Choosing the right Certified Public Accountant (CPA) is a critical decision for any small business owner. A CPA does more than just handle taxes—they provide valuable financial insights, ensure compliance with regulations, and help optimize your business’s financial strategies. With the right CPA, you can navigate complex financial challenges, make informed decisions, and focus on growing your business. This blog offers essential tips to help you select a CPA who aligns with your business needs and goals.

In the world of small business accounting, an accountant plays a pivotal role in assessing your financial health and guiding strategic financial decisions.

While day-to-day financial records are typically managed by a bookkeeper—who tracks income, expenses, and compiles monthly financial statements—an accountant goes a step further. They analyze your business finances, offer insights, and provide expert advice.

Small business accounting services encompass a wide range of solutions, including tax planning, financial forecasting, payroll management, and more. These services are often customized to align with the unique needs of your business. Essentially, accountants act as financial consultants, ensuring your finances are in order, assisting with tax filings, and supporting you during audits.

By partnering with a skilled accountant, you can gain valuable financial insights that empower smarter business decisions.

If your business is still in its early stages or operating as a hobby, you may not immediately need to hire an accountant. However, consulting with one early on can prove invaluable. Early advice from an accountant can help refine your business plan, highlight tax deductions for startups, and provide financial clarity—all at little to no cost.

Most accountants offer free initial consultations. These sessions provide insight into their expertise and services, offering you advice and clarity about how they can support your business in the future.

While there’s no universal “right time” to hire an accountant, having a CPA on board becomes essential once your business starts generating consistent profits. Below are key milestones that suggest it’s time to bring in a professional accountant:

Hiring an accountant at the right time ensures your financial systems are robust, tax obligations are met efficiently, and your business remains compliant. It also provides you with peace of mind to focus on growing your enterprise.

Ready to delegate the financial management of your business to a CPA? Here are some effective tips to help you find a reliable accountant:

Tap into your local small business network for referrals. Fellow entrepreneurs, community organizations like the Chamber of Commerce, or networking groups such as Rotary clubs are great places to start. You may also discover valuable leads through professionals you already work with, like your bank, realtor, or loan officer.

If local referrals don’t pan out, turn to online platforms. Search for accountants in your area and read reviews about their services. Websites like Yelp, LinkedIn, and online forums, as well as local Facebook groups, can provide honest feedback and help you identify trusted accountants in your community.

