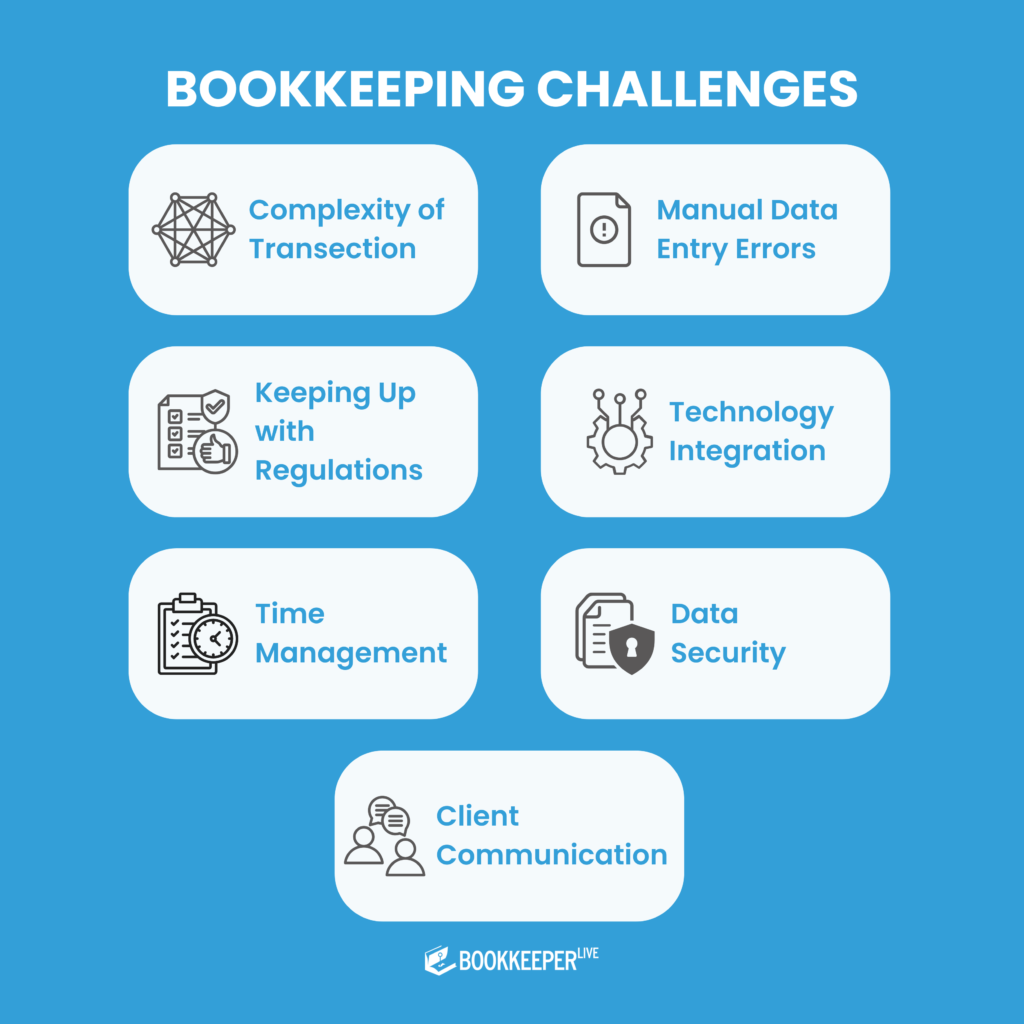

Bookkeeping is the backbone of any successful business and equips the owners with a clear picture of financial health and compliance against regulatory aspects. However, for many business owners, bookkeeping is a hassle and time-consuming process. This blog explores the difficulties often faced in bookkeeping and offers actionable solutions to simplify the process.

Essentially, bookkeeping would mean recording, organizing, and keeping track of financial transactions. This includes all purchases, sales, payments, and receipts. The process is vital, but it does require concentration, time, and penetration into financial systems; that's why so many people dread it.

High volume of transactions: Most businesses record a very high volume of daily transactions and missing a few entries might make the financial statement incomplete

Human error: Even though automation has aided greatly in the reduction of mistakes, manual data entry always attracts wrong figures or missed entries, which might affect financial reporting or tax filings.

Solution: Invest in bookkeeping software that automates data entry and reduces the risk of errors. Tools like QuickBooks or Xero can streamline the process, saving time and enhancing accuracy.

Changing rules: These financial regulations and tax laws keep changing and make it difficult for businesses to maintain compliance.

Fines for non-compliance: A lot of errors in applying those rules can result in fines, audits, or legal complications.

Solution: Keep abreast of tax law amendments or hire a reputable accountant who follows the tax law amendments.

Uncertain expenditure: Companies lack a proper revenue balance and therefore usually fail to provide a balanced amount against expenditures, and it eventually creates cash flow issues.

Poor projections: In the absence of proper cash flow projections, the companies face shortfalls that hinder their general operations.

Solution: Maintaining inflows and outflows through usage of cash flow management tools. Establish a financial cushion in case of unexpected expense and projected growth.

Time-consuming: Matching books with the bank statements and finding the differences would require considerable time especially when the business involves several accounts.

Errors are very common: Even the slightest difference in accounts tends to build up and become a huge financial mismatch.

Solution: Perform reconciliations on a regular basis - not just at the end of the month. Even completely automated reconciliation tools simplify this process.

Choosing the right software: With numerous options for bookkeeping tools, it might be difficult to choose the right one to suit your business's needs.

Difficulty in integration: It is often complex and challenging to integrate new software with the rest of the systems.

Solutions: Research bookkeeping software extensively before investing. Choose tools that are scalable and offer user-friendly interfaces with good integration with your current systems.

Increased complexity: As businesses grow, financial transactions are more complex, requiring bookkeeping techniques of greater complexity.

Resource Limitations: Scaling businesses have to decide whether to hire in-house staff or outsource some of the bookkeeping tasks.

Solution: External bookkeeping should be outsourced to professionals who can better handle the growing complexities, while strategic business activities are carried out by you.

Implement automation: Technology reduces hands-on work, minimizes errors, and saves time, thereby increasing efficiency. Most such tools offer real-time reporting and cloud integration capabilities.

Outsource to professionals: Outsourcing bookkeeping to experts saves ample time and ensures compliance with regulations relating to financial law.

Prioritize training: Ensure that staff handling bookkeeping are trained on the latest software and financial regulations. Regular workshops can be invaluable.

Schedule regular reviews: Conducting routine financial reviews or audits helps catch errors early and keeps financial records accurate.

Bookkeeping gives you a clear overview of your business’s performance, ensures tax compliance, and supports smart decision-making. While it can be challenging, using the right tools, adopting efficient processes, and seeking proper support such as outsourcing bookkeeping services can make it much easier to manage.

By staying proactive and outsourcing to professionals when needed, you can tackle bookkeeping challenges with confidence and focus on growing your business successfully.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.