In August, the U.S. Bureau of Labor Statistics reported that the consumer price index (CPI) went up by 0.2%, the same increase as in July. Over the past year, the overall price level has risen by 2.5%. While these increases may seem small, they can affect more than just your spending—they can also show up on your tax forms. These higher numbers can lead to changes in tax brackets and other key thresholds, meaning some deductions and tax rates will be adjusted accordingly.

According to Bloomberg Tax & Accounting, the inflation-related adjustments in the tax code will rise by 2.8% for 2025. This increase is much smaller than the 7.1% rise seen in 2023 and half of the increase taxpayers saw in 2024.

So, what does this mean for your taxes in 2025? Starting January 1, 2025, the adjustments will affect things like deductions, tax brackets, and other key tax figures, but these aren't the rates for 2024. You can find the official tax details for 2024 here.

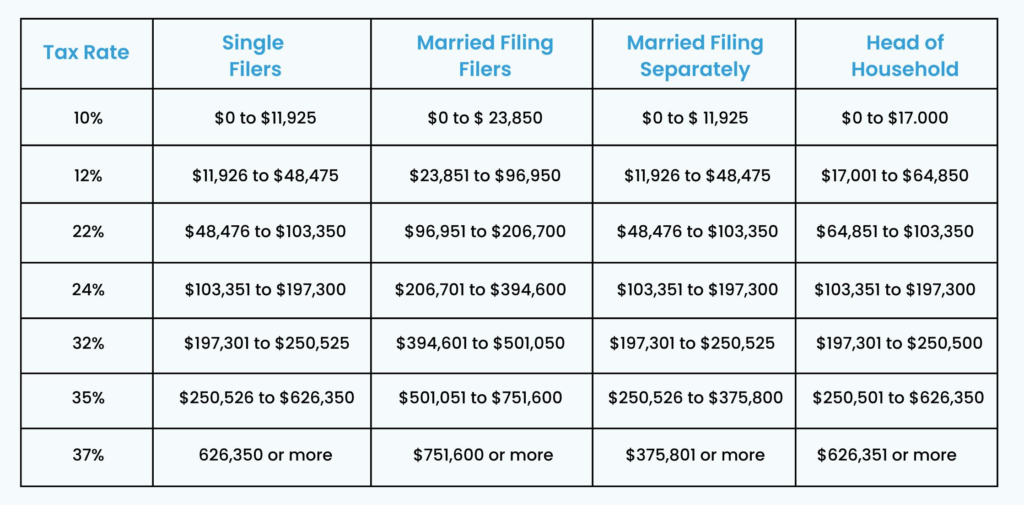

A tax bracket is a range of income that is taxed at a particular rate. In most countries, including the U.S., the more you earn, the higher the percentage of your income that will be taxed. Tax brackets are structured progressively, meaning the rate increases as your income rises. However, not all of your income is taxed at the highest rate. Instead, different portions of your income are taxed at different rates, which is why it’s important to understand how these brackets work.

In 2025, the U.S. tax system will follow a similar structure to previous years, with adjustments for inflation. The tax brackets are divided into income ranges, and each range is taxed at a different percentage. Below, we’ll explore the tax rates for individuals, married couples, and heads of households.

While tax brackets will help determine how much you pay in taxes, you have several ways to minimize your tax liability. Here are some tips for tax planning:

Tax brackets are an important part of understanding how your income is taxed and can help you plan your financial future. In 2025, the tax brackets will remain similar to past years but will adjust for inflation. By understanding these tax rates and making smart financial choices, you can reduce your tax burden and keep more of your hard-earned money. Whether you're filing as a single individual, a married couple, or head of household, it's essential to know where you stand and take advantage of tax-saving strategies.

Make sure to stay informed and consult with a tax professional to navigate the complexities of the tax system effectively.

1 Will tax laws continue to change in 2025?

Yes, tax laws can change from year to year. It’s important to stay informed about the latest updates, as inflation adjustments and other changes in tax policy may affect your tax planning.

2. What are tax brackets and how do they work?

Tax brackets are ranges of income that are taxed at a specific rate. In the U.S., the more you earn, the higher the percentage of your income will be taxed. However, not all of your income is taxed at the highest rate. Instead, different portions of your income fall within different brackets, and each portion is taxed at the corresponding rate.

3. How will tax brackets change in 2025?

In 2025, tax brackets will be adjusted for inflation by 2.8%. This means that the income thresholds for each tax rate will be slightly higher, allowing individuals to earn more before moving into a higher tax bracket.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.