Effective bookkeeping is crucial for the success and growth of any startup. By choosing the right method, such as single-entry or double-entry bookkeeping, businesses can ensure accurate financial records, detect errors early, and make informed decisions. Implementing streamlined bookkeeping practices helps startups manage cash flow, comply with tax regulations, and plan for future growth.

Bookkeeping is the foundation of efficient financial management for businesses of every size. It involves the systematic recording, organizing, and tracking of a company’s financial transactions to ensure accuracy and transparency. This essential process provides businesses with a clear view of their financial health, enabling informed decision-making and strategic planning. By maintaining accurate financial records, businesses can manage cash flow, comply with tax regulations, and support long-term growth. Understanding the role of bookkeeping is vital for building a strong and sustainable financial foundation.

Example:

Imagine a small retail store that sells clothing. Every day, the store records sales, tracks inventory purchases, and logs expenses like rent and utilities. By carefully documenting these transactions, the store owner can monitor profits, identify best-selling products, and plan for seasonal inventory. Without organized bookkeeping, it would be difficult to manage cash flow, file taxes correctly, or make informed decisions about expanding the business.

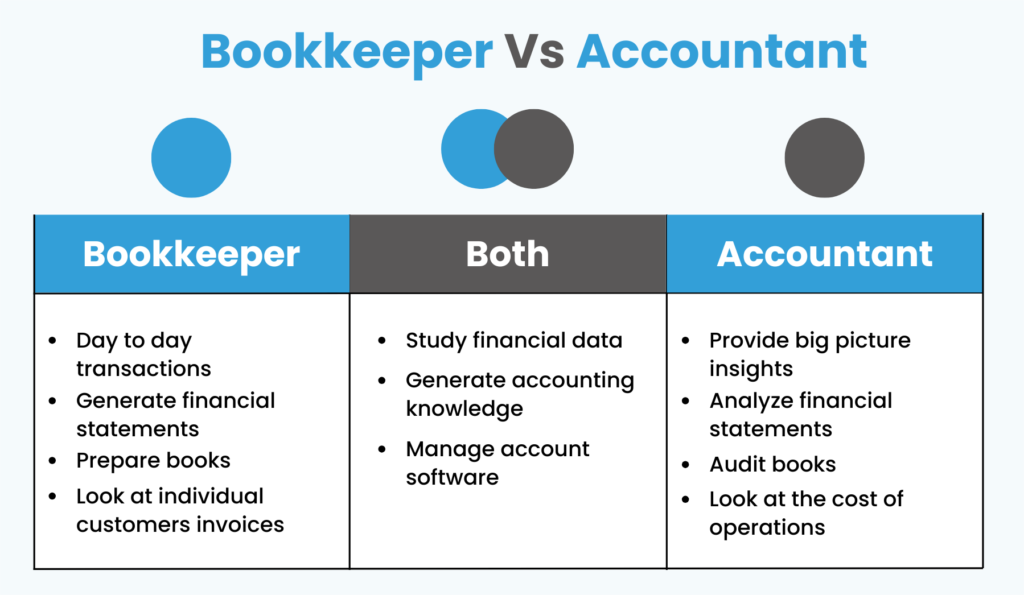

Effective financial management is vital for startups, and understanding the difference between bookkeeping and accounting is key to maintaining financial stability. While these two processes are closely related, they serve distinct roles in managing a business’s finances.

Bookkeeping focuses on the day-to-day recording of all financial transactions within a business. This includes tracking income from sales, expenses, payroll, and other financial activities. Bookkeepers are responsible for accurately documenting and organizing these transactions, ensuring that financial records are up-to-date and well-structured. This detailed record-keeping forms the foundation for all financial analysis and reporting.

Accounting, on the other hand, involves interpreting and analyzing the data collected through bookkeeping. Accountants assess financial performance, identify trends, and create reports that provide valuable insights into a company’s financial health. These insights are crucial for strategic decision-making, budgeting, and future planning.

Additionally, while bookkeeping can often be managed internally with basic financial knowledge, accounting typically requires specialized expertise. Professional accountants are well-versed in financial regulations and reporting standards, allowing them to prepare essential documents such as tax returns, financial statements, and compliance reports.

In summary, bookkeeping delivers organized financial data, while accounting turns that data into meaningful insights that guide business growth and decision-making. For startups, recognizing the unique roles of both functions is essential for sustainable financial success.

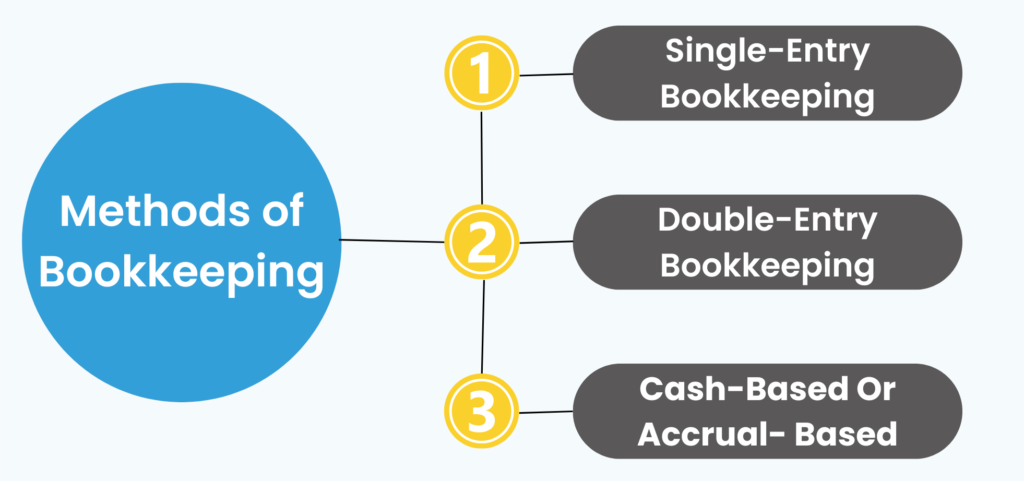

Laying a strong financial foundation is crucial in the early stages of a startup. Selecting the most suitable bookkeeping method depends largely on two factors: the volume of transactions and the level of revenue your business generates. While some methods may appear simple, they can lead to complications as the business grows. Below is an overview of common bookkeeping methods to help you choose the best approach for your startup and avoid potential challenges.

