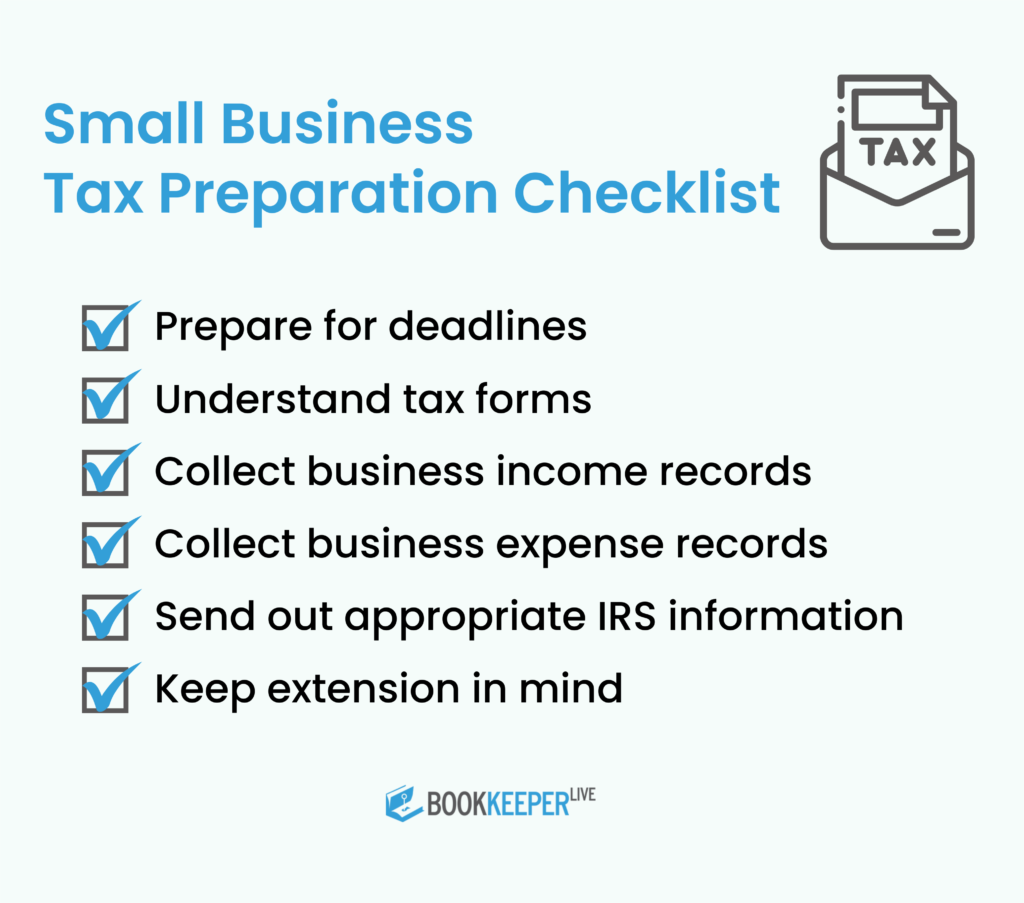

Staying organized with these documents will make filing your taxes easier and help ensure accuracy to avoid delays.

Don't wait until the last minute—start preparing for tax season now with BookkeeperLive. Our experienced and friendly tax professionals are here to offer expert guidance and ensure you get the maximum refund possible. Whether you’re looking to plan ahead or need help filing, our outsourced tax preparation service is here to provide you with the support and peace of mind you deserve. We're open year-round and ready to assist you every step of the way. Schedule your appointment with BookkeeperLive today and take control of your tax situation!

1. When will the IRS start accepting tax returns for 2025?

Tax season for 2025 will officially begin in late January when the IRS starts accepting returns. The exact date is typically announced in early January.

2. Is it better to file my taxes online or on paper in 2025?

Filing electronically is faster and more secure. E-filing also typically results in a quicker refund and reduces the chances of errors compared to paper returns.

3. Do I need to file taxes if I only have a small amount of income?

If your income is below the filing threshold, you may not be required to file, but it may still be beneficial, especially if you are eligible for a refund or certain credits.

4. What should I do if I receive a tax notice from the IRS?

If you receive a notice from the IRS, carefully read the letter for instructions. It may be regarding missing information or discrepancies in your return. If necessary, contact the IRS to resolve the issue.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.