Running a successful hair salon requires more than just creativity and excellent customer service—it also hinges on effective financial management, especially bookkeeping. Bookkeeping involves systematically recording, organizing, and managing your salon’s financial transactions. If you want to gain a clear understanding of how your business is performing, accurate bookkeeping is essential.

In this guide, we'll explore the importance of bookkeeping for hair salons, key financial transactions, and practical tips to avoid common accounting mistakes. Whether you're new to the business or looking to streamline your financial operations, these tips will guide you toward informed decision-making for your salon’s growth.

Accurate bookkeeping is the foundation of a well-run salon, providing a clear snapshot of your financial status. By implementing proper salon accounting practices, you can track income, control expenses, and ensure profitability. Here are key reasons why accurate bookkeeping is vital:

Clear financial records help you track performance, identify growth opportunities, and scale your business effectively.

A salon handles a wide variety of daily financial transactions. Managing these properly is key to current profitability and preparing for tax obligations. Here are the most common financial transactions in a salon:

Purchases include everything from shampoos and hair dyes to salon equipment like chairs and mirrors. Properly tracking purchases helps you manage inventory, monitor expenses, and prevent stock shortages.

Sales transactions encompass the services you provide (e.g., haircuts, coloring) and retail products sold. Tracking sales is crucial for understanding performance, customer preferences, and profitability. A point-of-sale (POS) system can streamline this process.

If your salon has taken out loans for startup costs, renovations, or equipment, it's important to manage loan transactions. Regular monitoring helps you avoid fees, penalties, and damage to your credit score.

Expenses include rent, utilities, advertising, and consumables. Categorizing expenses can help you identify areas where you can reduce spending, improving profitability.

Revenue from services and product sales drives your salon’s profitability. Keeping detailed revenue records aids in financial planning, tax preparation, and performance analysis.

Paying stylists, receptionists, and assistants involves managing wages, tips, and bonuses. Accurate payroll management is crucial for labor law compliance and ensuring employee satisfaction.

Salons must manage various tax obligations, including sales tax, payroll tax, and business income tax. Staying on top of tax transactions helps you avoid legal penalties and ensures timely payments.

Transfer transactions involve moving funds between accounts, such as from checking to savings. Proper tracking of transfers helps maintain liquidity and prevent overdraft fees.

If your salon invests in assets like stocks or bonds, it's essential to manage these transactions carefully. Consult with a financial advisor to ensure your investments align with your business goals.

Many salon owners make accounting mistakes that can lead to serious financial problems. One common error is mixing personal and business finances, which complicates record-keeping and increases personal liability. Another is poor expense tracking, which makes it difficult to manage budgets or find opportunities for cost reduction.

To avoid these pitfalls, keep personal and business accounts separate, track expenses diligently, and regularly balance your accounts. This ensures greater control over your finances and supports long-term success.

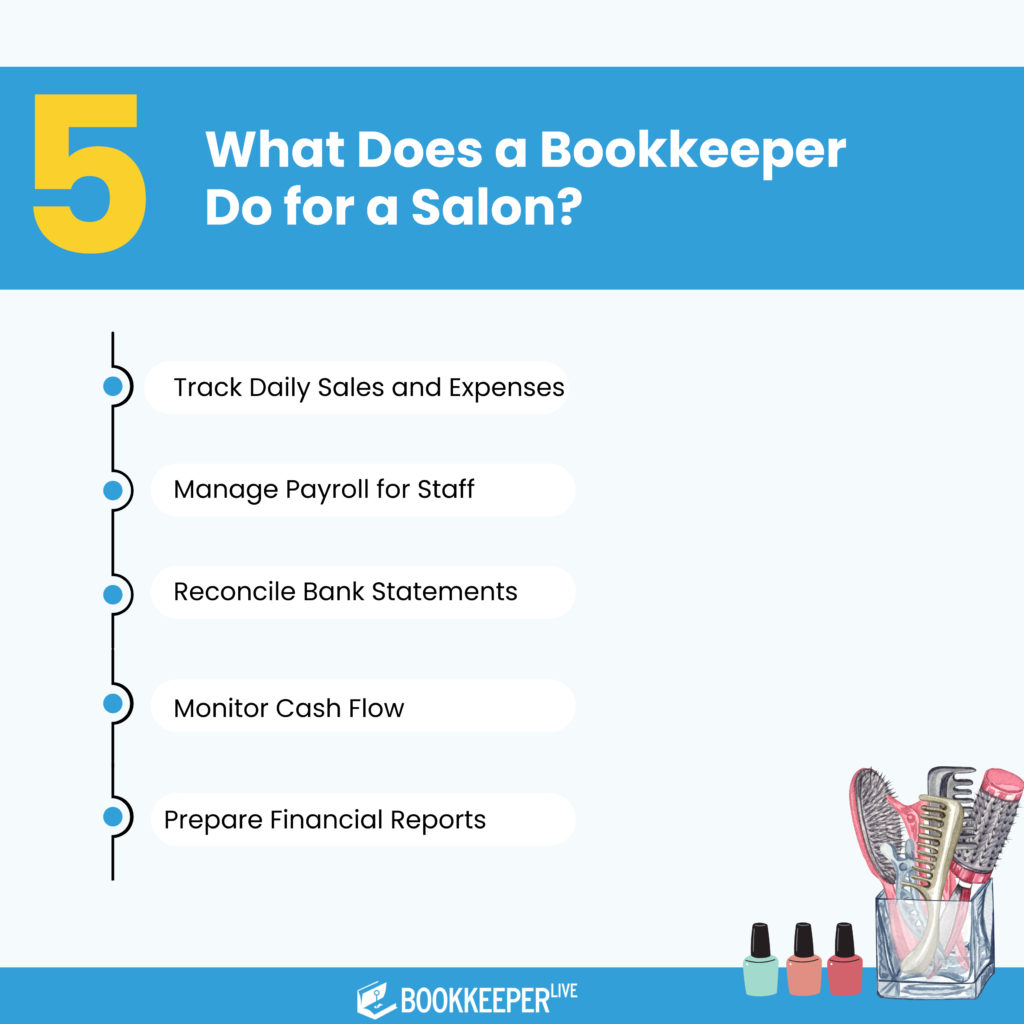

Running a salon involves many responsibilities, and bookkeeping doesn't have to be one of them. Outsourcing bookkeeping services can help you avoid complex financial management tasks and costly mistakes. Professional bookkeepers handle everything from sales tracking to tax preparation, giving you more time to focus on providing excellent service and growing your salon.

1. How should I track inventory for hair products and supplies?

Use an inventory management system to track stock levels, costs, and sales. A barcode scanner or POS system can increase efficiency.

2. How do I handle employee tips and commissions?

Report employee tips as part of their income. Depending on your state’s regulations, commissions may be treated as wages or part of service revenue.

3. Should I hire a professional bookkeeper or accountant?

If managing your salon’s finances feels overwhelming, hiring a professional bookkeeper can ensure accuracy, offer expert advice, and save you time.

By following these tips, you'll set your salon up for long-term financial success.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.