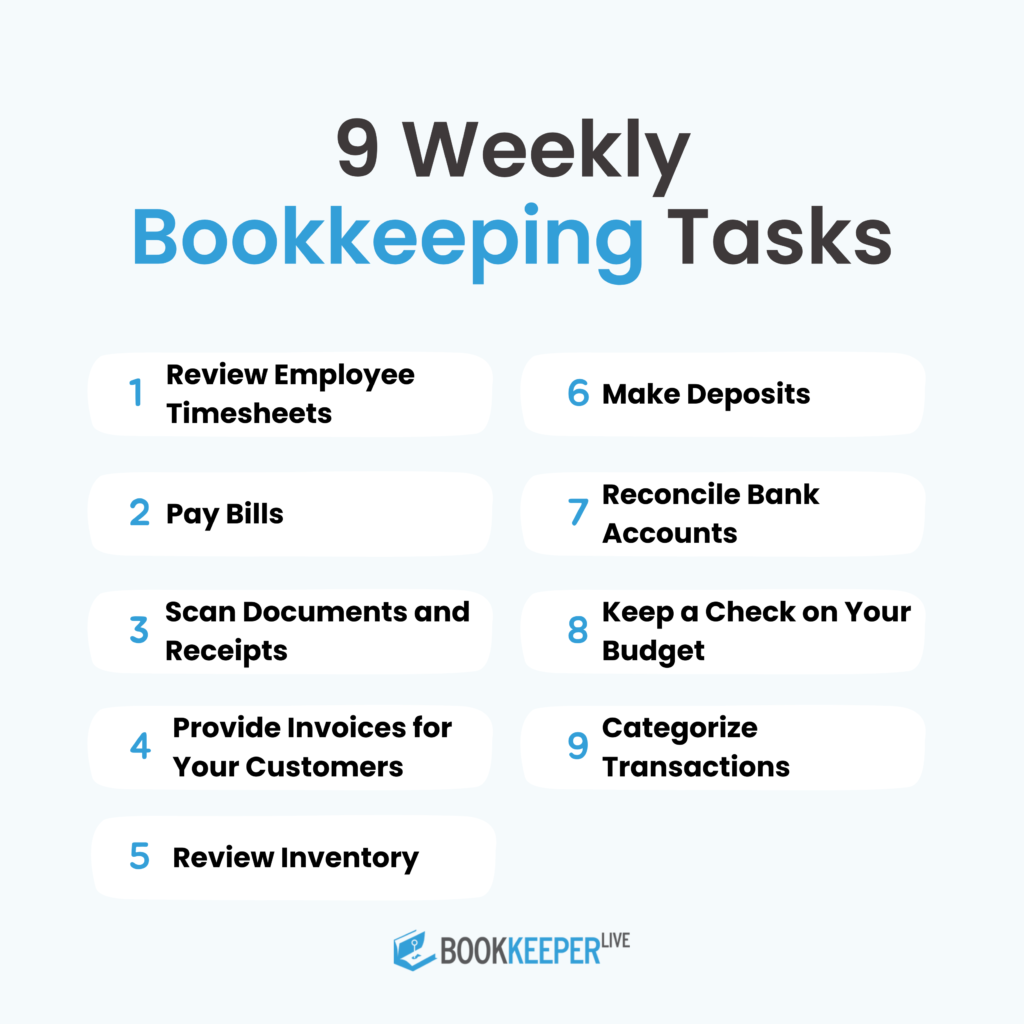

For small business owners, effective bookkeeping is not just about managing daily transactions—it’s about staying organized, maintaining accurate financial records, and keeping the business running smoothly. The key to success lies in consistency. By dedicating time each week to essential bookkeeping tasks, you can ensure the long-term financial health of your business and avoid costly mistakes. Below, we’ll explore nine essential bookkeeping tasks you must perform every week, explaining their importance and how they contribute to your business’s success.

Employee timesheets are an integral part of your business’s payroll and labor cost management. Each week, review the timesheets to ensure that they are accurate and reflect the actual hours worked by employees. Errors in timesheets can lead to overpayments or underpayments, causing payroll issues and potentially harming employee trust.

Managing accounts payable is one of the most critical bookkeeping tasks for small businesses. Set aside time each week to enter bills into your accounting software and schedule payments. Consistently paying bills on time not only strengthens relationships with your suppliers but also helps avoid late fees and penalties.

Staying organized with your documents and receipts is crucial for accurate bookkeeping, especially when it comes to tax preparation. Make it a weekly habit to scan all receipts, invoices, and other financial documents. This way, you’ll have digital records that are easy to access and review whenever necessary.

Creating and sending invoices promptly is essential for keeping your accounts receivable in order. Each week, review your sales and issue invoices for any work completed or products delivered. Also, follow up on any overdue invoices to ensure timely payments from your customers.

For businesses that sell physical products, inventory management is a crucial weekly task. Review your inventory levels to make sure that they align with the records in your bookkeeping system. This helps you avoid both stock shortages and overstocking, which can tie up your capital.

To ensure that your business maintains a positive cash flow, make it a point to deposit any checks or cash received during the week. This way, your bank balance will accurately reflect the funds available for expenses and other financial obligations.

Reconciling the bank is comparing your internal financial records to your bank statements to ensure that they match. Doing this task weekly helps you quickly identify and resolve discrepancies, such as unauthorized transactions, bank fees, or errors in your records.

A business budget is a financial roadmap that helps guide spending and investments. Monitoring your budget weekly allows you to compare your actual expenses and income against your projections. This way, you can make adjustments before small issues become big problems.

Properly categorizing your income and expenses is essential for generating accurate financial reports. Take time each week to review and categorize transactions in your bookkeeping software. Organizing each expense into specific categories helps you track spending and manage your budget effectively.

The types of categories used may vary depending on your business needs, but common examples include:

Why this matters: When all accounts are accurately categorized, you’ll be better equipped to assess the financial health of your business, identify potential cost-saving areas, and streamline tax preparation. Incorrect or missing categorization can lead to faulty financial reporting and missed tax deductions.

Weekly transaction categorization will also help maintain accurate records and quickly highlight any issues or red flags. By staying on top of this task, you'll save time and money, especially when it comes to claiming business expenses at tax time.

Tip: Make rules in your accounting software so that recurring transactions are automatically categorized, reducing manual data entry and minimizing errors.

Routine Bookkeeping for Your Business Consistency with these nine steps will ensure that your bookkeeping is accurate and always up to date. Not only will this save you time, but it will also help you avoid costly mistakes, allowing you to gain valuable insights into your business's financial performance. In the long run, staying regular with bookkeeping enhances decision-making and contributes to sustainable business growth. For businesses looking to optimize their financial management further, partnering with an outsourced bookkeeping service can provide professional expertise, helping you keep your financials in check and ensure your business stays on the path to success.

BookkeeperLive provides affordable bookkeeping and accounting services tailored to your business goals.

No calls, No meetings, No spam. Get started with a free trial by filling out the form.

*NDA included for your data protection.

Copyright © 2025 BookkeeperLive. All rights reserved. Privacy Policy Terms of Use

Please visit our India site to see services designed for your country

Enter the code, fill out the form, and unlock financial clarity with a free trial.