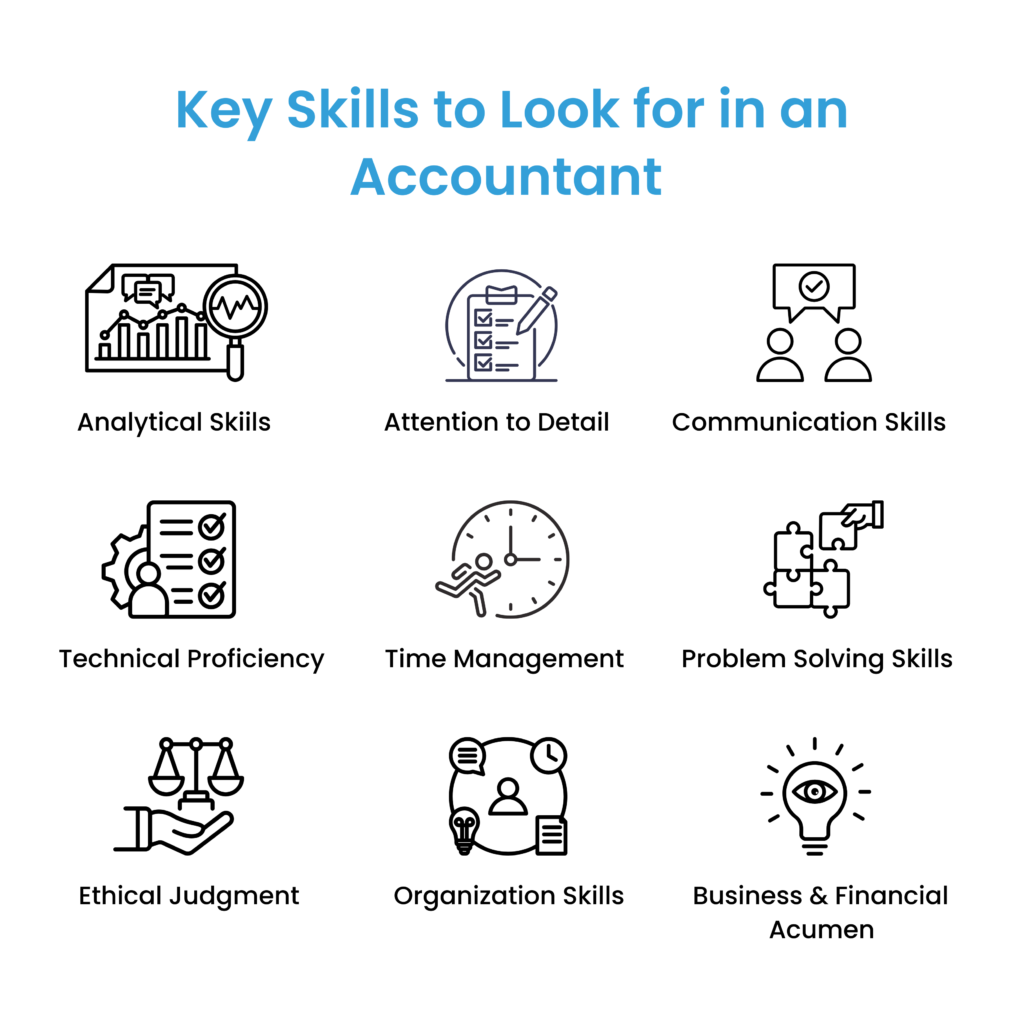

Accountants often specialize in specific areas, so it’s important to find one whose skills align with your business requirements. Some accountants focus on tax preparation for multiple clients, while others work closely with a select number of small business owners, offering year-round financial guidance. Some may also provide bookkeeping services alongside tax preparation, while others concentrate on complex compliance or regulatory matters. You’ll find both independent accountants and larger CPA firms to choose from.

During your initial consultation, inquire about the range of services they offer and their approach to working with clients. Additionally, discuss their experience within your industry to ensure they understand the unique financial challenges your business may face.

An experienced accountant should have the necessary credentials to demonstrate their expertise in handling business taxes. Start by confirming whether they hold a Preparer Tax Identification Number (PTIN), which is mandated by the IRS for anyone who is paid to prepare tax returns.

Beyond a PTIN, look for additional certifications or licenses. A certified public accountant (CPA), enrolled agent (EA), licensed attorney, or someone who has completed the IRS Annual Filing Season Program will be listed in the IRS directory. These credentials signify that the accountant meets professional standards and is authorized to provide tax services.

Membership in respected professional organizations can also indicate a trustworthy accountant. Check if they are affiliated with groups like:

These organizations require their members to meet rigorous standards, such as completing an accredited accounting program, adhering to a professional code of ethics, and maintaining years of industry experience. Choosing an accountant who is a member of one or more of these organizations provides added assurance that they are qualified and reliable.

After narrowing down your list, it’s time to meet with prospective accountants for in-depth discussions. These meetings will help you evaluate their suitability for your business. Prepare a list of key topics and questions to cover, such as:

By thoroughly discussing these topics, you can better assess which accountant is the right fit for your business.

Choosing the right accountant is about more than qualifications—it’s about finding a trusted partner who can guide your business through financial decisions and navigate complex tax laws.

A reliable accountant does more than prepare tax documents. They’ll sign them with their professional credentials, ensuring accountability, and represent you in case of any tax-related inquiries or issues. Given the sensitive and critical nature of financial information, it’s essential to feel confident and secure with your choice.

Your accountant will play a key role in shaping your business’s financial strategy and compliance, so trust and rapport are vital. Ensure you’re comfortable discussing sensitive matters with them and that their communication style aligns with your needs.

Working with an accountant can significantly enhance your financial management, especially during tax season. To maximize the value they bring, ask the right questions and gain insights into critical aspects of your business’s financial health.

Cash flow challenges are common among early-stage entrepreneurs. If your business struggles to meet payment obligations or lacks the capital for growth, consult your accountant. They can analyze your financial patterns, identify underlying causes, and recommend strategies to improve cash flow. With their expert advice, you can transition from feeling reactive to being proactive in managing your finances, taking greater control of your business's trajectory.

Small businesses can take advantage of numerous tax deductions, many of which are specific to particular industries. However, only expenses deemed “ordinary and necessary” for your business operations qualify for deductions. Your accountant can help identify deductions you’re eligible for and uncover opportunities you might have overlooked, ensuring you maximize your tax savings while staying compliant with regulations.

By engaging in meaningful conversations and leveraging their expertise, you can turn your accountant into a valuable partner in driving your business success.

1. Are any business expenses partially deductible, and how can I maximize deductions?

Not all business expenses are fully deductible. Categories such as meals and entertainment, business travel, and mixed-use expenses like home office items (e.g., internet or cell phone service) often qualify for partial deductions. An accountant can guide you in calculating the deductible portion based on how often the item is used for work purposes, ensuring accuracy and compliance.

2. Do recent tax law changes impact my business?

Tax laws frequently change, and some updates could significantly impact your business. An accountant’s expertise includes staying up to date with these changes, identifying opportunities to save, and ensuring you adapt to new regulations.

3. How does my business’s legal structure influence taxes?

The legal structure of your business—whether it’s a sole proprietorship, LLC, partnership, or corporation—affects your tax liabilities and potential benefits. Discuss with your accountant whether any tax advantages or drawbacks apply to your current structure. They may suggest restructuring, such as an LLC filing as an S corporation, to optimize tax savings and reduce audit risks.

4. Can I deduct my health insurance premiums?

As a self-employed individual, you may qualify to deduct your health insurance premiums from your taxes. However, eligibility depends on factors such as whether you qualify to join a spouse’s health insurance plan. An accountant can clarify these rules and help determine if your current plan qualifies for a deduction, ensuring you make the most of available tax breaks.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.