Single-entry bookkeeping:

This method involves recording each financial transaction once, typically in a cash book that tracks income and expenses. It is simple to manage and doesn’t require formal accounting knowledge. However, single-entry bookkeeping has significant limitations. It lacks an internal error-checking system, making it harder to identify mistakes. Additionally, it doesn’t provide a comprehensive view of the business’s financial health, making it difficult to assess profitability or make strategic decisions. While small businesses under a certain turnover limit may use this method under tax regulations, it becomes inefficient as a business grows. Over time, this method has become more theoretical and is rarely used in practice.

Double-entry bookkeeping:

This system offers a more accurate and complete financial overview by recording every transaction in two accounts—once as a debit and once as a credit. It follows the principle: “For every debit, there is an equal and corresponding credit.” For example, if your business makes a sale worth $10,000, it would be recorded as:

This ensures that the total debits equal the total credits, maintaining the balance in the accounting system.

The double-entry system ensures that total debits always match total credits, allowing for easier detection of errors and discrepancies. This method provides a clearer picture of a company’s financial position and simplifies tax reporting. Due to its accuracy and reliability, double-entry bookkeeping is widely preferred by businesses seeking thorough financial management and long-term growth.

Although bookkeeping isn’t legally required for every business, adopting a reliable system—especially the double-entry method—is highly recommended for startups aiming to grow. Double-entry bookkeeping helps prevent compliance issues and supports business expansion by providing a strong financial foundation.

The single-entry system, while still legally accepted, is mostly suitable for very small businesses due to its simplicity and limited financial insights.

After selecting either single-entry or double-entry bookkeeping, the next important step is deciding how your business will record income and expenses. This involves choosing between cash-based accounting and accrual-based accounting. This choice directly impacts how your business tracks financial performance.

Cash-based accounting:

In this method, income is recorded when cash is actually received, and expenses are recorded when they are paid. However, it may not provide a clear picture of your business’s financial health, especially if you have unpaid invoices or outstanding bills. This can make budgeting and forecasting more difficult.

Accrual-based accounting:

With accrual accounting, income is recorded when it is earned (even if the payment hasn’t been received), and expenses are recorded when they are incurred. This approach gives a more accurate view of your company’s financial status by reflecting credit sales and pending expenses in real-time. While this method requires a more advanced bookkeeping system, it offers significant advantages for larger businesses or startups preparing for growth and meeting government compliance standards.

For startups looking to scale, using double-entry bookkeeping combined with accrual-based accounting is the most effective choice. It provides accurate financial tracking, helps with compliance, and offers better insights for strategic decision-making. On the other hand, very small businesses with simple operations might manage with a single-entry and cash-based system, but should consider upgrading as they grow.

Understanding the core principles of bookkeeping is essential for maintaining accurate and organized financial records. These principles form the foundation of effective financial management and ensure that a business’s financial activities are properly tracked and reported.

Double-entry accounting is a fundamental bookkeeping principle that requires every financial transaction to be recorded in two accounts—one as a debit and the other as a credit. This system ensures that the accounting equation (Assets = Liabilities + Equity) always stays balanced.

A Chart of Accounts is an organized list of all the financial accounts a business uses to record transactions. These accounts are organized into categories like assets, liabilities, equity, revenue, and expenses. This structure helps bookkeepers systematically track and manage financial data. By using a well-structured chart of accounts, businesses can easily monitor their financial health and generate accurate financial reports.

Journal entries are the first step in recording business transactions. Each entry includes important details such as the date, the accounts affected, and the amounts debited and credited. This chronological recording of transactions ensures that all financial activities are accurately documented, forming the basis for the general ledger. Properly maintained journal entries help businesses organize their financial data and simplify the process of preparing financial statements.

By following these core bookkeeping principles, businesses can maintain accurate records, ensure financial transparency, and make well-informed financial decisions.

Choosing the right bookkeeping method is a critical step for any startup to be on top of their finances and ensure smooth growth. But let's face it—bookkeeping can be overwhelming, especially when you're busy building your business. That's where outsourced bookkeeping services come in.

By working with an professional bookkeeper, you can leave the number crunching to the experts. This way, you can be sure that your financial records are accurate and updated without the stress of managing it yourself. Besides, these services can help you stay compliant with tax regulations and give you peace of mind to focus on growing your business. Whether you are just starting or planning to scale, having professionals handle your bookkeeping allows you to concentrate on what matters most-your business.

1. What are the key bookkeeping tasks a startup should focus on?

Key tasks include:

2. When should a startup hire a bookkeeper?

Startups should consider hiring a bookkeeper once their financial transactions become too complex or time-consuming to handle alone. This may be when they start generating consistent revenue, hiring employees, or dealing with taxes

3. How can I track my startup’s expenses efficiently?

Start by categorizing expenses into clear categories (e.g., office supplies, marketing, salaries) and use accounting software or apps to track them. Consider attaching digital receipts to each expense entry for accurate record-keeping.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.